As filed with the Securities and Exchange Commission on July 28, 2022.

Registration No. 333-264463

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 3

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

bioAffinity Technologies, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 8731 | 46-5211056 | ||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

22211 W Interstate 10

Suite 1206

San Antonio, Texas 78257

210-698-5334

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Maria Zannes

Chief Executive Officer

22211 W Interstate 10

Suite 1206

San Antonio, Texas 78257

210-698-5334

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Wilhelm E. Liebmann, Esq. Dykema Gossett PLLC 112 E. Pecan Street Suite 1800 San Antonio, Texas 78205 (210) 554-5414 |

Ross David Carmel, Esq. Carmel, Milazzo & Feil LLP 55 West 39th Street 18th Floor New York, New York 10018 (212) 658-0458 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated July 28, 2022.

PRELIMINARY PROSPECTUS

1,180,000 Units

Each Unit Consisting of

One Share of Common Stock,

One Tradeable Warrant to Purchase One Share of Common Stock, and

One Non-tradeable Warrant to Purchase One Share of Common Stock

(and the shares of Common Stock underlying such Warrants)

bioAffinity Technologies, Inc.

bioAffinity Technologies, Inc., a Delaware corporation headquartered in Texas (the “Company”), develops noninvasive, early-stage diagnostics to detect, and is researching targeted therapies to treat, cancer at the cellular level.

This is the initial public offering (the “Offering”) of 1,180,000 units (each, a “Unit,” collectively, the “Units”) at an assumed public offering price (the “Offering Price”) of $6.00 per Unit. The actual Offering Price of the Units will be determined between the underwriters and us at the time of pricing, considering our historical performance and capital structure, prevailing market conditions, and overall assessment of our business. Each Unit consists of one share of our common stock, $0.007 par value per share (the “Common Stock”), one tradeable warrant (each, a “Tradeable Warrant,” collectively, the “Tradeable Warrants”) to purchase one share of Common Stock at an anticipated exercise price of $7.20 per share (120% of the anticipated $6.00 per-Unit Offering Price), and one non-tradeable warrant (each, a “Non-tradeable Warrant,” collectively, the “Non-tradeable Warrants”; together with the Tradeable Warrants, each, a “Warrant,” collectively, the “Warrants”) to purchase one share of Common Stock at an anticipated exercise price of $7.50 per share (125% of the anticipated $6.00 per-Unit Offering Price). The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of Common Stock and the Warrants underlying the Units are immediately separable and will be issued separately in this Offering. Each Warrant offered as part of this Offering is immediately exercisable on the date of issuance and will expire five years from the date of issuance.

In connection with this Offering, our Board of Directors and stockholders approved a 1-for-7 reverse stock split of our Common Stock, which became effective with the State of Delaware on June 23, 2022. All share and per-share information in this prospectus reflects the 1-for-7 reverse stock split.

Prior to this Offering, there has been no public market for our Common Stock or our Warrants. We have applied to list our Common Stock and our Tradeable Warrants on the Nasdaq Capital Market (“Nasdaq”) under the symbols “BIAF” and “BIAFW,” respectively.

We are an “emerging growth company” and a “smaller reporting company” under applicable federal securities laws and will be subject to reduced public company reporting requirements.

We are aware that 14 of our current stockholders have indicated an interest in purchasing Units in this Offering and we currently anticipate they may purchase approximately 11.85% of the Units in this Offering, assuming that the underwriters will not exercise the Over-Allotment Option (as defined below). Immediately after this Offering, our officers and directors will control approximately 50.9% of the voting power of our Common Stock, as determined in accordance with the beneficial-ownership provisions of Rule 13d-3 and Item 403 of Regulation S-K under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). See the “Principal Stockholders” section beginning on page 96 of this prospectus for a description of how beneficial ownership is calculated and related matters.

For so long as 30% of the shares of our “Series A Convertible Preferred Stock,” par value $0.001 per share (our “Series A Preferred Stock”), remain outstanding, the holders of our Series A Preferred Stock, voting as a separate class, are entitled to elect one director of the Company (such right, the “Series A Director Designation Right”; such director, the “Series A Representative”). Immediately prior to the closing of this Offering, all of the issued and outstanding shares of Series A Preferred Stock will be automatically converted into fully paid and nonassessable shares of Common Stock at the then-effective conversion rate of the Series A Preferred Stock. Following such automatic conversion, the Company will never again issue the shares so converted, all such converted shares will cease to be part of the Company’s authorized stock, and the Series A Director Designation Right will cease to exist because fewer than 30% of the Series A Preferred Stock shares will be outstanding. The director who currently serves as the Series A Representative, however, will continue to serve as a director until his earlier resignation or removal or until his successor is duly elected and qualified. The number of Board seats for election by the holders of the Common Stock will be expanded by one so that the director position that the holders of the Series A Preferred Stock were previously entitled to elect will be subject to election by the holders of the Common Stock following the conversion of the Series A Preferred Stock into Common Stock in connection with this Offering. See the “Management—Board of Directors Composition” section of this prospectus.

Investing in our securities involves a high degree of risk. See the “Risk Factors” section beginning on page 14 of this prospectus for a discussion of the factors that you should consider before investing in our Common Stock.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit | Total Assuming No Exercise of Over- Allotment Option | Total With Full Exercise of Over- Allotment Option | ||||||||||

| Public Offering Price | $ | $ | $ | |||||||||

| Underwriting discount(1) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us(2) | $ | $ | $ | |||||||||

| (1) | We have agreed to issue, on the closing date of this Offering, a warrant to WallachBeth Capital, LLC, the representative of the underwriters (the “Representative”; such warrant, the “Representative’s Warrant”), to purchase an amount equal to two percent (2.0%) of the aggregate number of shares of Common Stock underlying the Units sold by us in this Offering. The Representative’s Warrant is exercisable for a period of five years from the closing date of this Offering, commencing on the date that is 180 days after the commencement date of sales of the Units. Please read the section titled “Underwriting” for a description of all underwriting compensation payable by us in connection with this Offering. | |

| (2) | The amount of Offering proceeds to us presented in this table does not give effect to any exercise of the Over-Allotment Option (if any) we have granted to the underwriters or upon the exercise of the Warrant we will issue to the Representative, as described herein. |

We have granted the underwriters a 45-day option from the date of this prospectus to purchase up to a total of an additional 177,000 shares of Common Stock at the initial Offering Price per Unit less $0.02, and/or 177,000 Tradeable Warrants at $0.01 per Tradeable Warrant, and/or 177,000 Non-tradeable Warrants at $0.01 per Non-tradeable Warrant, or any combination of additional shares of Common Stock and Warrants representing, in the aggregate, up to 15% of the number of Units sold in this Offering (the “Over-Allotment Option”), in all cases less the underwriting discount.

The underwriters expect to deliver the Units to purchasers on or about _____, 2022 through the book-entry facilities of The Depository Trust Company.

WallachBeth Capital, LLC

Craft Capital Management LLC

WestPark Capital, Inc.

The date of this prospectus is July 28, 2022.

bioAffinity Technologies, Inc.

TABLE OF CONTENTS

Market, industry, and other data

About this Prospectus

You should rely only on the information contained in this prospectus prepared by us or on our behalf or to which we have referred you. We have not, and the underwriters have not, authorized any other person to provide you with information different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell the securities described herein in any jurisdiction where an offer or sale is not permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our Common Stock. Our business, financial condition, results of operations, and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

Unless the context otherwise requires, the information in this prospectus (other than in the historical financial statements) assumes that the underwriters will not exercise their option to purchase additional shares of Common Stock or additional Warrants.

Through and including _______, 2022 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this Offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside of the United States: Neither we nor any of the underwriters have done anything that would permit this Offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this Offering in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus and any free writing prospectus must inform themselves about and observe any restrictions relating to this Offering and the distribution of this prospectus outside of the United States. See “Underwriting—Selling Restrictions” on page 114.

Industry and Market Data

This prospectus includes estimates regarding market and industry data. Unless otherwise indicated, information concerning our industry and the markets in which we operate, including our general expectations, market position, market opportunity, and market size, are based on our management’s knowledge and experience in the markets in which we operate, together with currently available information obtained from various third-party sources, including publicly available information, industry reports and publications, surveys, our customers, trade and business organizations, and other contacts in the markets in which we operate. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

Trademarks and Trade Names

We own or have rights to various trademarks, service marks, and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks, and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names, or products in this prospectus is not intended to, and does not imply a relationship with or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks, and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks, and trade names.

| i |

This summary provides an overview of information appearing elsewhere in this prospectus and highlights the key aspects of this Offering. This summary does not contain all of the information you should consider prior to investing in our Common Stock. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing at the end of this prospectus, before making any investment decision. Our fiscal year ends on December 31. Unless the context otherwise requires, references to “bioAffinity,” the “Company,” “we,” “us,” and “our” in this prospectus refer to bioAffinity Technologies, Inc. and our consolidated subsidiaries.

Overview

bioAffinity Technologies, Inc. is a privately held company incorporated in Delaware addressing the need for noninvasive diagnosis of early-stage cancer and diseases of the lung, and targeted cancer treatment. Our Company develops proprietary noninvasive diagnostic tests and cancer therapeutics using technology that preferentially targets cancer cells and cell populations indicative of a diseased state. Research and optimization of our platform technologies are conducted in our laboratories at The University of Texas at San Antonio. We are developing our platform technologies so that, in the future, they will be able to detect and monitor diseases of the lung and other cancers and treat many cancers.

More than 100 different types of cancers have been identified, all marked by the abnormal and unrestricted proliferation of cells that can eventually kill a patient stricken with the disease. Lung, breast, prostate, and colorectal cancers are the most common, representing more than half of all cancer diagnoses. Lung cancer alone, by far the deadliest, is responsible for an estimated 1.8 million deaths worldwide annually.1

A patient’s overall cancer survivability depends on the type of cancer and the stage at which cancer is treated. The early diagnosis of cancer, before it spreads, is a significant contributor to survival. This is true for lung cancer that is most often detected in later stage when the cancer has spread to other parts of the body. However, if lung cancer is detected and treated early (Stage I), the current overall five-year survival rate of 20.5%2 for Stages II-IV can leap to a 10-year survival rate of 92%.3

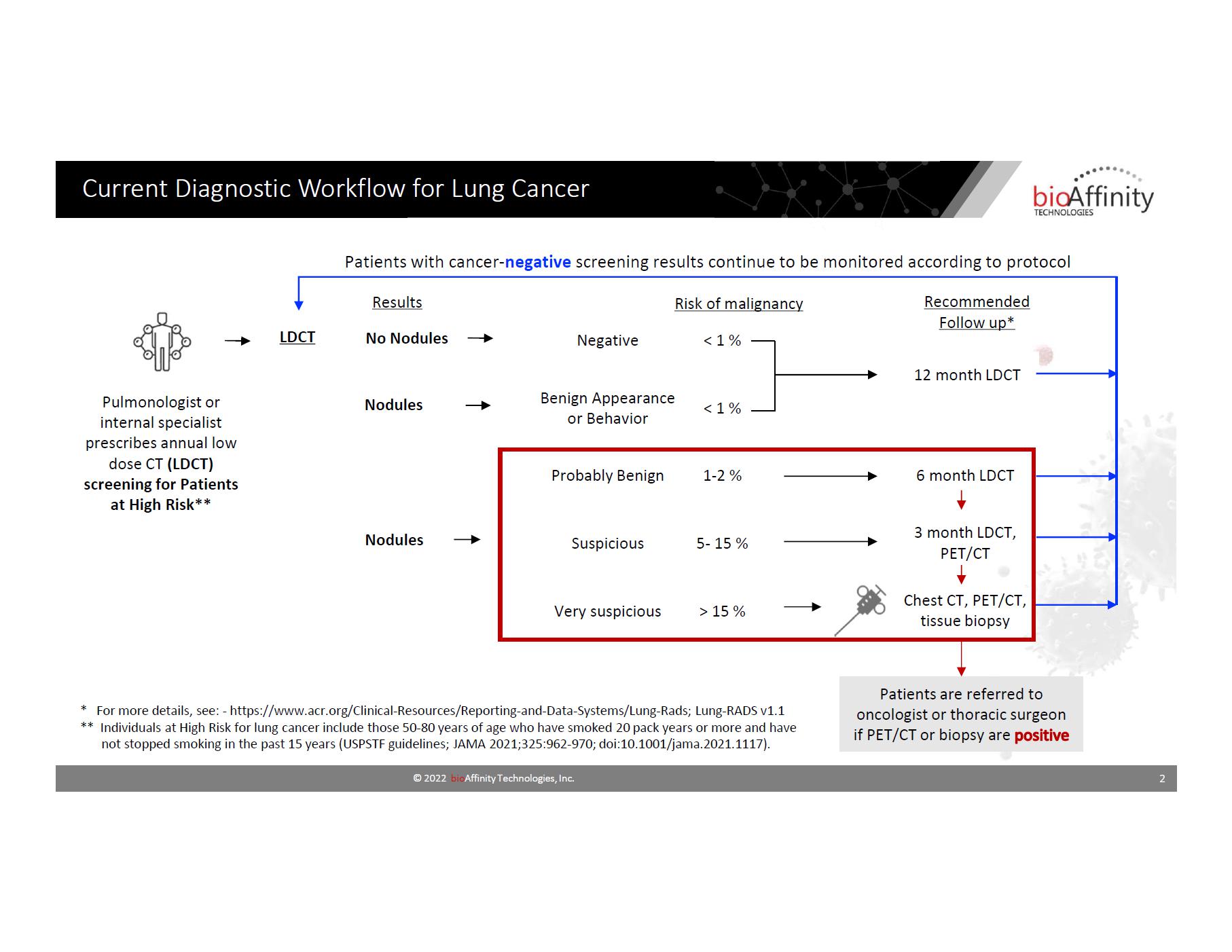

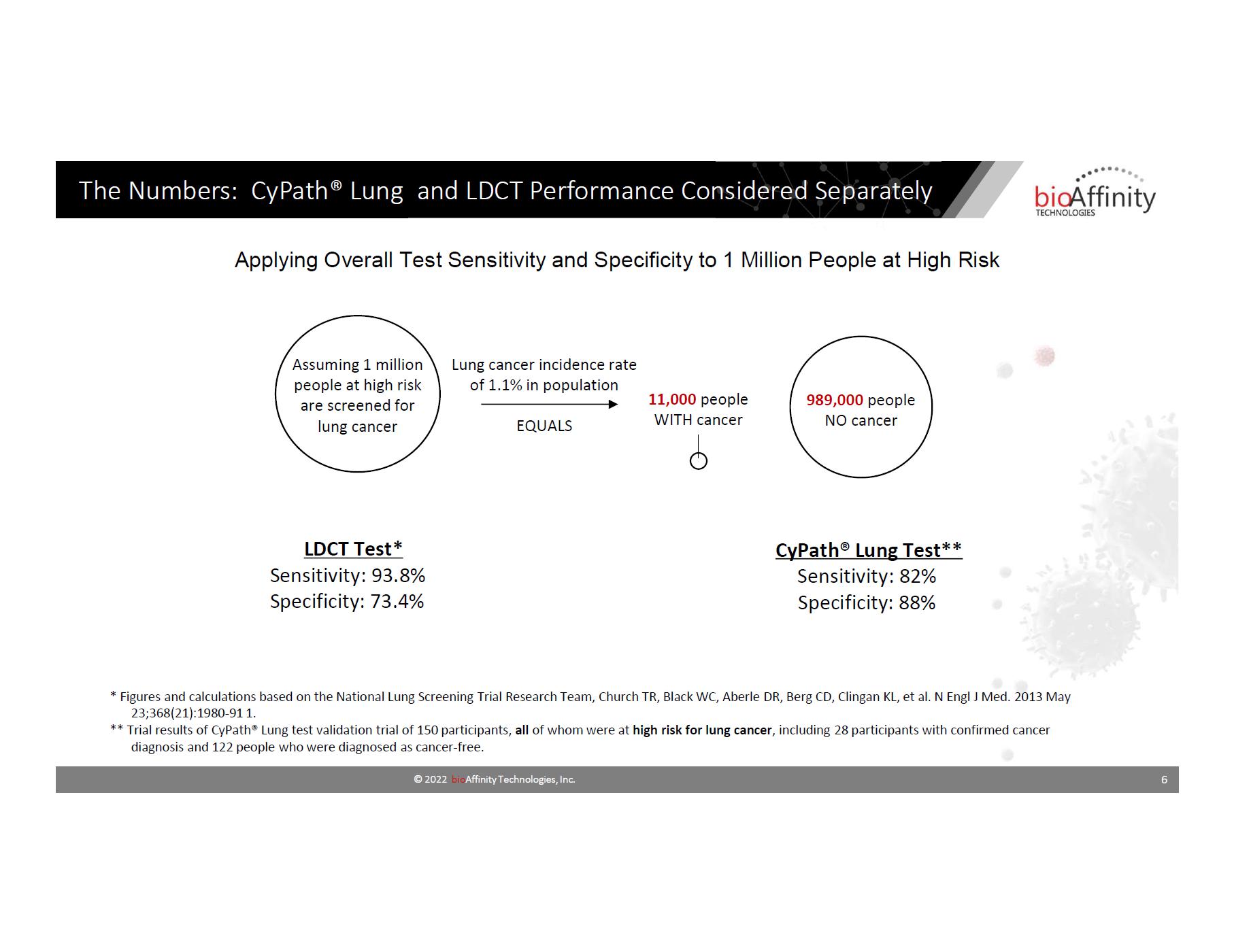

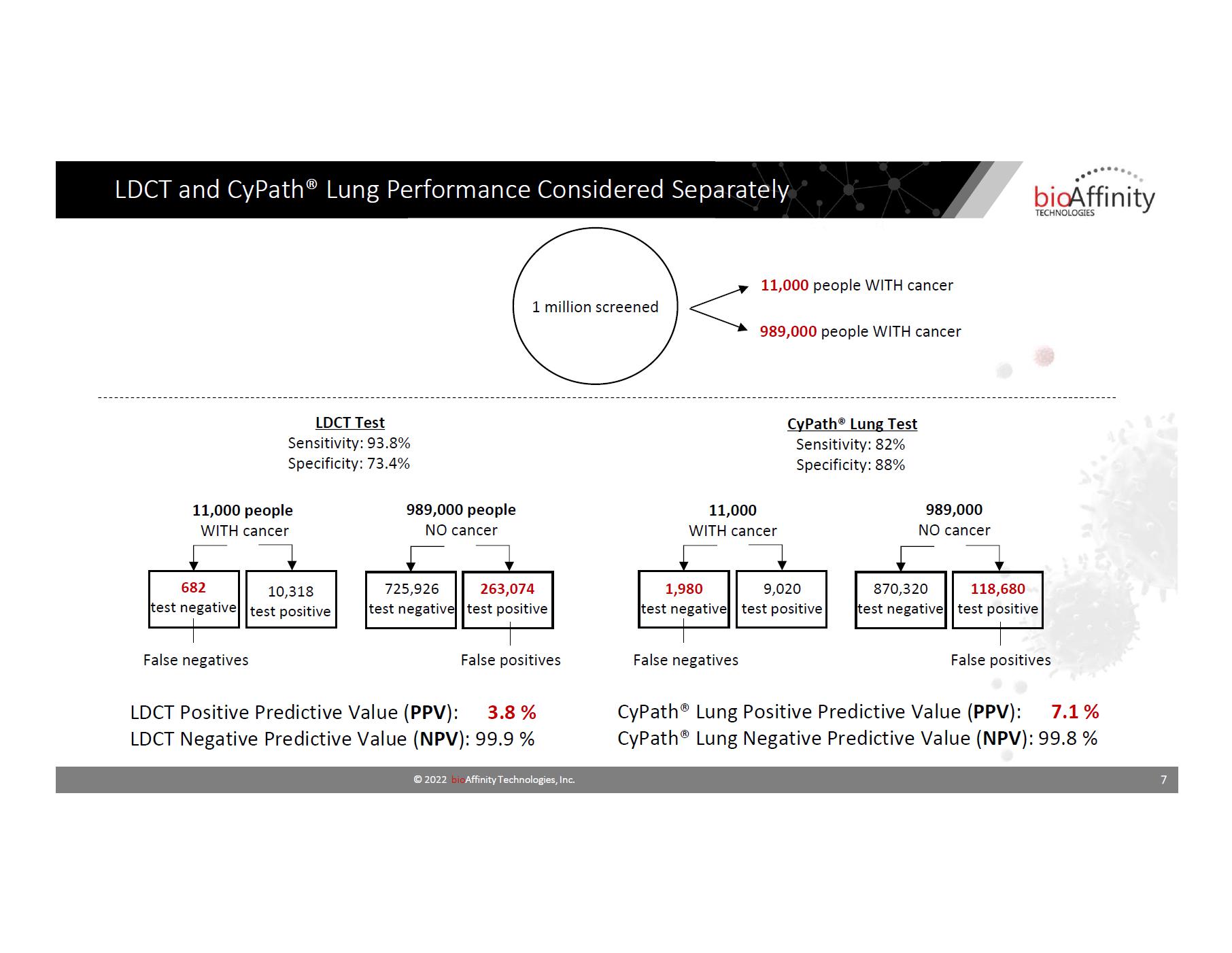

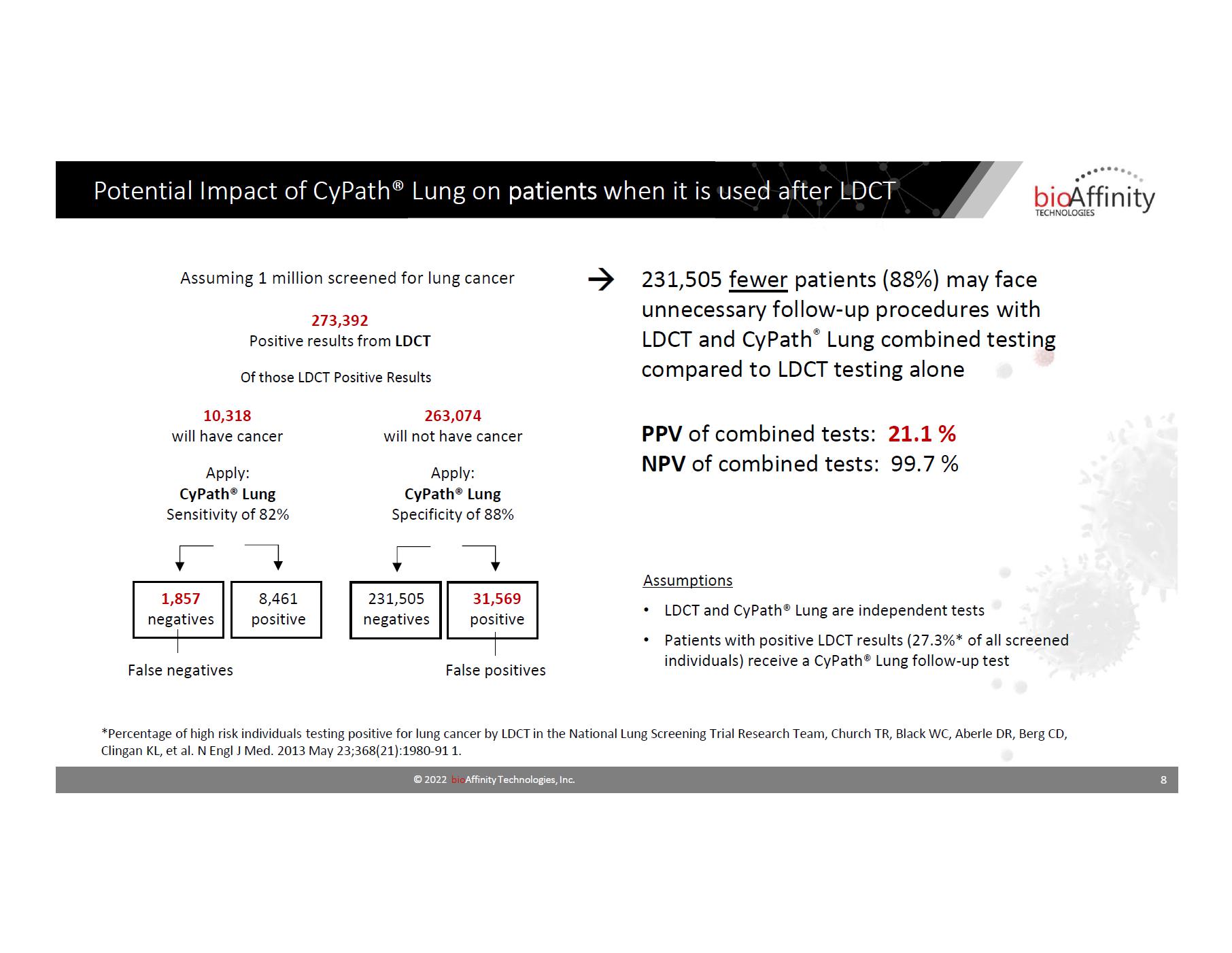

Current diagnostic protocols include lab tests, various imaging techniques, and biopsy followed by microscopic examination of tissue samples. None of these methods perfectly detects cancer cells, especially in the early stages of the disease. Low-dose computed tomography (LDCT) is recommended for screening patients at high risk for lung cancer. Results of a large clinical trial of more than 53,000 patients showed that screening for lung cancer by LDCT lowered the mortality rate by 20% as compared to x-ray imaging.4,5 However, the study found that of every 100 people screened for lung cancer who received a positive LDCT result, fewer than four of those individuals truly had the disease. Consequently, there is a great and urgent need for better targeted diagnostic methods that are safe, accurate, rapid, noninvasive, and cost effective for the detection of early-stage lung cancer.

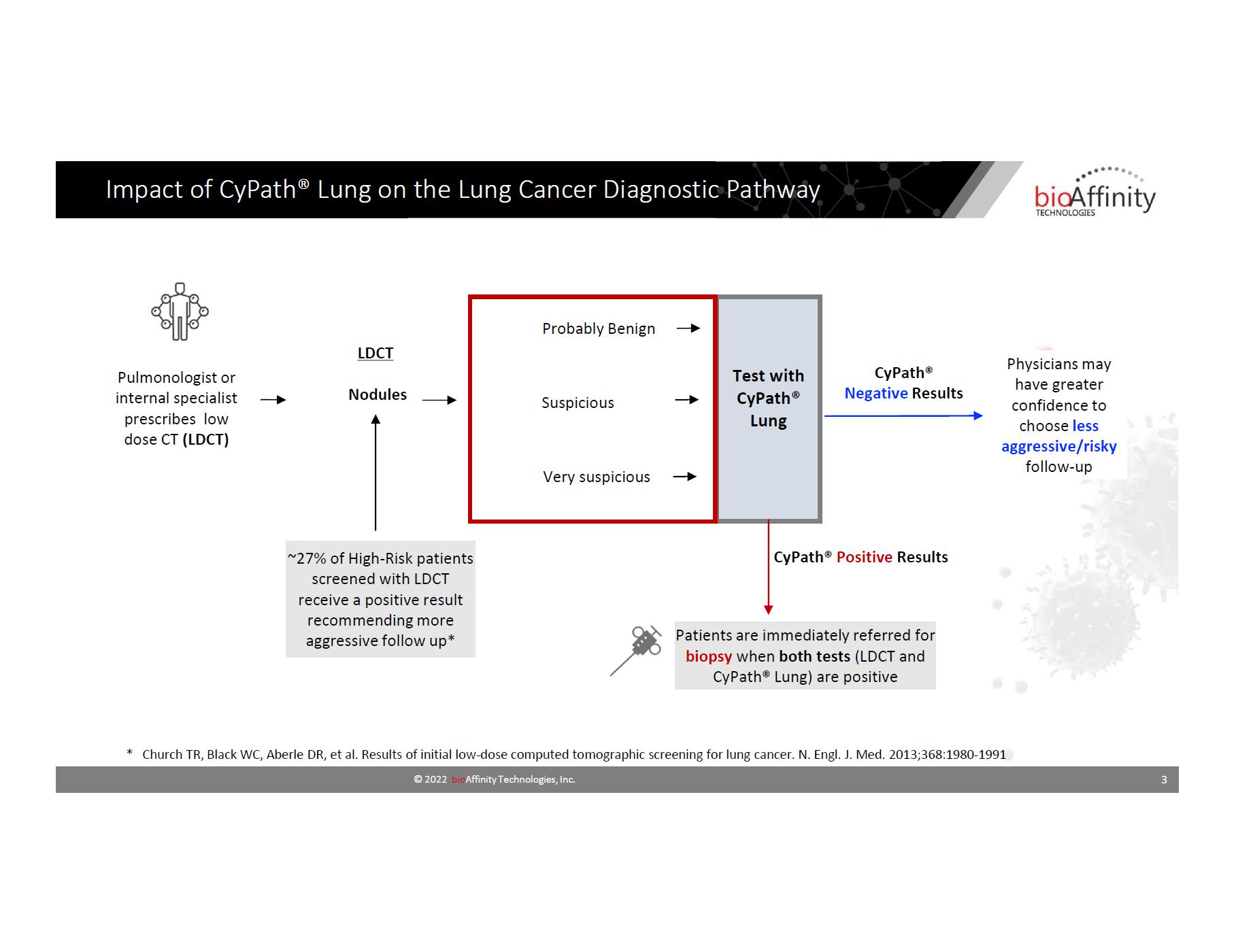

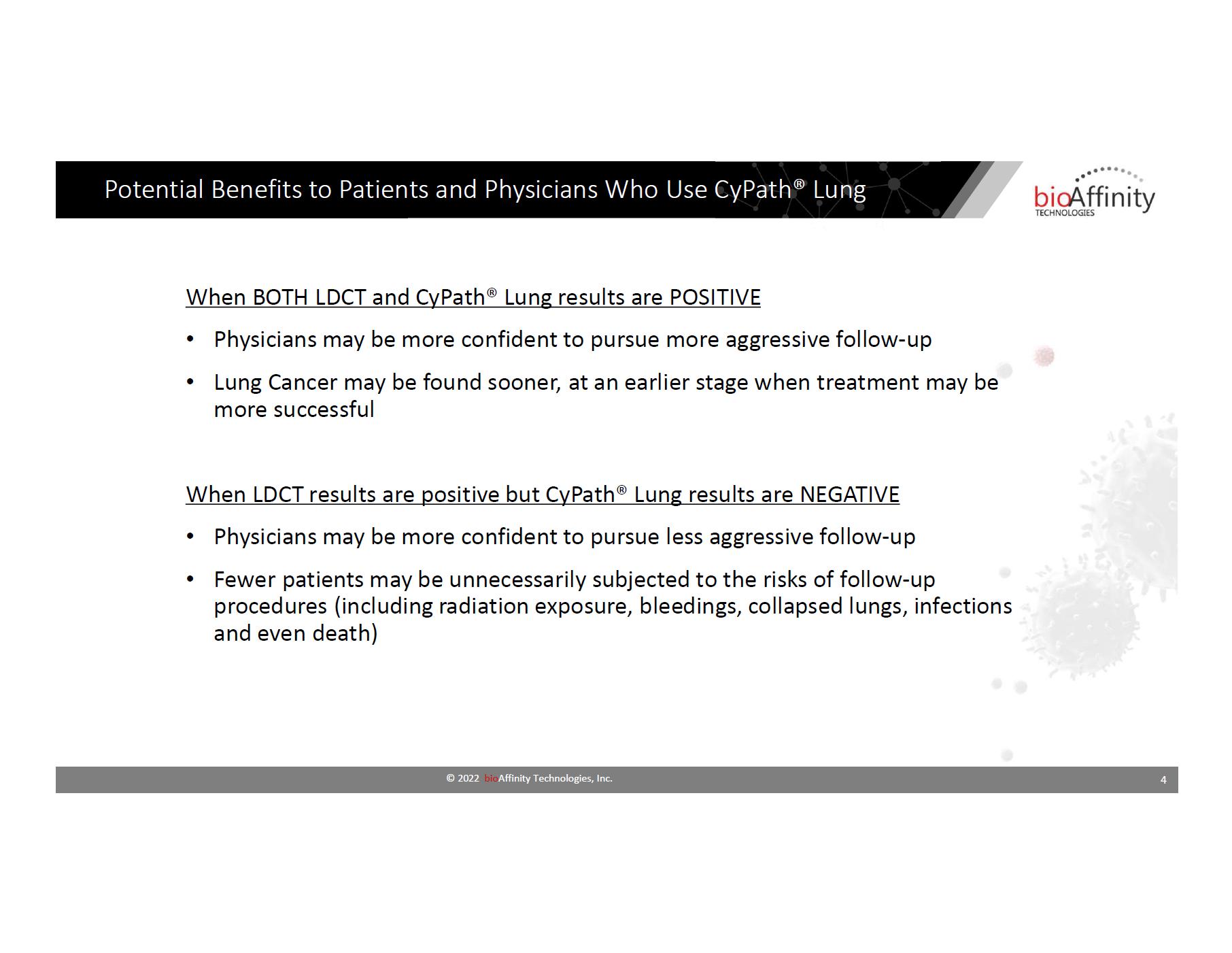

Our first diagnostic test, CyPath® Lung, addresses the need for early detection of lung cancer, the leading cause of cancer-related deaths. In order to identify patients more confidently who need to undergo more invasive follow-up procedures, physicians will be able to order CyPath® Lung to assist in the assessment of the potential for the disease. CyPath® Lung thus serves as another tool in the physician’s decision-making process to distinguish between patients who are likely to have lung cancer and will benefit from timely intervention and those who are likely without disease and should continue their annual screening for lung cancer.

| 1 | The Cancer Atlas, Third Edition, American Cancer Society (ACS), World Health Organization (WHO) and The Union for International Cancer Control (UICC); https://canceratlas.cancer.org/the-burden/lung-cancer/. |

| 2 | SEER Cancer Statistics Review, 1975–2018; https://seer.cancer.gov/statfacts/html/lungb.htm. |

| 3 | The International Early Lung Cancer Action Program Investigators, Survival of Patients with Stage I Lung Cancer Detected on CT Screening. N Engl J Med. 2006;355:1763-71. |

| 4 | Aberle DR, Adams AM, Berg CD, et al. Reduced lung-cancer mortality with low-dose computed tomographic screening. N Engl J Med. 2011;365:395-409. |

| 5 | Church TR, Black WC, Aberle DR, et al. Results of initial low-dose computed tomographic screening for lung cancer. N Engl J Med. 2013;368:1980-1991. |

| 1 |

CyPath® Lung is a noninvasive test for the early detection of lung cancer. Our test uses flow cytometry to analyze the different type of cells in a person’s sputum, or phlegm from the lungs, to find characteristics indicative of lung cancer, including cancer and cancer-related cells that have shed from a lung tumor. Flow cytometry is a technology to group cells into populations of cells that look similar, based on their size, internal structures, and the presence of certain molecules on the outside or inside of the cell. Flow cytometry does this one cell at a time, scanning a large number of cells in a relatively short time period. For example, an average sputum sample containing about 20 million cells can be profiled cell-by-cell by flow cytometry in less than 20 minutes using the CyPath® Lung protocol. To collect a sputum sample, a patient blows into a hand-held, noninvasive assist device that acts to break up mucus in the lungs and help a person cough up the sputum from the lung into a collection cup. The sputum sample is shipped overnight to the laboratory and processed in accordance with CyPath® Lung protocol. Sample processing includes labeling cells with a synthetic porphyrin that attaches to cancer and cancer-associated cells (specifically, the porphyrin called meso-tetra (4-carboxyphenyl) porphine or “TCPP”). Sample processing also includes the use of antibodies that attach to specific types of cells. The processed sputum sample is run through a flow cytometer that can identify cancer and cancer-related cells labeled by TCPP and other cell populations. The resulting data is automatically analyzed immediately after data acquisition by proprietary automated analysis software that is fully integrated into the test and generates both quantitative and qualitative diagnostic results in the form of a patient report that is provided to the ordering physician.

CyPath® Lung has the potential to increase overall diagnostic accuracy of lung cancer leading to increased survival, lower the number of unnecessary invasive procedures, reduce patient anxiety, and lower medical costs.6 bioAffinity Technologies intends to develop the CyPath® platform technology for use in the detection of other lung diseases, such as chronic obstructive pulmonary disease (“COPD”) and asthma. The Company further intends to develop tests to detect other cancers, including prostate cancer at an early stage, and to monitor for recurrence of bladder cancer.

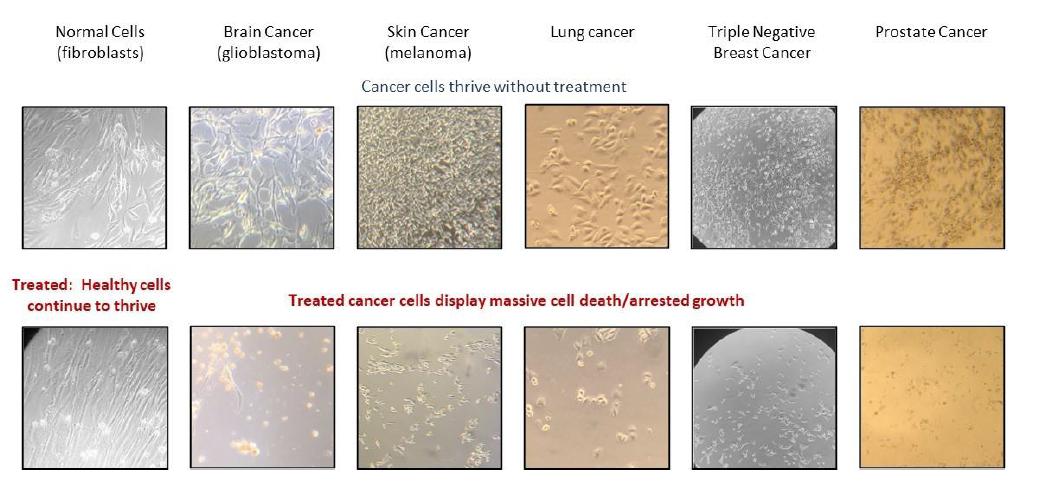

Through our wholly owned subsidiary, OncoSelect® Therapeutics, LLC, our Company is focused on expanding its broad platform technologies to create targeted therapeutics to fight cancer. In researching how TCPP, the porphyrin used in CyPath® Lung, enters cancer cells, we discovered a novel potential therapy that kills cancer cells that have been grown in petri dishes without apparent harm to normal cells. This approach uses RNA interference (“RNAi”), a natural mechanism for selectively silencing (eliminating or “knocking down”) a gene. Genes provide cells with instructions for making proteins, and silencing a gene by RNAi refers to stopping or reducing production of the protein specified by that gene. We discovered that treating cells in the laboratory with certain small interfering RNAs (“siRNAs,” which are short, chemically synthesized nucleic acid molecules), we can silence the two genes and thereby the production of two cell-surface proteins, causing potent and selective cancer cell death while leaving normal cells virtually unharmed. Our potential therapies will be achieved, in part, by advancing studies of the siRNA-driven silencing of two genes encoding for the cell surface proteins CD320 and LRP2. We found that silencing these two genes resulted in cell death in multiple human cancer cell lines, including lung, breast, prostate, melanoma, and brain cancer cell lines, but left normal human fibroblast and breast epithelial cells virtually unaffected.

Financial

To date, we have devoted a substantial portion of our efforts and financial resources to the development of the CyPath® Lung test. As a result, since our inception in 2014, we have generated no revenue from sales of the CyPath® Lung test and have funded our operations principally through private sales of our equity or debt securities. We have never been profitable and, as of March 31, 2022, we had an accumulated deficit of approximately $30.0 million. We currently have a total negative working capital of $12.8 million, including $11.7 million of convertible notes. We expect to continue to incur significant operating losses for the foreseeable future as we continue the development of our diagnostic tests or therapeutic products and advance them through clinical trials.

Corporate Information

We were incorporated in the State of Delaware on March 26, 2014. Our principal executive office is located at 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257, and our telephone number at that address is (210) 698-5334. Our laboratory diagnostic and therapeutic research is conducted at The Harvey Sandler Cancer Research Laboratories, which is located at Science Research Laboratories, Suite 1.424, University of Texas at San Antonio, San Antonio, Texas 78249. Our website address is https://www.bioaffinitytech.com/. Information contained on or that can be accessed through our website is not incorporated by reference into this prospectus. Investors should not consider any such information to be part of this prospectus.

| 6 | Analysis of the Potential Diagnostic, Patient And Economic Impact of CyPath® Lung When Used After LDCT Screening to Detect Lung Cancer, bioAffinity Technologies Internal Analysis with citations, 2022; attached as Appendix I of this prospectus. |

| 2 |

Reverse Stock Split

Our Board of Directors and stockholders approved an amendment to our Certificate of Incorporation to effect a 1-for-7 reverse stock split of our Common Stock in connection with this Offering, which became effective with the State of Delaware on June 23, 2022. As a result of the reverse stock split every seven shares of our outstanding Common Stock was combined and reclassified into one share of our Common Stock. No fractional shares were issued in connection with the reverse stock split, and any of our stockholders that were entitled to receive a fractional share as a result of the reverse stock split instead received cash in lieu of the fractional share valued at the per-Unit price of this Offering. The purpose of the reverse stock split was to allow us to meet the minimum share price requirement of the Nasdaq Capital Market.

Organizational Structure

The following organizational chart depicts our principal operating subsidiaries:

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” (an “EGC”) as defined in the Jumpstart Our Business Startups Act of 2012. As an EGC, for up to five years, we may elect to take advantage of certain specified exemptions from reporting and other regulatory requirements that are otherwise generally applicable to public companies. For example, these exemptions would allow us to:

| ● | present two, rather than three, years of audited financial statements with correspondingly reduced disclosure in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section (the “MD&A”) of this prospectus; | |

| ● | defer the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting; | |

| ● | make reduced disclosures about our executive compensation arrangements; and | |

| ● | forego the adoption of new or revised financial accounting standards until they would be applicable to private companies. |

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under SEC rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding internal control over financial reporting, to provide a compensation discussion and analysis, or to provide a pay-for-performance graph or CEO pay ratio disclosure, and they may present two, rather than three, years of audited financial statements and related MD&A disclosure.

| 3 |

We may take advantage of these exemptions up until the last day of the fiscal year following the fifth anniversary of this Offering or until we are no longer an EGC, which would be the case if (i) our total annual gross revenues are $1.07 billion or more; (ii) we issue more than $1 billion in non-convertible debt during a consecutive three-year period; or (iii) we become a “large accelerated filer,” as defined in the Exchange Act. We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of certain reduced reporting obligations in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. For more information, see “Risk Factors—General Risk Factors—We are an “emerging growth company,” and the reduced disclosure requirements applicable to emerging growth companies may make our Common Stock less attractive to investors.”

Our Business

bioAffinity Technologies, Inc. focuses on the need for noninvasive diagnosis of early-stage cancer and diseases of the lung, and targeted cancer therapeutics. The Company has developed a proprietary platform for in vitro diagnostics of which the first is a noninvasive test for early detection of lung cancer. The Company’s diagnostic tests are based on platform technologies that may be applicable to detecting other lung diseases such as chronic obstructive pulmonary disease (COPD) and asthma, and diagnosing other types of cancer such as prostate and bladder cancers.

Once cancer has been diagnosed, a variety of treatment options are available, depending on the cancer type and stage. Surgery and radiation treatments are typically site-specific, while chemotherapy is usually systemically administered. Chemotherapy presents a particular challenge because of a relative lack of selectivity for cancer cells and inability to differentiate between normal, healthy cells and cancer cells. Ideally, site-specific delivery of cancer-killing drugs would treat the disease and spare healthy cells. Our research to discover how the porphyrin used in CyPath® Lung enters cancer cells has led to discoveries that could lead to novel cancer therapeutics that selectively kill cancer cells of the lung, breast, brain, skin and prostate without apparent harm to normal (non-cancerous) cells.

Our First Diagnostic Test - CyPath® Lung

Lung cancer remains the most commonly diagnosed cancer and the leading cause of cancer-related deaths worldwide. Globally, there were an estimated 2.1 million lung cancer cases and 1.8 million lung cancer deaths in 2018.7 If detected and treated early (Stage I), the overall five-year survival rate of 21.5% leaps to a 10-year survival rate of 92%.8 Unfortunately, most lung cancer is detected in late stages. A large national clinical trial showed that screening for lung cancer using low-dose computed tomography (“LDCT”) can lower the mortality rate by 20% as compared to screening by x-ray if LDCT screening is used by patients at high risk for lung cancer on an annual basis.9 LDCT is therefore recommended for screening of an estimated 18 million Americans who are at high risk for lung cancer. However, LDCT was shown to have a low positive predictive rate of less than 4%. This means that for every 100 people who receive a positive result from LDCT screening and are suspected of having lung cancer, only four of those patients truly have the disease. A reliable, noninvasive and cost-effective diagnostic test can increase diagnosis of early-stage lung cancer while lowering the number of unnecessary and invasive procedures for patients with a false positive result from LDCT screening. (False positive means a person who does not have lung cancer but receives a positive result, in this case from LDCT screening.)

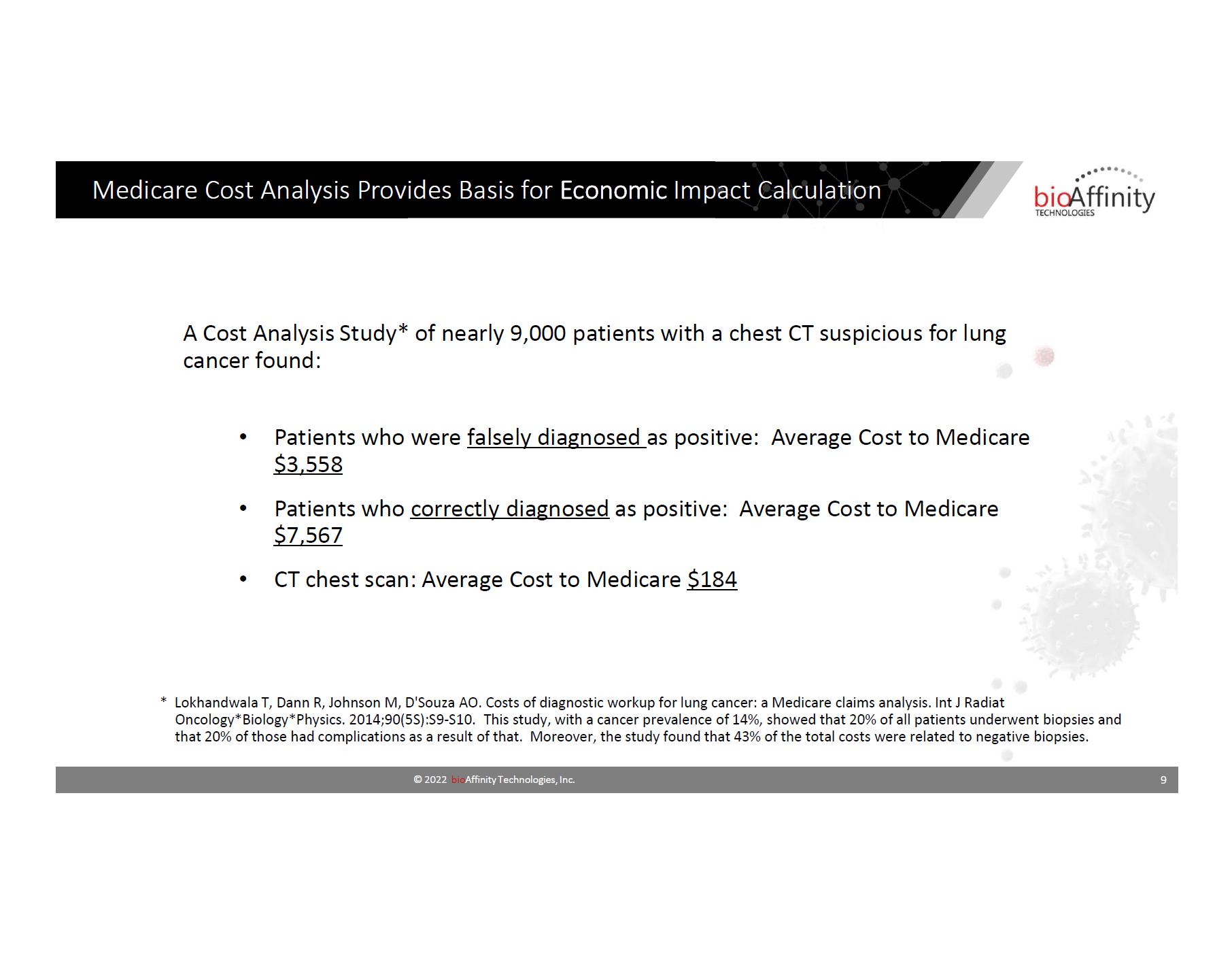

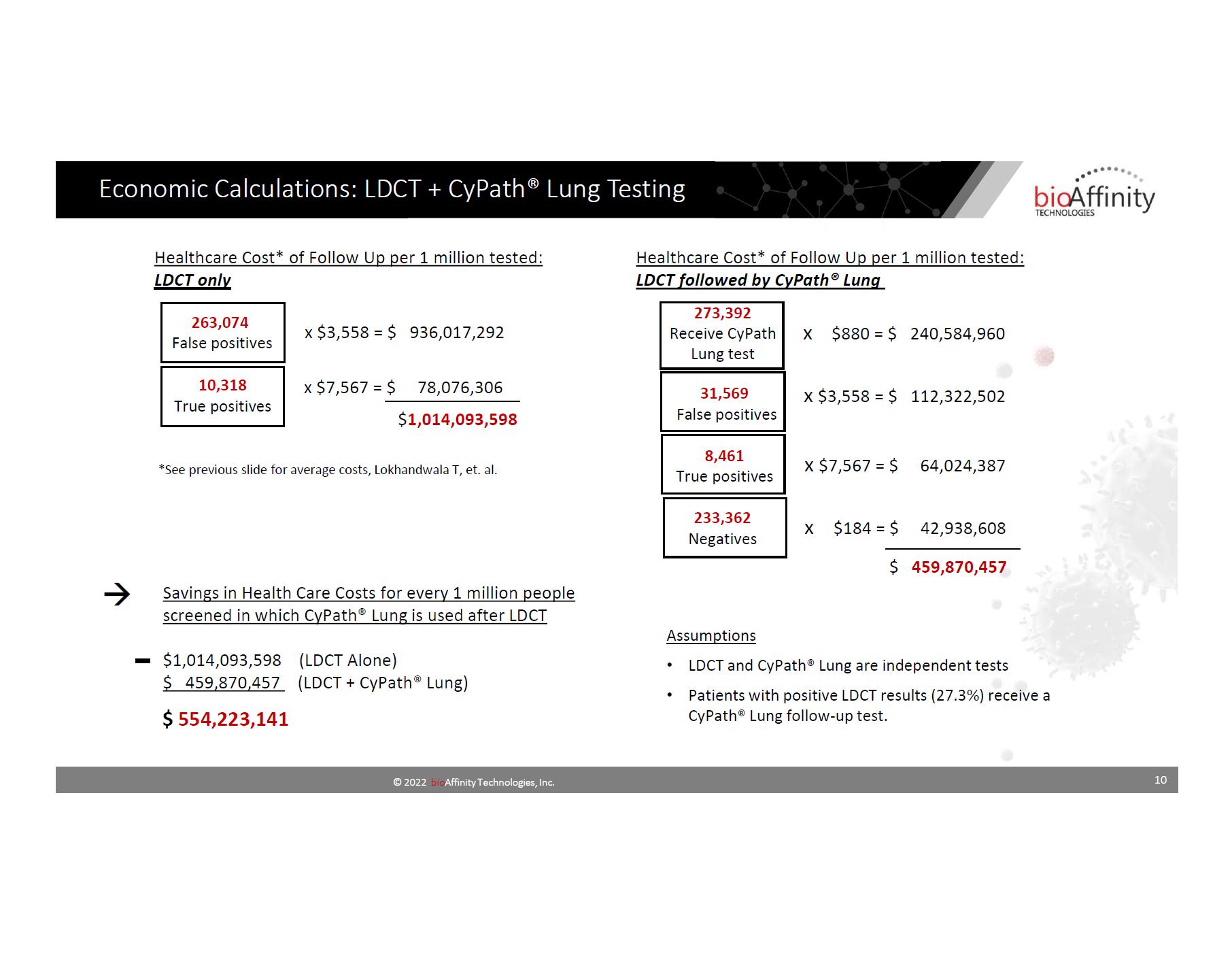

CyPath® Lung is a test for early-stage lung cancer that is designed to meet the need for greater diagnostic certainty. Its use in conjunction with LDCT is predicted to improve the positive predictive value (the probability that patients with a positive LDCT scan truly have the disease) by a factor of five.10 Our analysis concludes that improving the positive predictive value of LDCT with the use of CyPath® Lung has the potential to subject fewer patients to the stresses of misdiagnosis or unnecessary diagnostic procedures such as biopsies, while also reducing healthcare costs.11

| 7 | The Cancer Atlas, American Cancer Society (ACS), World Health Organization (WHO) and The Union for International Cancer Control (UICC); https://canceratlas.cancer.org/the-burden/lung-cancer/. |

| 8 | The International Early Lung Cancer Action Program Investigators, Survival of Patients with Stage I Lung Cancer Detected on CT Screening. N Engl J Med. 2006;355:1763-71. |

| 9 | Aberle DR, Adams AM, Berg CD, et al. Reduced lung-cancer mortality with low-dose computed tomographic screening. N Engl J Med. 2011;365:395-409. |

| 10 | Analysis of the Potential Diagnostic, Patient And Economic Impact of CyPath® Lung When Used After LDCT Screening to Detect Lung Cancer, bioAffinity Technologies Internal Analysis with citations, 2022; attached as Appendix I of this prospectus. |

| 11 | Ibid. |

| 4 |

The CyPath® Lung diagnostic process uses sputum, or phlegm, that is obtained noninvasively in the privacy of a patient’s home. Physicians can order the test for patients they suspect have lung cancer or patients with a positive LDCT screening result. CyPath® Lung uses flow cytometry to analyze cell populations in a person’s sputum to find characteristics indicative of lung cancer, including cancer or cancer-related cells that have shed from a lung tumor. A patient collects his or her sample using a hand-held, noninvasive assist device that acts to break up mucus in the lungs and help a person cough up their sputum from the lung into a collection cup. The sputum sample is shipped overnight to a clinical pathology laboratory that is accredited by the College of American Pathologists (“CAP”) and certified by the Clinical Laboratory Improvement Amendments of 1988 (“CLIA”) program, and processed with CyPath® that includes antibodies that distinguish different cell types and the synthetic porphyrin TCPP that identifies cancer cells and/or cancer-associated cells. The sputum sample is analyzed using flow cytometry, a well-established technology that analyzes the properties of single cells in minutes. An average sputum sample containing about 20 million cells can be profiled by flow cytometry in less than 20 minutes. Proprietary automated analysis software developed by the Company analyzes sample data in minutes, resulting in a patient report provided to the physician who orders the test. CyPath® Lung can be used by physicians to find early-stage lung cancer in their patients who have undergone lung cancer screening.

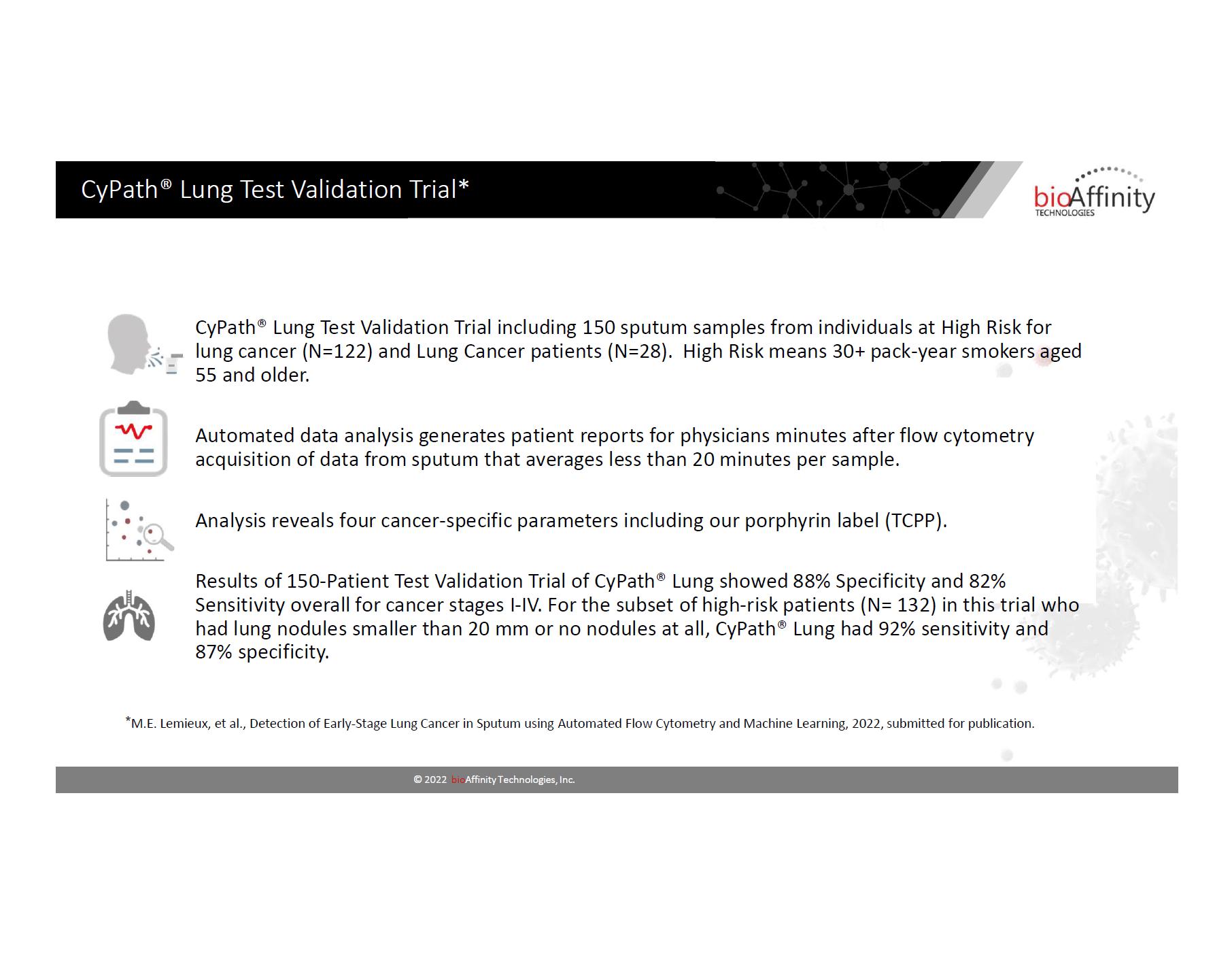

The Company conducted a 150-patient test validation trial of people at high risk for lung cancer including patients with the disease (N-28) and those cancer-free (N-122) that resulted in CyPath® Lung’s overall 88% specificity, meaning the ability to correctly identify a person without cancer, and 82% sensitivity, meaning the ability to correctly identify cancer in a person with the disease. For the subset of patients in this trial who had lung nodules smaller than 20 millimeters (“mm”) or no nodules at all, this trial resulted in 92% sensitivity and 87% specificity. In this subset of 132 individuals with small nodules, 119 patients were cancer-free and 13 had confirmed lung cancer. The detection of small lung nodules in people who have early-stage cancer can increase lung cancer survival.12

This 19-month test validation trial required participants to provide a sputum sample and CT imaging of the lungs. Participants provided a sputum sample and were released from the study after a physician either confirmed the individual was cancer-free by examination of CT imaging or confirmed the presence of lung cancer by biopsy. Data acquired by flow cytometry and patient data was analyzed to produce results. The data included (1) the proportion of cells with a high ratio of high TCPP fluorescence intensity over cell size; (2) the proportion of cells with an intermediate ratio of fluorescence intensity caused by the viability dye (FVS510) over cell size; (3) the proportion of cells that were CD206 negative but positive for one or more of the following markers: CD66b (granulocytes), CD3 (T cells), and CD19 (B cells): and patient age.

The CyPath® technology is based on research originating at Los Alamos National Laboratory in collaboration with St. Mary’s Hospital (Colorado) in which cancer samples were differentiated from non-cancer samples with 100% accuracy.13 This early research was conducted with sputum from 12 uranium miners. Microscope slides were made and the sputum samples labeled with the active ingredient of CyPath®, the synthetic and fluorescent porphyrin TCPP. Porphyrins are pigments that can be taken up by cells and can result in the cell fluorescing a red or purplish color that can be detected under a microscope or by flow cytometry. Porphyrins can be man-made, like TCPP, or they can be naturally occurring, like heme that is responsible for the red color in red blood cells. Cancer cells are known to take up certain porphyrins in higher amounts than non-cancer cells, and the high affinity for cancer cells displayed by TCPP makes it an excellent bio-label for cancer.14 The Los Alamos research study of 12 uranium miners included eight men with cancer and four healthy individuals. Researchers were blinded to the sample origin and looked for the presence of highly fluorescent cells indicating uptake of TCPP and the presence of lung cancer. The length of the study and specific follow-up was not reported, but researchers did report that one patient entering the study as a healthy subject was correctly diagnosed with cancer by the test.

We conducted market research with pulmonologists, oncologists, cardiothoracic surgeons, radiologists, and internists engaged in the diagnosis and treatment of lung cancer to help assess these stakeholders’ reactions to the new diagnostic test. Research revealed a strong interest in CyPath® Lung, driven by the high level of unmet clinical need for noninvasive diagnostics. A survey conducted with 240 pulmonologists and internists, the primary audience for the test, showed that 96% would use CyPath® Lung if it were available today as an adjunct with LDCT screening and diagnosis. Physicians responded favorably to a noninvasive diagnostic technology that gives them more confidence in their decision to proceed with more aggressive follow-up procedures if the test comes back positive. If test results are negative, physicians could rule out lung cancer, thus reducing the number of costly invasive procedures that result from the LDCT false-positive rate.

The CyPath® Lung laboratory test will be ordered by a physician for use by people at high risk for lung cancer who are recommended for annual screening by LDCT. While LDCT is shown to lower the mortality rate of lung cancer by at least 20% as compared to x-ray screening,15 the LDCT screening method has a low positive predictive value that can result in many people undergoing unnecessary invasive diagnostic procedures to confirm or rule out the presence of lung cancer. A physician who orders a CyPath® Lung test can have greater confidence in determining the next steps in patient care.16 Noninvasive sample collection and the test’s three-day turnaround in providing patient results after sample receipt make CyPath® Lung well suited for both sophisticated and less developed markets. Existing Current Procedural Terminology (“CPT”) codes associated with flow cytometry have been identified for use in reimbursement of CyPath® Lung as a laboratory-developed test (an “LDT”) based on the test’s use of flow cytometry to detect lung cancer.

| 12 | Aberle DR, Adams AM, Berg CD, et al. Reduced lung-cancer mortality with low-dose computed tomographic screening. N Engl J Med. 2011;365:395-409. |

| 13 | Cole, et. al. US Patent 5,162,231, supplemental material. |

| 14 | El-Far MA, Pimstone N. A comparative study of 28 porphyrins and their abilities to localize in mouse mammary carcinoma: uroporphyrin I superior to hematoporphyrin derivative. Prog Clin Biol Res. 1984;170:661–672. |

| 15 | Aberle DR, Adams AM, Berg CD, et al. Reduced lung-cancer mortality with low-dose computed tomographic screening. N Engl J Med. 2011;365:395-409. |

| 16 | Ibid, Internal Analysis, 2022, attached as Appendix I of this prospectus. |

| 5 |

Patients will use the Smiths Medical’s acapella® Choice Blue device with CyPath® Lung to assist patients in opening lung passageways and expelling sputum into a collection cup noninvasively. The acapella® Choice Blue has been 510(k) cleared by the U.S. Food and Drug Administration (the “FDA”) as a positive expiratory pressure device to help mobilize lung secretions in people with certain lung conditions. bioAffinity Technologies has an agreement with GO2 Partners to produce patient collection kits and to provide warehousing and distributions services for sending out the kits. Laboratory reagents, supplies and equipment are commercially available through multiple vendors. Sample processing, labeling, and data collection can be accomplished by a laboratory technician skilled in general laboratory techniques. Data analysis leading to a physician’s report is done by automated analysis software fully integrated into the test.

The Company’s business-development plan (our “Business Plan”) envisions four phases of expanding market entry that are timed to maximize Company resources and minimize market risk. Each of the four phases are discussed in detail in the “Business—CyPath® Lung Business Development Plan” section of this prospectus beginning on page 62.

OncoSelect® Therapeutics Research

OncoSelect® Therapeutics, LLC, a Delaware limited liability company and wholly owned subsidiary of bioAffinity (“OncoSelect®”), is a preclinical stage biopharmaceutical discovery company with a focus on therapeutics that deliver cytotoxic (cell-killing) effects on a broad selection of human cancers from diverse tissues while having little or no effect on normal cells.

Unlike many of our industry competitors, OncoSelect® does not pursue therapies that depend on specific mutations, biomarkers, or other genetic or epigenetic abnormalities for their effect. We pursue research based on our own scientific discoveries demonstrating that inhibition of the expression of two specific cell membrane proteins result in the selective killing of various cancer cell types grown in the laboratory with little or no effect on normal (non-cancerous) cells.

Our scientific discoveries stemmed from research we conducted to better understand the mechanism by which TCPP, the synthetic porphyrin used in CyPath® Lung, selectively enters cancer cells. We have established several specific areas of therapeutic research that have evolved from our TCPP experiments.

OncoSelect® therapies offer the possibility of broad applications in cancer treatment. OncoSelect® will use a licensing business model for selective chemotherapeutic compounds to be developed by the Company.

The Company will pursue its therapeutics business through OncoSelect®. Initial therapeutic compositions to be developed will be based on market and cost factors. Composition synthesis is being outsourced to one of several select vendors. bioAffinity will conduct initial testing of promising compounds with assistance from select vendors who have contractually relinquished any claim to discoveries, data, or intellectual property. Additional patents will be filed based on testing, and results will be publicized to evaluate the interest in individual compounds and pursue licensing opportunities. The Company will continue to develop, test, publish its findings, and partner to maximize revenues and contain expenses.

Intellectual Property Portfolio

As of July 26, 2022, the Company and its subsidiary OncoSelect have a patent estate that includes 14 issued U.S. and foreign counterpart patents, including three U.S. patents and eleven foreign counterpart patents in Australia, Canada, China, France, Germany, Hong Kong, Italy, Mexico, Spain, Sweden, and the United Kingdom. Two awarded patents directed at diagnostic applications expire in 2022, and one U.S. patent and nine counterpart foreign patents directed at diagnostic applications expire in 2030. Therapeutic patents registered in Australia and Mexico expire in 2037. One therapeutic patent application that has been granted in China expires in 2037 once registered.

| 6 |

With regard to our diagnostic test CyPath® Lung and other diagnostic candidates, we have three issued U.S. patents and nine foreign counterpart patents in Canada, China, France, Germany, Hong Kong, Italy, Spain, Sweden, and the United Kingdom. With regard to our diagnostic patent applications, one of two families is directed at diagnosing lung health using flow cytometry, and the other is directed at proprietary compensation beads used to calibrate the flow cytometry instrument and used in CyPath® Lung data acquisition. Pending applications directed at diagnosing lung health include one pending U.S. non-provisional patent application and eight foreign counterpart patent applications in Australia, Canada, China, European Patent Office, Hong Kong, Japan, Mexico, and Singapore filed in 2019, one provisional patent application filed in 2021 and two provisional patent applications filed in 2022. The patent application directed at the composition of compensation beads was filed as a provisional application in 2021.

With regard to our therapeutic product candidates, we have three pending U.S. patent applications, two issued foreign patents, three pending Patent Cooperation Treaty International patent applications, and ten foreign applications pending in Canada, China, European Patent Office, Hong Kong, India, and Japan. The therapeutic intellectual property is made up of four families directed at our therapeutic product candidates, including two families directed at siRNA product candidates, one family directed at soluble CD320 used in the treatment of cancer, and one family directed at porphyrin conjugates for treating cancer.

Industry, Business Development, and Competition

Industry Opportunity

The global market for cancer diagnostic tests is expected to grow dramatically in coming years. Cancer diagnostic tests, including devices, grew from $156.27 billion in 2020 to $170.21 billion in 2021, with a compound annual growth rate of 8.9%, and is projected to reach $239.23 billion in 2025.17 Lung cancer is the most common cancer globally and its incidence continues to increase in some large nations including China.18 The global market for lung cancer diagnostic tests was estimated at $2.5 billion in 2020 and is projected to reach a value of $4.3 billion by 2027, with a compounded annual growth rate of 8.1% over 2020-2027.19 Clinical diagnostics play an important role in disease prevention, detection, and management. bioAffinity’s first test, CyPath® Lung, focuses on the leading cause of cancer death among both men and women. Each year, more people die of lung cancer than of colon, breast, and prostate cancers combined, making up almost 18% of all cancer deaths worldwide. Lung cancer typically may not be symptomatic in its early stages when it is most treatable. An estimated 18 million patients at high risk for lung cancer in the U.S. are recommended for annual screening. Initially, physicians would order CyPath® Lung for those high-risk patients as an adjunct to LDCT screening to aid in the decision whether or not to pursue more aggressive follow-up procedures. A more accurate and reliable lung diagnostic pathway using LDCT and noninvasive methods could result in fewer patients being subjected to the stresses of unnecessary, invasive diagnostic procedures such as biopsies. CyPath® Lung is well suited for use in both sophisticated and less-developed markets because sample collection is noninvasive and conducted at home, the sample can be shipped overnight by commercial carriers and sample processing and automated analysis can be completed by laboratory technicians skilled in general laboratory techniques. Patient reports are provided to the ordering physician within three days of sample receipt at the laboratory.

| 17 | Global Cancer Diagnostics Market Research Report 2021 - ResearchAndMarkets.com., 2021. |

| 18 | Zhang Y, Luo G, Etxeberria J, Hao Y. Global patterns and trends in lung cancer incidence: a population-based study. J Thorac Oncol. 2021;16:933–944. |

| 19 | Reportlinker: Global Lung Cancer Diagnostics Industry. https://www.reportlinker.com/p05834219/Global-Lung-Cancer-Diagnostics-Industry.html. |

| 7 |

Competitive Strengths

bioAffinity Technologies conducts an ongoing competitive analysis of companies in the lung cancer diagnostic sector of the clinical diagnostics market. In 2022, the Company evaluated companies that reported an interest in diagnosing lung cancer, focusing on 67 companies and academic institutions it identified as active in the early lung cancer diagnostic sector. A thorough evaluation of the early lung cancer diagnostic landscape reveals multiple reasons why CyPath® Lung is positioned to be a market leader. CyPath® Lung performance shown in the Company’s test validation trial resulted in 92% sensitivity and 87% specificity in high-risk patients who had lung nodules 20 mm or smaller. Eight out of ten (80%) Stage I tumors were correctly identified, indicating that CyPath® Lung can find lung cancer at its earliest stage. Overall, when diagnosing lung cancer in all stages, the clinical trial resulted in CyPath® Lung specificity of 88% and sensitivity of 82%, similar to far more invasive procedures and surgery currently used to diagnose lung cancer. (See the “Comparison of CyPath® Lung to Current Standards of Care” chart in the “Business” section of this prospectus.) The test validation trial of 150 patients was conducted over 19 months. Participants provided a sputum sample and were released from the study after a physician either confirmed the individual was cancer-free by examination of CT imaging or confirmed the presence of lung cancer by biopsy. Test data used to produce results included:(1) the proportion of cells with a high ratio of high TCPP fluorescence intensity over cell size; (2) the proportion of cells with an intermediate ratio of fluorescence intensity caused by the viability dye (FVS510) over cell size; (3) the proportion of cells that were CD206 negative but positive for one or more of the following markers: CD66b (granulocytes), CD3 (T cells), and CD19 (B cells): and patient age.

The majority of competitors’ tests either incorrectly classify a high proportion of people without cancer as having the disease (known as false negatives) more than 50% of the time or misdiagnose people as cancer-free (known as false positives) more than 50% of the time. It is important to note that most competitors who have conducted clinical trials also have not designed their trials to evaluate the test’s measure of accuracy – such as sensitivity and specificity – in the high-risk population for whom the test is intended. CyPath® Lung has identified existing CPT codes for use with CyPath® Lung that have a reimbursable track record. A patient collects his or her sample at home, which is a particular benefit during a pandemic. Sample processing for CyPath® Lung can be done by laboratory technicians, and reagents used by the test are widely available. Data acquisition and analysis and test results are fully automated.

Business Strategies

The Company is moving forward with commercialization of CyPath® Lung in a systematic, four-phased Business Plan that is expected to maximize resources and minimize market risk. Briefly, Phase 1 of the Business Plan begins with a market launch in Texas of CyPath® Lung as an LDT under the CLIA program administered by the Centers for Medicare and Medicaid Services (“CMS”), in partnership with the states, and standards issued by CAP. An LDT is a type of in vitro diagnostic (“IVD”) test that is developed, validated and performed within a single laboratory. CyPath® Lung has been validated and is being performed by Precision Pathology Services (“Precision Pathology”), a CAP-accredited, CLIA-certified clinical pathology laboratory in San Antonio, Texas, pursuant to a joint development agreement with the Company. Precision Pathology has completed the required analytical validation in accordance with CLIA, which looks at the performance characteristics of a test used to describe the quality of patient test results and includes an analysis of accuracy, precision, analytical sensitivity, analytical specificity, reportable range, reference interval, and other performance characteristics that the test system must be evaluated by in the laboratory that intends to offer the test system for sale. This analytical validation is limited to the specific conditions, staff, equipment and patient population of the particular laboratory. Having completed the CLIA analytical validation, Precision Pathology is offering the CyPath® Lung test for sale with a controlled rollout beginning in Texas, which we anticipate will require six months, before expanding throughout the Southwest region of the U.S. through the first half of 2023. After establishing CyPath® Lung in the Southwest market, the laboratory will expand sales in 2023 to additional states with plans to market the test nationwide.

In Phase 2, the Company will launch CyPath® Lung as a CE-marked IVD test in the European Union (the “EU”). We intend to execute an agreement in Phase 2 with one or more commercial laboratories to sell CyPath® Lung in the EU market. In Phase 3, we will submit a request for de novo classification to the FDA to classify CyPath® Lung as a Class II IVD medical device for the detection of lung cancer. In order to seek de novo classification and marketing authorization of CyPath® Lung by the FDA, we must conduct a “pivotal clinical trial” to demonstrate the safety and efficacy of CyPath® Lung. We are currently working with a contract research organization (a “CRO”) to finalize the design of the pivotal clinical trial and plan to submit a pre-submission package to the FDA in the third quarter of 2022 to obtain the FDA’s feedback on the study design. A pivotal clinical trial is scheduled to begin in early 2023. Final design of the pivotal clinical trial has not been determined at this time, including the number of participants and patient follow-up. We expect to conduct a pivotal clinical trial that requires between two to three years depending on the clinical trial’s size, objectives and endpoints. Assuming the study is successful, we intend to submit a de novo classification request to the FDA within six months of study completion. If the de novo request is granted by the FDA, we expect such marketing authorization to result in a larger market and greater market share for CyPath® Lung. FDA marketing authorization also can lead to higher reimbursement, expanded claims and additional indications for use of CyPath® Lung for the early detection of lung cancer. Phase 4 will accelerate the diagnostic’s market presence to expand into other global markets, including China, Southeast Asia, and Australia. The timeline for commercialization is discussed in the “Business—CyPath® Lung Business Development Plan” section on page 62.

Summary of Risk Factors

Like any emerging growth company, we face significant risk factors that may impede our plans for successful commercialization of our diagnostic and therapeutic products. These risks are discussed in detail under the “Risk Factors” discussion beginning on page 14 of this prospectus.

The following summarizes the principal factors that make an investment in our Company speculative or risky, all of which are more fully described in the section below titled “Risk Factors.” This summary should be read in conjunction with the section below titled “Risk Factors” and should not be relied upon as an exhaustive summary of the material risks facing our business. The following factors could result in harm to our business, reputation, revenue, financial results, and prospects, among other impacts:

| ● | our limited operating history and history of net losses since our inception; | |

| ● | our need to obtain substantial additional funding to complete the development and commercialization of our diagnostic tests and therapeutic product candidates; | |

| ● | potential dilution to our stockholders, including purchasers of Common Stock in this Offering, resulting from the conversion of our preferred stock, par value $0.001 per share (our “Preferred Stock”) and convertible debt outstanding, and potential restrictions, due to raising additional capital; | |

| ● | the impact of a material weakness identified in our internal control over financial reporting; | |

| ● | the early stage of our development efforts; |

| 8 |

| ● | the unpredictability of future trial results; | |

| ● | the difficulty in predicting the results, timing, and cost of our development of our diagnostic tests and therapeutic product candidates and the likelihood of obtaining regulatory approval; | |

| ● | the risk of experiencing delays or difficulties in the enrollment and/or retention of patients in clinical trials; | |

| ● | potential changes to interim, “top-line” or preliminary results from our clinical trials as more patient data becomes available and are subject to audit and verification procedures; | |

| ● | the risk that the FDA may not agree with our LDT regulatory strategy or that Congress may enact legislation giving the FDA new authorities to regulate LDTs; | |

| ● | the lengthy, time consuming, and unpredictable nature of regulatory approval processes; | |

| ● | the risk that our preclinical studies and clinical trials fail to demonstrate the safety and efficacy of our diagnostic tests or therapeutic product candidates; | |

| ● | the risk that data from clinical trials conducted outside of the United States may not be accepted by regulatory authorities; | |

| ● | the impact of ongoing regulatory obligations and continued regulatory review, even if we receive regulatory approval for any of our diagnostic tests or therapeutic product candidates; | |

| ● | our lack of control over the supply, regulatory status, or regulatory approval of third-party drugs or biologics with which our diagnostic tests or therapeutic product candidates are used in combination; | |

| ● | our lack of control over the conduct of investigator-initiated clinical trials or other clinical trials sponsored by organizations or agencies other than us; | |

| ● | the risk that we fail to develop additional diagnostic tests or therapeutic product candidates; | |

| ● | the risk that we are unable to penetrate multiple markets; | |

| ● | the risk that our diagnostic tests and therapeutic product candidates may fail to achieve market acceptance, even they receive marketing authorization; | |

| ● | if we are unable to obtain and maintain sufficient intellectual property protection for our platform and our diagnostic tests or therapeutic product candidates, or if the scope of the intellectual property protection is not sufficiently broad, our competitive position may be adversely affected; | |

| ● | the price of our stock may be volatile, and you could lose all or part of your investment. Unstable market and economic conditions may have serious adverse consequences on our business, financial condition and stock price; | |

| ● | our success is highly dependent on our ability to attract and retain highly skilled executive officers and employees; | |

| ● | we face significant competition from other biotechnology and pharmaceutical companies, and our operating results will suffer if we fail to compete effectively; and | |

| ● | our business is affected by the ongoing COVID-19 pandemic and may be significantly adversely affected as the pandemic continues or if other events out of our control disrupt our business or that of our third-party providers. |

| 9 |

THE OFFERING

| Issuer. | bioAffinity Technologies, Inc. | |

| Securities Offered. | 1,180,000 Units, each Unit consisting of (i) one share of our Common Stock, (ii) one five-year Tradeable Warrant to purchase one share of our Common Stock for an assumed exercise price of $7.20 per share (120% of the assumed $6.00 Offering Price of one Unit), and one five-year Non-tradeable Warrant to purchase one share of our Common Stock for an assumed exercise price of $7.50 per share (125% of the assumed $6.00 per-Unit Offering Price), as adjusted to reflect a 1-for-7 reverse stock split of our Common Stock that became effective on June 23, 2022. The Warrants are exercisable from the date of issuance until the fifth anniversary of such date. The actual number of Units we will offer will be determined based on the actual Offering Price. The Units will not be certificated or issued in stand-alone form. The shares of our Common Stock and the Warrants underlying the Units are immediately separable upon issuance and will be issued separately in this Offering. | |

| Description of the Warrants. | Each Unit consists of one share of Common Stock and two Warrants: one Tradeable Warrant and one Non-tradeable Warrant. Each Tradeable Warrant is exercisable for one share of Common Stock for an assumed $7.20 per share (120% of the assumed $6.00 Offering Price of one Unit). Each Non-tradeable Warrant is exercisable for one share of Common Stock for an assumed $7.50 per share (125% of the assumed per-Unit Offering Price). Upon the exercise of a Warrant, the assumed exercise price of the underlying share of Common Stock is subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations, or similar events affecting our Common Stock as described herein. A holder may not exercise any portion of a Warrant to the extent that the holder, together with its affiliates and any other person or entity acting as a group, would beneficially own more than 9.99% of our outstanding Common Stock after exercise, as such percentage ownership is determined in accordance with the terms of the Warrants. Each Warrant will be exercisable immediately upon issuance and will expire five (5) years after the initial issuance date. The terms of the Warrants will be governed by a Warrant Agent Agreement, dated as of the effective date of this Offering, between us and VStock Transfer, LLC as the warrant agent (the “Warrant Agent”). This prospectus also relates to the offering of the shares of Common Stock issuable upon exercise of the Warrants. For more information regarding the Warrants, you should carefully read the section titled “Description of Securities—Warrants” on page 100 of this prospectus. | |

| Over-Allotment Option. | We have granted the underwriters a 45-day Over-Allotment Option to purchase up to an additional 177,000 shares of Common Stock at the Offering Price per Unit less $0.02, and/or up to 177,000 Tradeable Warrants at $0.01 per Tradeable Warrant, and/or up to 177,000 Non-tradeable Warrants at $0.01 per Non-tradeable Warrant, or any combination of additional shares of Common Stock and Warrants representing, in the aggregate, up to 15% of the number of Units sold in this Offering solely to cover over-allotments, if any, in all cases less the underwriting discounts payable by us. | |

| Voting Rights. | Each share of Common Stock entitles its holder to one vote on all matters to be voted on by stockholders generally. Holders of our “Series A Convertible Preferred Stock,” par value $0.001 per share (our “Series A Preferred Stock”), have the same voting rights and powers as holders of the Common Stock. Each holder of our Series A Preferred Stock is entitled to the number of votes such holder would be entitled to upon the conversion of their Series A Preferred Stock shares into shares of Common Stock. Shares of our Series A Preferred Stock have voting rights and powers equal to the voting rights and powers of our Common Stock and vote together with the shares of our Common Stock as a single class for all matters except for the election of a designated director as described below and as required by law. For so long as 30% of the Series A Preferred Stock shares remain outstanding, the holders of our Series A Preferred Stock, voting as a separate class, are entitled to elect one director of the Company (such right, the “Series A Director Designation Right”; such director, the “Series A Representative”).

In accordance with Section 3(B)(i) of the Certificate of Designation of the Series A Preferred Stock, all of the issued and outstanding shares of Series A Preferred Stock will be automatically converted into fully paid and nonassessable shares of Common Stock at the then-effective conversion rate of the Series A Preferred Stock immediately prior to the closing of this Offering. The conversion rate of Series A Preferred Stock into Common Stock is initially 1 for 7 (as adjusted for the 1-for-7 reverse stock split) but is subject to further adjustment in the event of a stock split, stock dividend or similar event. Following the automatic conversion of the Series A Preferred Stock shares into Common Stock in connection with and immediately prior to this Offering, the Company will never again issue the shares so converted, and all such converted shares will cease to be part of the Company’s authorized stock. Furthermore, the Series A Director Designation Right will cease to exist because fewer than 30% of the Series A Preferred Stock shares will be outstanding. The director who currently serves as the Series A Representative, however, will continue to serve as a director until his earlier resignation or removal or until his successor is duly elected and qualified. The number of Board seats for election by the holders of the Common Stock will be expanded by one so that the director position that the holders of the Series A Preferred Stock were previously entitled to elect will be subject to election by the holders of the Common Stock following the conversion of the Series A Preferred Stock into Common Stock in connection with this Offering. See “Description of Securities.”

As determined in accordance with the beneficial-ownership provisions of Rule 13d-3 and Item 403 of Regulation S-K under the Exchange Act, immediately after this Offering, our officers and directors will control approximately 50.9% of the voting power of our Common Stock. See “Principal Stockholders.” | |

| Use of Proceeds. | We estimate that the net proceeds to us from the sale of our Units in this Offering will be approximately $5.5 million, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. This assumes an Offering Price of $6.00 per Unit. If the underwriters exercise their Over-Allotment Option in shares of Common Stock in full, the net proceeds to us will be approximately $6.5 million.

We intend to use the net proceeds from this Offering for working capital and for general corporate purposes, which may include laboratory test and therapeutic product development, general and administrative matters, and capital expenditures. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present commitments or agreements to enter into any acquisitions or investments.

We cannot specify with certainty all of the uses of the net proceeds that we will receive from this Offering. Accordingly, we will have broad discretion in the application of these proceeds and our investors will be relying on the judgment of our management regarding the application of the net proceeds of this Offering. | |

| Dividend Policy. | We do not anticipate paying dividends on our Common Stock for the foreseeable future. | |

| Underwriters’ Compensation. | In connection with this Offering, the underwriters will receive an underwriting discount equal to 9.0% (subject to reduction) of the Offering Price of the Units in this Offering and of the shares or Warrants sold in the exercise of its Over-Allotment Option. If more than 25.0% of the Units offered hereby are sold to existing investors in the Company, then the cash fee to the underwriters will be reduced to 4.0% of the aggregate gross proceeds from the existing investors. We are aware that certain of our current stockholders have indicated an interest in purchasing Units in this Offering and we currently anticipate they may purchase approximately 11.85% of the Units in this Offering, assuming that the underwriters will not exercise the Over-Allotment Option. In addition, we have agreed to reimburse certain accountable expenses of the Representative, indemnify the underwriters for certain liabilities, including liabilities under the Securities Act, and to contribute to payments the underwriters may be required to make in respect thereof, in connection with this Offering, and provide to the Representative a right of first refusal to participate in future offerings. See “Underwriting” starting on page 109 of this prospectus. | |

| Representative’s Warrant. | The registration statement of which this prospectus is a part also registers for sale the Representative’s Warrant, which gives the Representative the right to purchase up to 2.0% (subject to reduction) of the shares of Common Stock underlying the Units sold in this Offering, as a portion of the underwriting compensation in connection with this Offering. The Representative’s Warrant will be exercisable at any time, and from time to time, in whole or in part, during the period commencing 180 days after the commencement of sales of the Units in this Offering and expires five years from the effective date of this Offering at an exercise price of $6.90 (115% of the assumed Offering Price per Unit). We are registering the Representative’s Warrant and the shares of Common Stock underlying the Representative’s Warrant in the registration statement of which this prospectus is a part. See “Underwriting—Representative’s Warrant” on page 110 of this prospectus for a description of the Representative’s Warrant. | |

Placement Agent’s Warrant.

|

In connection with the sale of our convertible bridge notes in the fourth quarter of 2021 and the first quarter of 2022, our placement agent, WallachBeth Capital, LLC (the “Placement Agent”), will receive a commission of 9.0% of the gross proceeds received from introduced parties and will be issued a warrant to purchase 29,464 shares of our Common Stock (the “Placement Agent’s Warrant”). The Placement Agent’s Warrant will have substantially the same terms as those issued to our noteholders. That warrant is considered as compensation to the Placement Agent pursuant to the rules of FINRA and will not be exercisable until 180 days after the commencement of the sale of the Units in this Offering. The exercise price of one share of our Common Stock pursuant to the Placement Agent’s Warrant will be equal to 120% of the initial Offering Price of one Unit in this Offering). We are registering the shares of Common Stock underlying the Placement Agent’s Warrant in the registration statement of which this prospectus is a part. |

| 10 |

| Lock-Up Agreements. | We have agreed with the underwriters not to sell additional equity securities for a period of 180 days after the effective date of this Offering. Our directors and officers have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible into Common Stock, subject to certain exceptions, for a period of 180- days after the date of this prospectus, which restriction may be waived in the discretion of the Representative. See “Underwriting—Lock-Up Agreements” on page 111 of this prospectus. | |

| Risk Factors. | You should read the “Risk Factors” section beginning on page 14 of this prospectus and the other information included herein for a discussion of factors to consider prior to deciding to invest in our Units. | |

| Reverse Stock Split. | In connection with this Offering, we completed a 1-for-7 reverse stock split of our Common Stock on June 23, 2022. The purpose of the reverse stock split was to meet the minimum stock price requirement of the Nasdaq Capital Market. All share numbers in this prospectus have been adjusted to give effect to the reverse stock split. | |

| Proposed Nasdaq Capital Market Listing. | We have applied to have our Common Stock listed on the Nasdaq Capital Market under the symbol “BIAF.” We have applied to have our Warrants listed on the Nasdaq Capital market under the symbol “BIAFW.” No assurance can be given that our Nasdaq listing applications will be approved, or that a trading market will develop for our Common Stock or Warrants. We will not proceed with this Offering if our applications to list our Common Stock or our Warrants on Nasdaq are not approved. | |

| Transfer Agent and Warrant Agent. | The transfer agent and registrar for our Common Stock and the Warrant Agent for our Warrants is VStock Transfer, LLC. |

| (1) | The number of shares of Common Stock outstanding immediately before this Offering excludes: (i) any shares of Common Stock issuable upon the mandatory conversion of convertible promissory notes issued by us to a number of investors in private placement transactions occurring between December 2018 and January 2022 at a conversion price of $4.20 per share; (ii) 756,558 shares issuable upon the mandatory conversion of our Series A Preferred Stock issued by us to a number of investors in a private placement in July 2017; (iii) 2,815,967 shares issuable upon the exercise of Common Stock purchase warrants that were issued by us to a number of investors in private placement transactions occurring between March 2017 and July 2022 with a weighted average exercise price equal to the initial Offering Price in this Offering; and (iv) 876,952 shares issuable upon the exercise of stock options issued under our 2014 Equity Incentive Plan to certain of our employees, directors, and consultants between April 2014 and March 2022. |

| (2) | The number of shares of Common Stock to be outstanding immediately following this Offering excludes: |

| ● | 2,360,000 shares of Common Stock issuable upon the exercise of the Warrants underlying the Units sold in this Offering; | |

| ● | 177,000 shares of Common Stock issuable upon the exercise of the Over-Allotment Option; | |

| ● | 23,600 shares of Common Stock issuable upon the exercise of the Representative’s Warrant and 29,464 shares of Common Stock issuable upon the exercise of the Placement Agent’s Warrant; | |

| ● | 2,815,967 shares of Common Stock issuable upon the exercise of Common Stock purchase warrants with a term of five years issued to the holders of our convertible notes with a weighted average exercise price equal to $5.25 per share; and | |

| ● | 876,952 shares of Common Stock issuable upon the exercise of stock options granted under our 2014 Equity Incentive Plan with a weighted average exercise price equal to $4.11 per share. |

Except as otherwise indicated, all information in this prospectus assumes:

| ● | the issuance of 756,558 shares of Common Stock issuable upon the conversion of Series A Preferred Stock at the completion of this Offering; | |

| ● | no exercise of the Warrants underlying the Units in this Offering; | |

| ● | no exercise of any options under the Company’s 2014 Equity Incentive Plan; | |

| ● | no exercise of the Representative’s Warrant or the Placement Agent’s Warrant; and | |

| ● | no exercise of the Over-Allotment Option. |

SUMMARY FINANCIAL DATA