As filed with the Securities and Exchange Commission on September 20, 2023.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 8731 | ||||

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Chief Executive Officer

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Leslie Marlow, Esq. Hank Gracin, Esq. Patrick J. Egan, Esq. Blank Rome LLP 1271 Avenue of the Americas New York, New York 10020 Tel: (212) 885-5000 |

Ross David Carmel, Esq. Jeffrey P. Wofford, Esq. Carmel, Milazzo & Feil LLP 55 West 39th Street 4th Floor New York, New York 10018 (212) 658-0458 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller

reporting company | ||

| Emerging

growth company |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated September 20, 2023.

PRELIMINARY PROSPECTUS

3,086,419 Units

Each Unit Consisting of

One Share of Common Stock and

One Warrant to Purchase One Share of Common Stock,

(and the shares of Common Stock underlying such Warrants)

bioAffinity Technologies, Inc.

bioAffinity Technologies, Inc., a Delaware corporation headquartered in Texas (the “Company”), develops noninvasive, diagnostics to detect cancer and lung disease at early stage, and is researching targeted therapies to treat cancer at the cellular level.

This is the public offering (the “Offering”) of up to 3,086,419 units (each, a “Unit,” collectively, the “Units”). Each Unit consists of one share of our common stock, $0.007 par value per share (the “Common Stock”) and one warrant to purchase one share of Common Stock at an at an assumed offering price of $1.62 per Unit, which was the closing price of the Common Stock on September 13, 2023. The Units have no stand-alone rights and will not be certificated or issued as stand-alone securities. The shares of Common Stock and the Warrants underlying the Units are immediately separable and will be issued separately in this Offering. Each Warrant offered as part of this Offering will have an exercise price of $[●] per share (equal to 120% of the public offering price of each Unit sold in this offering), is immediately exercisable on the date of issuance and will expire five years from the date of issuance. The actual public offering price per Unit (the “Offering Price”) will be determined between the underwriters and us at the time of pricing, considering our historical performance and capital structure, prevailing market conditions, and overall assessment of our business.

Pursuant to the registration statement related to this prospectus, we are also registering the shares of Common Stock issuable upon exercise of Warrants.

Our Common Stock and our tradeable warrants issued in our initial public offering (the “Tradeable Warrants”) are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbols “BIAF” and “BIAFW,” respectively. On September 13, 2023, the last reported sale price of our Common Stock was $1.62 per share and the last reported sale price of our Tradeable Warrants was $0.21. The actual Offering Price will be determined between us and WallachBeth Capital, LLC (“WallachBeth”) as the representative of the underwriters at the time of pricing, taking into consideration several factors as described in “Underwriting – Pricing of the Offer” and may be at a discount to the current market price. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

We are an “emerging growth company” and a “smaller reporting company” under applicable federal securities laws and will be subject to reduced public company reporting requirements.

Investing in our securities involves a high degree of risk. See the “Risk Factors” section beginning on page 14 of this prospectus for a discussion of the factors that you should consider before investing in our Common Stock.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Unit | Total Assuming No Exercise of Over- Allotment Option | Total With Full Exercise of Over- Allotment Option | ||||||||||

| Public Offering Price | $ | $ | $ | |||||||||

| Underwriting discount(1) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us(2) | $ | $ | $ | |||||||||

| (1) | We have agreed to issue, on the closing date of this Offering, a warrant to WallachBeth Capital, LLC, the representative of the underwriters (the “Representative”; such warrant, the “Representative’s Warrant”), to purchase an amount equal to two percent (2.0%) of the aggregate number of shares of Common Stock underlying the Units sold by us in this Offering. The Representative’s Warrant is exercisable for a period of five years, commencing on the date that is 180 days after the commencement date of sales of the Units in this Offering and expiring on the five year anniversary of the effective date of the registration statement of the Offering. Please read the section titled “Underwriting” for a description of all underwriting compensation payable by us in connection with this Offering. | |

| (2) | The amount of Offering proceeds to us presented in this table does not give effect to any exercise of the Warrant we will issue to the Representative, as described herein. |

We have granted the underwriters a 45-day option from the date of this prospectus to purchase up to a total of an additional 462,962 shares of Common Stock at $[●] per share (the Offering Price less $0.01), and/or 462,962 Warrants at $0.01 per Warrant, or any combination of additional shares of Common Stock and Warrants representing, in the aggregate, up to 15% of the number of Units sold in this Offering (the “Over-Allotment Option”), in all cases less the underwriting discount.

The underwriters expect to deliver the Units to purchasers on or about [●], 2023 through the book-entry facilities of The Depository Trust Company.

WallachBeth Capital, LLC

Craft Capital Management LLC

The date of this prospectus is September [●], 2023.

bioAffinity Technologies, Inc.

TABLE OF CONTENTS

MARKET, INDUSTRY, AND OTHER DATA

About this Prospectus

You should rely only on the information contained in this prospectus prepared by us or on our behalf or to which we have referred you. We have not, and the underwriters have not, authorized any other person to provide you with information different from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the underwriter take responsibility for and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriters are not, making an offer to sell the securities described herein in any jurisdiction where an offer or sale is not permitted. The information in this prospectus, or any free writing prospectus, is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our Units. Our business, financial condition, results of operations, and prospects may have changed since that date.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. Please read “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

Unless the context otherwise requires, the information in this prospectus (other than in the historical financial statements) assumes that the underwriters will not exercise their option to purchase additional shares of our common stock, $0.007 par value per share (the “Common Stock”) or additional warrants to purchase shares of Common Stock (the “Warrants”).

For investors outside of the United States: We are not making an offer of any securities in any jurisdiction in which such offer is unlawful. Neither we nor any of the underwriters have done anything that would permit this Offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this Offering in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside of the United States who come into possession of this prospectus and any free writing prospectus must inform themselves about and observe any restrictions relating to this Offering and the distribution of this prospectus outside of the United States. See “Underwriting—Selling Restrictions” on page 110.

Industry and Market Data

This prospectus includes estimates regarding market and industry data. Unless otherwise indicated, information concerning our industry and the markets in which we operate, including our general expectations, market position, market opportunity, and market size, are based on our management’s knowledge and experience in the markets in which we operate, together with currently available information obtained from various third-party sources, including publicly available information, industry reports and publications, surveys, our customers, trade and business organizations, and other contacts in the markets in which we operate. Although we believe these third-party sources are reliable as of their respective dates, neither we nor the underwriters have independently verified the accuracy or completeness of this information. Some data is also based on our good faith estimates. The industry in which we operate is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section entitled “Risk Factors.” These and other factors could cause results to differ materially from those expressed in these publications.

Trademarks and Trade Names

We own or have rights to various trademarks, service marks, and trade names that we use in connection with the operation of our business. This prospectus may also contain trademarks, service marks, and trade names of third parties, which are the property of their respective owners. Our use or display of third parties’ trademarks, service marks, trade names, or products in this prospectus is not intended to, and does not imply a relationship with or endorsement or sponsorship by us. Solely for convenience, the trademarks, service marks, and trade names referred to in this prospectus may appear without the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks, service marks, and trade names.

| 1 |

PROSPECTUS SUMMARY

This summary provides an overview of information appearing elsewhere in this prospectus and highlights the key aspects of this Offering. This summary does not contain all of the information you should consider prior to investing in our Common Stock or Warrants. You should read this entire prospectus carefully, including the sections titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing at the end of this prospectus, before making any investment decision. Our fiscal year ends on December 31. Unless the context otherwise requires, references to “bioAffinity,” the “Company,” “we,” “us,” and “our” in this prospectus refer to bioAffinity Technologies, Inc. and our consolidated subsidiaries.

Overview

bioAffinity Technologies, Inc. (the “Company,” “we,” or “our”) develops noninvasive diagnostics to detect early-stage lung cancer and other diseases of the lung. We are developing our platform technologies so that, in the future, they could result in broad-spectrum cancer treatments. We develop proprietary noninvasive diagnostic tests using technology that preferentially targets cancer cells and cell populations indicative of a diseased state.

We were formed as a Delaware corporation on March 26, 2014. On June 15, 2016, we formed OncoSelect® Therapeutics, LLC (“OncoSelect®”), a Delaware limited liability company and our wholly owned subsidiary. On August 14, 2023, we formed Precision Pathology Laboratory Services, LLC (“PPLS”), a Texas limited liability company and our wholly owned subsidiary. Research and optimization of our platform technologies are conducted in our laboratories at The University of Texas at San Antonio.

Our first diagnostic test, CyPath® Lung, addresses the need for noninvasive detection of early-stage lung cancer. Lung cancer is the leading cause of cancer-related deaths. Physicians will be able to order CyPath® Lung to assist in their assessment of patients who are at high risk for lung cancer. The CyPath® Lung test enables physicians to more confidently identify patients who will likely benefit from timely intervention and more invasive follow-up procedures and is another tool to help distinguish them from patients who are likely without lung cancer and should continue annual screening. CyPath® Lung has the potential to increase overall diagnostic accuracy of lung cancer, which could lead to increased survival, fewer unnecessary invasive procedures, reduced patient anxiety, and lower medical costs.

Through our wholly owned subsidiary, OncoSelect®, our research has led to discoveries of novel potential cancer therapeutics that specifically and selectively target cancer cells that have been grown in petri dishes.

Recent Developments

On September 18, 2023, PPLS, our wholly owned subsidiary, consummated the acquisition (the “Acquisition”) of a clinical anatomic and clinical pathology laboratory and related services business in San Antonio, Texas (the “ Laboratory Assets”) pursuant to the terms of an Asset Purchase Agreement (the “Asset Purchase Agreement”) dated September 18, 2023 that it entered into with Village Oaks Pathology Services, P.A., a Texas professional association d/b/a Precision Pathology Services (“Village Oaks”) and Dr. Roby P. Joyce, M.D. As a result of the Acquisition, the clinical pathology laboratory is owned by PPLS. Dr. Joyce was the Medical Director and Laboratory Director of the clinical pathology laboratory prior to the Acquisition and he continues to serve as Medical Director and Laboratory Director after the Acquisition. PPLS is accredited by the College of American Pathologists (“CAP”) and certified under the Clinical Laboratory Improvement Amendments of 1988 (“CLIA”). Founded in 2007 by Dr. Roby Joyce, Village Oaks has provided pathology services to physicians practicing in a variety of outpatient settings. Since September 2021, Village Oaks, under the trade name Precision Pathology Services, has offered for sale CyPath® Lung as a laboratory developed test (“LDT”) for the detection of early-stage lung cancer. In addition to CyPath® Lung, PPLS intends to continue to offer a range of laboratory services including respiratory testing for SARS-CoV-2 and influenza, anatomical pathology, morphological stains, histological services, DNA extractions, STI testing and women’s and men’s health testing.

Pursuant to the terms of the Asset Purchase Agreement, PPLS acquired the Laboratory Assets, which included all of the assets owned by Village Oaks other than medical assets, which are assets Village Oaks used in connection with its management and operation of a clinical pathology laboratory, now owned by PPLS, and related services business and assumed certain liabilities and obligations. Pursuant to the terms of the Asset Purchase Agreement Village Oaks received $3,500,000 in consideration for the assets to be purchased by PPLS, of which $1,000,000 was paid by the issuance of 564,972 shares of our restricted Common Stock to a trust controlled by Dr. Joyce (the “Joyce Trust”), which share number was determined by dividing $1,000,000 by $1.77, the average of the trading day closing prices for the 30 days prior to September 15, 2023, rounded to the nearest whole share.

The Asset Purchase Agreement contains customary representations, warranties and covenants made by PPLS and Village Oaks and consummation of the transaction was subject to customary closing conditions, including, among other things, entry into the other ancillary agreements described below. Subject to certain customary limitations, Village Oaks agreed to indemnify PPLS, its successors and assigns, and each of their affiliates, and PPLS’ officers, directors, employees and other authorized agents against certain losses related to, among other things, breaches of Village Oaks’ representations, warranties, covenants and agreements as well as any excluded liabilities and excluded assets described therein. Subject to certain customary limitations, PPLS also agreed to indemnify Village Oaks, its successors and assigns, and each of their affiliates, and Village Oaks’ officers, directors, employees and other authorized agents against certain losses related to, among other things, breaches of PPLS’ representations, warranties, covenants and agreements as well as any assumed liabilities.

Pursuant to the Asset Purchase Agreement, PPLS assumed all liabilities and obligations and obtained any and all rights, title and interest of Village Oaks in and to (i) all leases for equipment and personal property related to the Laboratory Assets (the “Assumed Leases”), pursuant to an Assumption Agreement by and between Village Oaks and PPLS (the “Assumption Agreement”) and, (ii) certain other contracts related to the Laboratory Assets, including the license to develop, manufacture, use, market and sell CyPath® Lung (the “Assumed Contracts”) pursuant to the Assumption Agreement; (iii) all accounts payable of Village Oaks as of September 18, 2023 that were incurred in the ordinary course of business consistent with past custom and practice; and (iv) the lease of the premises used in connection with operation of the CLIA-certified and CAP-accredited clinical pathology laboratory, pursuant to an Assignment and Assumption of Lease by and between Village Oaks and PPLS (the “Assignment of Lease”), which Assignment of Lease was consented to by the landlord of the leased premises. The monthly rent is currently $10,143.83 per month and the term of the Lease is five years.

| 2 |

In connection with the Asset Purchase Agreement, PPLS entered into a Management Services Agreement with Village Oaks (the “Management Services Agreement”) pursuant to which PPLS will provide comprehensive management and administrative services to Village Oaks in connection with the operation of Village Oaks’ professional cytopathology, histopathology, clinical and anatomic pathology interpretation medical services practice. PPLS will provide space, equipment, administrative, management and clinical personnel, billing and collection, and related management services to Village Oaks in exchange for a management fee of 70% of the net revenues received by Village Oaks from the provision of the medical services. The Management Services Agreement has an initial term of 20 years and provides that upon expiration of the initial term, it will be automatically extended for two additional successive terms of five years each, unless either party delivers written notice of its intention not to extend the term of the agreement not less than 90 days prior to the expiration of the preceding term. The Management Services Agreement also provides that until the fifth anniversary of its effective date, Village Oaks will not, without the prior written approval of PPLS own, operate or have any financial interest in any other person or entity that operates an independent laboratory or an enterprise within the United States that provides or promotes management or administrative services or any product or services substantially similar to those provided by PPLS.

In connection with the Asset Purchase Agreement, PPLS entered into a Succession Agreement with Village Oaks and Dr. Joyce (the “Succession Agreement”), pursuant to which Dr. Joyce, as holder of 100% of the issued and outstanding stock of Village Oaks, and Village Oaks are restricted from disposing of their equity interests in Village Oaks, subject to certain exceptions, without the prior written consent of us and Village Oaks. The Succession Agreement further provides that the entire equity interest held by Dr. Joyce in Village Oaks will be automatically assigned and transferred to a successor who meets the Eligibility Requirements of a Designated Physician, as such terms are defined and described in the Succession Agreement, in the event of, among other things, the death, disability, retirement, or a court’s determination of incompetence of Dr. Joyce, as well as Dr. Joyce’s failure to satisfy the eligibility requirements of a Designated Physician, exclusion or disqualification from participation in the Medicare program, conviction of a felony or crime or moral turpitude, bankruptcy filing, or material breach of the Succession Agreement. In the event of the automatic transfer of Dr. Joyce’s equity interests in Village Oaks as provided in the Succession Agreement, such agreement provides that the board of directors of Village Oaks shall nominate a group of three candidates as the Designated Physician who satisfy the Eligibility Requirements. In the event the Company desires not to select any of such candidates, the Company shall select and appoint a successor Designated Physician from any other physicians that satisfy the Eligibility Requirements. Subject in all cases to the Management Services Agreement, Dr. Joyce shall not cause any voluntary interruption of the conduct of Village Oaks’ business and operations, and shall use commercially reasonable efforts to preserve (or assist us in preserving) all rights, privileges and franchises held by Village Oaks, including the maintenance of all contracts, copyrights, trademarks, licenses and registrations.

In connection with the Asset Purchase Agreement, PPLS entered into a Professional Services Agreement with Village Oaks (the “Professional Services Agreement”) pursuant to which Village Oaks will provide pathology interpretation services as requested on behalf of PPLS based on the professional fees approved for the CPT code for the services provided under the Medicare Physician Fee Schedule in the locality where the test is performed. The Professional Services Agreement has an initial term of 20 years and provides that upon expiration of the initial term, it will be automatically extended for successive terms of twelve months each, unless either party delivers written notice of its intention not to extend the term of the agreement not less than 30 days prior to the expiration of the preceding term.

In connection with the Asset Purchase Agreement, we entered into an Executive Employment Agreement with Dr. Joyce (the “Joyce Employment Agreement”), for a term of three years, pursuant to which he serves as the Medical Director and Laboratory Director of PPLS, at a base salary of $333,333.34 per year. Pursuant to the Joyce Employment Agreement, Dr. Joyce was also appointed to serve on our Board of Directors. Dr. Joyce will be eligible to participate in or receive benefits under our benefit plans generally made available to executives of similar status and responsibilities and will be provided use of a company car. In the event the Joyce Employment Agreement is terminated for any reason, including by Dr. Joyce upon 60 days’ notice, by us for cause or by reason of Dr. Joyce’s death, Dr. Joyce (or his estate, as applicable) will receive his base salary for the remainder of the three-year employment term. However, the Joyce Employment Agreement provides that if Dr. Joyce breaches any of the restrictive covenants set forth in the Joyce Employment Agreement, including a covenant not to compete during his term of employment and a covenant not to knowingly disclose confidential information, such breach will be grounds for the immediate termination of Dr. Joyce and will result in the forfeiture of all compensation and benefits otherwise due to Dr. Joyce.

One of the Assumed Leases is Equipment Usage Attachment, dated effective as of August 9, 2019, by and between Gen-Probe Sales & Service, Inc., together with its subsidiaries and affiliates (“Hologic”) and Village Oaks, as amended by that certain Amendment No. 1 to Equipment Usage Attachment dated November 2, 2020, as further amended by that certain Amendment No. 2 to Equipment Usage Attachment dated November 2, 2020, and as further amended by that certain Amendment No. 3 to Equipment Usage Attachment dated December 21, 2022 (the “Hologic Equipment Lease”), pursuant to which PPLS leases reagent equipment from Hologic and is required to purchase a minimum number of specified testing kits each year. The total monthly minimum purchase commitment PPLS is required to pay Hologic, inclusive of the lease of the reagent equipment, is $16,914 per month. The term of the Hologic Equipment Lease currently expires on December 20, 2027.

Another of the Assumed Leases is the Master Agreement, dated as of January 29, 2015, by and between Leica Microsystems, Inc. (“Leica”) and Village Oaks, as amended by Amendment No. 1 to the Master Agreement, dated on or about April 4, 2018, as further amended by that certain Amendment No. 2 to Master Agreement, dated March 23, 2021 (the “Leica Equipment Lease”), pursuant to which PPLS leases reagent equipment from Leica and is required to purchase a minimum number of specified testing kits. The total monthly minimum purchase commitment PPLS is required to pay to Leica, inclusive of the lease of the reagent equipment, is $19,790 per month. The term of the Leica Equipment Lease currently expires on March 23, 2026.

| 3 |

One of the Assumed Contracts is a Strategic Relationship License Agreement, dated December 1, 2022, by and between Pathology Watch, Inc. (“Pathology Watch”) and Village Oaks (the “License Agreement”). Pursuant to the License Agreement, Pathology Watch granted a license to its digital imaging cloud-based pathology platform to facilitate remote interpretation and billing of pathology specimens by qualified professionals to PPLS for a monthly fee of $25,000. In connection with the License Agreement, Pathology Watch also provides certain support services and marketing vendor services to PPLS for the monthly fee of $38,000, for a total monthly fee paid by PPLS to Precision Watch of $63,000. The License Agreement is for an initial term of twelve months, unless terminated by either party upon 90 days’ notice, and provides that upon expiration of the initial term (or any renewal term), it will be automatically extended for successive twelve month terms, unless either party notifies the other party of its intention not to renew the License Agreement not less than 90 days prior to the expiration of the current term.

In connection with the Asset Purchase Agreement, Dr. Joyce, on behalf of Village Oaks, executed a Bill of Sale (the “Bill of Sale”), pursuant to which all rights, title, and interest of Village Oaks in and to the permits listed on Exhibit A attached thereto, inclusive of the CLIA-certificate and CAP-accreditation, notwithstanding the transfer of the CLIA certificate by operation of law to PPLS upon consummation of the Acquisition, were confirmed to have been transferred and assigned to PPLS.

Benefits of the Acquisition

Since 2007, Village Oaks, d/b/a Precision Pathology Services, has provided pathology services to physicians practicing in a variety of outpatient settings. Since September 2021, Village Oaks has offered CyPath® Lung as an LDT for the detection of early-stage lung cancer. The Acquisition of the Laboratory Assets supports and enhances our commercial strategy by integrating every aspect of CyPath® Lung, from manufacturing to sales and marketing, and to pathology services and reporting results back to physicians. The Acquisition results in consolidating the royalties to bioAffinity from sale of CyPath® Lung with the revenues derived by PPLS’ sale of the test. The Acquisition provides us with control over essential aspects of the CyPath® Lung test and an opportunity to build scale and efficiency as we expand commercialization. In addition, we anticipate the Acquisition can support our pivotal trial by providing the equipment, experienced laboratory personnel and administrative support including support for our planned United States (“U.S.”) Food and Drug Administration (the “FDA”) clinical study. Ownership of the Laboratory Assets also provides the clinical services required for us to develop future LDTs that expand our flow cytometry platform, including development of current research into a test for Chronic Obstructive Pulmonary Disease (“COPD”). Village Oaks’ operation of a CLIA-certified and CAP-accredited clinical pathology laboratory has been established over the past 16 years of service. The founder of Village Oaks, Dr. Joyce, will continue as PPLS’ Medical Director and Laboratory Director, thus providing continuity in professional relationships and services. PPLS intends to continue to offer a range of laboratory services in addition to CyPath® Lung, including respiratory testing for SARS-CoV-2 and influenza, anatomical pathology, morphological stains, histological services, DNA extractions, STI testing and women’s and men’s health testing.

Amendment to Warrants

On September 17, 2023, Mr. Girgenti, the Cranye Girgenti Testamentary Trust, Gary Rubin, The Harvey Sandler Revocable Trust, a trust of which Mr. Rubin is a co-trustee, Ms. Zannes and Dr. Joyce consented to an amendment of the terms of the outstanding warrants that they own. Such warrants include warrants (i) tradeable warrants (the “Tradeable Warrants”) to purchase 98,198, 39,182, and 39,182 shares of Common Stock owned by Mr. Girgenti, The Harvey Sandler Revocable Trust, and Ms. Zannes, respectively); (ii)non-tradeable warrants (the “Non-Tradeable Warrants”) to purchase 102,286, 40,813, and 40,813 shares of Common Stock owned by Mr. Girgenti, The Harvey Sandler Revocable Trust, and Ms. Zannes, respectively; and (iii) other outstanding warrants (the “Pre-IPO Warrants”) to purchase 469,063, 8,332, 571,373, 23,571, 17,137, and 14,285 shares of Common Stock owned by Mr. Girgenti, the Cranye Girgenti Testamentary Trust, Mr. Rubin, The Harvey Sandler Revocable Trust, Ms. Zannes and Dr. Joyce, respectively. The warrant amendment (the “Warrant Amendment”) provides that such warrants will not be exercisable until the date that we file a certificate of amendment to our certificate of incorporation with the State of Delaware which increases the number of shares of our authorized Common Stock to allow for sufficient authorized and unissued shares of Common Stock for the full exercise of all of the outstanding Pre-IPO Warrants, Tradeable Warrants and Non-Tradeable Warrants of the Company and the issuance of all of the shares of Common Stock underlying such warrants.

Financial

To date, we have devoted a substantial portion of our efforts and financial resources to the development of our first diagnostic test, CyPath® Lung. Since our inception in 2014, we have funded our operations principally through public and private sales of our equity or debt securities. On September 6, 2022, we completed our initial public offering of our securities pursuant to which we raised gross proceeds of $7.9 million. As of September 18, 2023, investors participating in the initial public offering exercised a total of 725,576 Tradeable Warrants at a price of $7.35 per share and 310,910 Non-Tradable Warrants at a price of $7.656 per share. Combined with our underwritten public offering, we received an aggregate of approximately $15.6 million as of September 28, 2022. We believe that our available cash together with the proceeds of this Offering will be sufficient to fund our planned operations for at least 12 months following the date of this prospectus.

In the second quarter of 2022, we started to recognize revenue from sales of the CyPath® Lung test by Village Oaks, a CAP-accredited and CLIA-certified clinical pathology laboratory to which we had previously granted a license to develop CyPath® Lung for commercialization and to manufacture, use, market and sell CyPath® Lung as an LDT prior to the Acquisition, which license was assigned to and assumed by PPLS, our wholly owned subsidiary, in connection with the Acquisition. We have never been profitable, and as of June 30, 2023, we had total working capital of $7.9 million and an accumulated deficit of approximately $39.9 million. As of June 30, 2023, we had cash and cash equivalents of $8.3 million. We expect to continue to incur significant operating losses for the foreseeable future as we continue the development of our diagnostic tests and therapeutic products and advance our diagnostic tests through clinical trials.

We anticipate raising additional cash needed through the private or public sales of equity or debt securities, collaborative arrangements, or a combination thereof, to continue to fund our operations and develop our products. There is no assurance that any such collaborative arrangement will be entered into or that financing will be available to us when needed in order to allow us to continue our operations, or if available, on terms acceptable to us. If we do not raise sufficient funds in a timely manner, we may be forced to curtail operations, delay our clinical trials, cease operations altogether, or file for bankruptcy.

Our First Diagnostic Test - CyPath® Lung

Lung cancer remains the most commonly diagnosed cancer and the leading cause of cancer-related deaths worldwide. Globally, there were an estimated 2.1 million lung cancer cases and 1.8 million lung cancer deaths in 2018, as reported by the World Health Organization in its 2018 Cancer Fact Sheet. According to the American Lung Association (the “ALA”), screening for individuals at high risk for lung cancer has the potential to improve lung cancer survival rates by finding disease at an earlier stage when it is more likely to be curable. A study published in the New England Journal of Medicine entitled “Survival of patients with stage I lung cancer detected on CT screening” dated October 26, 2006 reported that the survival rate of individuals with Stage I lung cancer who underwent surgical resection within one month after diagnosis had a ten-year survival rate of 92%, as compared to the overall five-year survival rate of 25%. Unfortunately, most lung cancer is detected in late stages. The results of a large national clinical trial that was reported in the New England Journal of Medicine in an article dated August 4, 2011, entitled “Reduced Lung-Cancer Mortality with Low-Dose Computed Tomographic Screening” showed that screening for lung cancer using low-dose computed tomography (“LDCT”) resulted in a reduction of the mortality rate by 20% as compared to screening by x-ray if LDCT screening is used by patients at high risk for lung cancer on an annual basis. Therefore LDCT scans are recommended for screening of an estimated 14 million Americans who are at high risk for lung cancer. If half of these high-risk individuals were screened, over 12,000 lung cancer deaths could be prevented, according to the ALA. However, the New England Journal of Medicine article also reported that LDCT was shown to have a low positive predictive rate of less than 4%. This means that for every 100 people who receive a positive result from LDCT screening and are suspected of having lung cancer, only four of those patients truly have the disease. A reliable, noninvasive and cost-effective diagnostic test can increase diagnosis of early-stage lung cancer while lowering the number of unnecessary and invasive procedures for patients with a false positive result from LDCT screening. (False positive means a person who does not have lung cancer but receives a positive result, in this case from LDCT screening.)

| 4 |

CyPath® Lung is a test for early-stage lung cancer that is designed to meet the need for greater diagnostic certainty. Based on our internal analysis, its use in conjunction with LDCT is predicted to improve the positive predictive value (the probability that patients with a positive LDCT scan truly have the disease) by a factor of five. Our analysis concludes that improving the positive predictive value of LDCT with the use of CyPath® Lung has the potential to subject fewer patients to the stresses of misdiagnosis or unnecessary diagnostic procedures such as biopsies, while also reducing healthcare costs.

CyPath® Lung uses flow cytometry technology to detect and analyze cell populations in a person’s sputum, or phlegm, to find characteristics indicative of lung cancer, including cancer and/or cancer-related cells that have shed from a lung tumor. The flow cytometer is a well-established instrument used in many commercial laboratories that records properties of labeled and unlabeled single cells. Sputum is an excellent sample for analysis because it is in direct contact with any malignancy in the lungs and can thus provide a snapshot of the tumor itself, its microenvironment, and its area of field cancerization. While studies have shown that expert cytological analysis of sputum can detect cancerous and pre-malignant cells, the level of scrutiny required for the analysis is not feasible in the laboratory routine, according to an October 22, 2009 article, “Premalignant and malignant cells in sputum from lung cancer patients,” published in Cancer Cytopathology. The process of looking at microscopy slides is an extremely laborious approach and demands years of expertise. CyPath® Lung uses flow cytometry and automated data analysis developed by artificial intelligence (“AI”) that allows for an entire sample of sputum to be examined for cost-effective, large-scale screening or diagnosis.

In particular, CyPath® Lung uses a synthetic porphyrin called meso-tetra (4-carboxyphenyl) porphyrin (“TCPP”). Porphyrins are biological pigments that, when exposed to ultraviolet light at certain wavelengths, can result in the cell fluorescing a red or purplish color that can be detected under a microscope or by flow cytometry, according to an article entitled “Laboratory Diagnosis of Porphyria,” published in Diagnostics (Basel) on July 26, 2021. Porphyrins can be man-made, like TCPP, or they can be naturally occurring, like heme that is responsible for the red color in red blood cells. Cancer cells are known to take up certain porphyrins in higher amounts than non-cancer cells, and the high affinity for cancer cells displayed by TCPP makes it an excellent bio-label for cancer, according to an article published in Progress in Clinical and Biological Research in 1984 entitled, “A comparative study of 28 porphyrins and their abilities to localize in mammary mouse carcinoma: uroporphyrin I superior to hematoporphyrin derivative.” As used in CyPath® Lung, the proportion of cells with high TCPP fluorescence intensity in a patient’s sputum sample is a significant predictor of lung cancer. We hold multiple patents protecting our use of TCPP for the diagnosis, monitoring, and treatment of cancer. In addition, we have multiple domestic and foreign patent applications to protect the use of flow cytometry and our AI-developed automated analysis platform in the detection of lung cancer and other lung diseases using sputum as a sample.

We developed an algorithm as part of a test validation trial that used machine learning to distinguish samples from high-risk patients who had lung cancer from those who are cancer-free. Village Oaks developed CyPath® Lung for sale as an LDT in accordance with the standards of the CAP and the regulations and guidance of the CLIA program, which is administered by the Centers for Medicare and Medicaid Services (“CMS”). Our test can analyze an average sputum sample containing about 14 million cells in approximately 30 minutes using integrated software for high-throughput, user-friendly standardized analysis of flow cytometric sample data. A physician’s report is generated within minutes after data acquisition. The test can be put into routine lab use without requiring expert evaluation of samples or being subject to operator bias. Our approach allows the entire sputum sample to be rapidly analyzed. The numerical analysis developed with machine learning captures complex interactions between lung cancer, the microenvironment, and areas of field cancerization that would be difficult if not impossible for individuals to predict or detect reliably by eye. For example, during test development, we discovered that viability staining density suggests a link with apoptosis, or cell death, that is linked to many cancers, including lung cancer. Our model also suggests that specific markers of immune cell populations may be informative as to the presence of cancer in the lung. These findings are the result of our machine learning approach to automated analysis.

The CyPath® Lung diagnostic process uses sputum that is obtained noninvasively in the privacy of a patient’s home. Physicians can order the test for patients they suspect have lung cancer or patients with a positive LDCT screening result. A patient collects his or her sample using a hand-held, noninvasive assist device, ICU Medical’s acapella® Choice Blue, that acts to break up mucus in the lungs and help a person cough up sputum from the lung into a collection cup. The acapella® Choice Blue has been 510(k) cleared by the FDA as a positive expiratory pressure device to help mobilize lung secretions in people with certain lung conditions. The sputum sample is shipped overnight to a clinical pathology laboratory that is accredited by the CAP and certified under the CLIA program, and processed with CyPath® Lung that includes antibodies that distinguish different cell types and the synthetic porphyrin TCPP that identifies cancer cells and/or cancer-associated cells. Proprietary automated analysis software developed by bioAffinity Technologies analyzes sample data in minutes, resulting in a patient report provided to the physician who orders the test. CyPath® Lung can be used by physicians to find early-stage lung cancer in their patients who have undergone lung cancer screening.

We conducted a 150-patient test validation trial of people at high risk for lung cancer including patients with the disease (N=28) and those cancer-free (N=122) that resulted in CyPath® Lung’s overall 88% specificity, meaning the ability to correctly identify a person without cancer, and 82% sensitivity, meaning the ability to correctly identify cancer in a person with the disease. For the subset of patients in this trial who had lung nodules smaller than 20 millimeters (“mm”) or no nodules at all, this trial resulted in 92% sensitivity and 87% specificity. In this subset of 132 individuals with small nodules, 119 patients were cancer-free and 13 had confirmed lung cancer. The detection of small lung nodules in people who have early-stage cancer can increase lung cancer survival.

In this 19-month test validation trial, participants provided a sputum sample and were released from the study after a physician either confirmed the individual was cancer-free by examination of CT imaging or confirmed the presence of lung cancer by biopsy. Flow cytometry and patient data used in the analysis produced results that included (1) the proportion of cells with a high ratio of high TCPP fluorescence intensity over cell size; (2) the proportion of cells with an intermediate ratio of fluorescence intensity caused by the viability dye (FVS510) over cell size; (3) the proportion of cells that were CD206 negative but positive for one or more of the following markers: CD66b (granulocytes), CD3 (T cells), and CD19 (B cells); and (4) patient age.

The CyPath® technology is based on research originating at Los Alamos National Laboratory in collaboration with St. Mary’s Hospital (Colorado) in which cancer samples were differentiated from non-cancer samples with 100% accuracy. This early research was conducted with sputum from 12 uranium miners. Microscope slides were made of the sputum samples labeled with the active ingredient of CyPath®, the synthetic and fluorescent porphyrin TCPP. The Los Alamos research study of 12 uranium miners included eight men with cancer and four healthy individuals. Researchers were blinded to the sample origin and looked for the presence of highly fluorescent cells indicating uptake of TCPP and the presence of lung cancer. The length of the study and specific follow-up was not reported, but researchers did report that one patient entering the study as a healthy subject was correctly diagnosed with cancer by the test.

| 5 |

We conducted market research with pulmonologists, oncologists, cardiothoracic surgeons, radiologists, and internists engaged in the diagnosis and treatment of lung cancer to help assess these stakeholders’ reactions to the new diagnostic test. Research revealed a strong interest in CyPath® Lung, driven by the high level of unmet clinical need for noninvasive diagnostics. A survey conducted with 240 pulmonologists and internists, the primary audience for the test, showed that 96% would use CyPath® Lung if it were available today as an adjunct to LDCT screening and diagnosis. Physicians responded favorably to a noninvasive diagnostic technology that gives them more confidence in their decision to proceed with more aggressive follow-up procedures if the test comes back positive. If test results are negative, physicians could rule out lung cancer, thus reducing the number of costly invasive procedures that result from the LDCT false-positive rate.

Physicians can order the CyPath® Lung laboratory test for use by people at high risk for lung cancer who are recommended for annual screening by LDCT. While LDCT is shown to lower the mortality rate of lung cancer by at least 20% as compared to x-ray screening, the LDCT screening method has a low positive predictive value that can result in many people undergoing unnecessary invasive diagnostic procedures to confirm or rule out the presence of lung cancer. A physician who orders a CyPath® Lung test can have greater confidence in determining the next steps in patient care. Noninvasive sample collection and the test’s three-day turnaround in providing patient results after sample receipt make CyPath® Lung well suited for both sophisticated and less developed markets. On June 6, 2023, the American Medical Association (“AMA”) approved a Current Procedural Terminology (“CPT”) Proprietary Laboratory Analysis (“PLA”) code specifically for use with CyPath® Lung, which code was publicly released on June 30, 2023. The new CPT code will be effective October 1, 2023. Prior to and in the interim until the new code is effective, CyPath® Lung is reported with a non-specific CPT code, for which payment is determined by the payer on a case-by-case basis. Payment for the new PLA code was discussed on July 19, 2023, by the Medicare Advisory Panel on Clinical Diagnostic Laboratory Tests. The CMS preliminary determination will be released in September 2023 followed by a 30-day comment period. A 2024 payment determination, effective January 1, 2024 will be made by CMS in November 2023. There is an opportunity for reconsideration in next year’s payment cycle.

We have an agreement with GO2 Partners to produce patient collection kits and to provide warehousing and distribution services for sending out the kits. Laboratory reagents, supplies and equipment are commercially available through multiple vendors. Sample processing, labeling, and data collection can be accomplished by a laboratory technician skilled in general laboratory techniques. Data analysis leading to a physician’s report is done by automated analysis software fully integrated into the test.

To our knowledge, CyPath® Lung is the first cancer diagnostic that combines automated flow cytometric analysis to predict the presence of lung cancer from sputum samples.

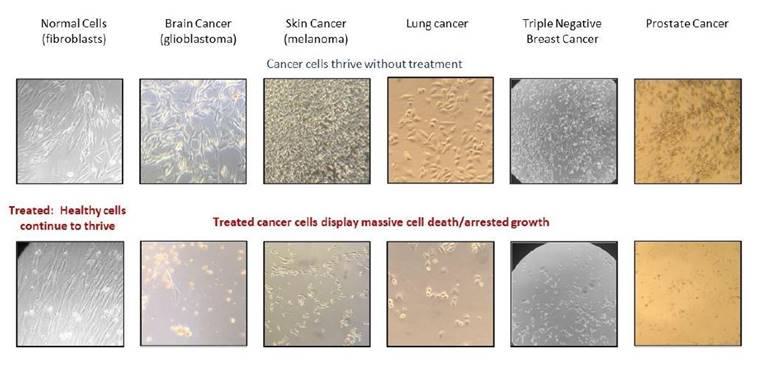

OncoSelect® Therapeutics Research

OncoSelect® Therapeutics, LLC, a Delaware limited liability company and our wholly-owned subsidiary, is a preclinical-stage biopharmaceutical discovery company with a focus on therapeutics that deliver cytotoxic (cell-killing) effects on a broad selection of human cancers from diverse tissues while having little or no effect on normal cells.

Unlike many of our industry competitors, OncoSelect® does not pursue therapies that depend on specific mutations, biomarkers, or other genetic or epigenetic abnormalities for their effect. We pursue research based on our own scientific discoveries demonstrating that inhibition of the expression of two specific cell membrane proteins results in the selective killing of various cancer cell types grown in the laboratory with little or no effect on normal (non-cancerous) cells.

Our scientific discoveries stemmed from research we conducted to better understand the mechanism by which TCPP, the synthetic porphyrin used in CyPath® Lung, selectively enters cancer cells. We have established several specific areas of therapeutic research that have evolved from our TCPP experiments.

OncoSelect® therapies offer the possibility of broad applications in cancer treatment. OncoSelect® will use a licensing business model for selective chemotherapeutic compounds to be developed by us.

Intellectual Property Portfolio

As of September 1, 2023, we and our subsidiary, OncoSelect®, have a patent estate that includes 15 issued U.S. and foreign counterpart patents, including two U.S. patents and thirteen foreign counterpart patents in Australia, Canada, China, France, Germany, Hong Kong, Italy, Mexico, Spain, Sweden, and the United Kingdom. One U.S. patent and nine counterpart foreign patents directed at diagnostic applications expire in 2030. Therapeutic patents registered in Australia, China, Hong Kong, Mexico, and the United States expire in 2037.

With regard to our diagnostic test CyPath® Lung and other diagnostic candidates, we have one issued U.S. patent and nine foreign counterpart patents in Canada, China, France, Germany, Hong Kong, Italy, Spain, Sweden, and the United Kingdom. With regard to our diagnostic patent applications, one of two families is directed at diagnosing lung health using flow cytometry, and the other is directed at proprietary compensation beads used to calibrate the flow cytometry instrument and used in CyPath® Lung data acquisition. Pending applications directed at diagnosing lung health include one pending U.S. non-provisional patent application and eight foreign counterpart patent applications in Australia, Canada, China, European Patent Office, Hong Kong, Japan, Mexico, and Singapore filed in 2019, one International Patent Application filed in 2022 and one International Patent Application filed in 2023. Also, a patent application directed at the composition of compensation beads was filed as an International Patent Application in 2022.

With regard to our therapeutic product candidates, we have one issued U.S. patent, four issued foreign patents, two pending U.S. applications, nine foreign applications pending in Canada, China, European Patent Office, Hong Kong, India, and Japan and one pending International Patent Application filed in 2022. The therapeutic intellectual property is made up of two families directed at our therapeutic product candidates, including one family directed at siRNA product candidates for the treatment of cancer, and another family directed at porphyrin conjugates for treating cancer.

| 6 |

Industry Opportunity

The global market for cancer diagnostic tests is expected to grow dramatically in coming years. According to a 2021 Global Cancer Diagnostics Market Research Report, cancer diagnostic tests, including devices, grew from $156.27 billion in 2020 to $170.21 billion in 2021, with a compound annual growth rate of 8.9%, and is projected to reach $239.23 billion in 2025. Lung cancer is the most common cancer globally and its incidence continues to increase in some large nations including China, where lung cancer is the leading cause of cancer-related morbidity and mortality, as reported in the Journal of Thoracic Oncology in October 2020 in an article entitled “Lung Cancer in People’s Republic of China.” According to a 2023 report “Lung Cancer Diagnostics: Global Strategic Business Report,” the global market for lung cancer diagnostic tests was estimated at $2.6 billion in 2022 and is projected to reach a value of $4.7 billion by 2030, with a compounded annual growth rate of 7.8% over 2022-2030. Clinical diagnostics play an important role in disease prevention, detection, and management. Our first test, CyPath® Lung, focuses on the leading cause of cancer death among both men and women. Lung cancer accounted for approximately 18% of all cancer deaths worldwide in 2020, as reported by the World Health Organization. Lung cancer typically may not be symptomatic in its early stages when it is most treatable. An estimated 14 million patients at high risk for lung cancer in the U.S. are recommended for annual screening. Initially, physicians would order CyPath® Lung for those high-risk patients as an adjunct to LDCT screening to aid in the decision whether to pursue more aggressive follow-up procedures. A more accurate and reliable lung diagnostic pathway using LDCT and noninvasive methods could result in fewer patients being subjected to the stresses of unnecessary, invasive diagnostic procedures such as biopsies. CyPath® Lung is well suited for use in both sophisticated and less-developed markets because sample collection is noninvasive and conducted at home, the sample can be shipped overnight by commercial carriers and sample processing and automated analysis can be completed by laboratory technicians skilled in general laboratory techniques. Patient reports are provided to the ordering physician within three days of sample receipt at the laboratory.

Competitive Strengths

We conduct an ongoing competitive analysis of companies in the lung cancer diagnostic sector of the clinical diagnostics market. In 2022, we evaluated companies that reported an interest in diagnosing lung cancer, focusing on 67 companies and academic institutions we identified as active in the early lung cancer diagnostic sector. A thorough evaluation of the early lung cancer diagnostic landscape reveals multiple reasons why CyPath® Lung is positioned to be a market leader. CyPath® Lung performance shown in our test validation trial resulted in 92% sensitivity and 87% specificity in high-risk patients who had lung nodules 20 mm or smaller. Eight out of 10 (80%) Stage I tumors were correctly identified, indicating that CyPath® Lung can find lung cancer at its earliest stage. Overall, when diagnosing lung cancer in all stages, the clinical trial resulted in CyPath® Lung specificity of 88% and sensitivity of 82%, similar to far more invasive procedures and surgery currently used to diagnose lung cancer. (See the “Comparison of CyPath® Lung to Current Standards of Care” chart in the “Business” section of this prospectus.) The test validation trial of 150 patients was conducted over 19 months. Participants provided a sputum sample and were released from the study after a physician either confirmed the individual was cancer-free by examination of CT imaging or confirmed the presence of lung cancer by biopsy. Test data used to produce results included: (1) the proportion of cells with a high ratio of high TCPP fluorescence intensity over cell size; (2) the proportion of cells with an intermediate ratio of fluorescence intensity caused by the viability dye (FVS510) over cell size; (3) the proportion of cells that were CD206 negative but positive for one or more of the following markers: CD66b (granulocytes), CD3 (T cells), and CD19 (B cells); and (4) patient age.

The majority of competitors’ tests either incorrectly classify a high proportion of people without cancer as having the disease (known as false negatives) more than 50% of the time or misdiagnose people as cancer-free (known as false positives) more than 50% of the time. It is important to note that most competitors who have conducted clinical trials also have not designed their trials to evaluate the test’s measure of accuracy – such as sensitivity and specificity – in the high-risk population for whom the test is intended A patient collects his or her sample at home, which is a particular benefit during a pandemic. Sample processing for CyPath® Lung can be done by laboratory technicians, and reagents used by the test are widely available. Data acquisition and analysis and test results are fully automated.

Business Strategies

We are moving forward with commercialization of CyPath® Lung in a systematic, four-phased business plan (“Business Plan”) for market entry into the U.S., the European Union (“EU”), and worldwide that are timed to maximize Company resources and minimize market risk. Phase 1 of our Business Plan has begun with a limited market launch of the Company’s CyPath® Lung LDT in South Texas. This limited test market launch is designed to evaluate our marketing program and help us ensure each step in the care pathway – from the initial order by physicians to sputum collection and processing, to generating and delivering the patient report – is efficient and effective. This limited test market approach allows us to refine future positioning and develop strategic insight for our CyPath® Lung test before expanding to a larger market. The next step in our marketing plan provides for and will be followed by expansion into the Southwest market area in 2024 followed by a staged nationwide expansion of sales and marketing. Phase 2 of our Business Plan anticipates entering the EU market with CyPath® Lung as a CE-marked in vitro diagnostic (“IVD”) test with sales in the Netherlands, followed by a staged EU expansion. Phase 3 of our Business Plan focuses on the marketing of an FDA-cleared CyPath® Lung test, beginning with a pivotal clinical trial in the U.S.

In Phase 3, we plan to submit a request for de novo classification to the FDA to classify CyPath® Lung as a Class II IVD medical device for the detection of lung cancer. In order to seek de novo classification and marketing authorization of CyPath® Lung by the FDA, we must conduct a “pivotal clinical trial” to demonstrate the safety and efficacy of CyPath® Lung. We are currently working with a contract research organization (“CRO”) to finalize the protocol for the pivotal clinical trial and plan to submit a pre-submission package to the FDA in the fourth quarter of 2023 to obtain the FDA’s feedback on the study design. A pivotal clinical trial is scheduled to begin in early 2024. Final design of the pivotal clinical trial has not been determined at this time; however we estimate enrollment of approximately 1,800 participants at high risk for lung cancer and expect the trial to require three years. Assuming the study is successful, we intend to submit a de novo classification request to the FDA within six months of study completion. If the de novo request is granted by the FDA, we expect such marketing authorization to result in a larger market and greater market share for CyPath® Lung. FDA marketing authorization also can lead to expanded claims and additional indications for use of CyPath® Lung for the early detection of lung cancer. Phase 4 will accelerate the diagnostic’s market presence to expand into other global markets, including China, Southeast Asia, and Australia.

Corporate Information

We were incorporated in the State of Delaware on March 26, 2014. Our principal executive office is located at 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257, and our telephone number at that address is (210) 698-5334. Our website address is https://www.bioaffinitytech.com/. Information contained on or that can be accessed through our website is not incorporated by reference into this prospectus. Investors should not consider any such information to be part of this prospectus.

| 7 |

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” (an “EGC”) as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As an EGC, for up to five years, we may elect to take advantage of certain specified exemptions from reporting and other regulatory requirements that are otherwise generally applicable to public companies. For example, these exemptions would allow us to:

| ● | present two, rather than three, years of audited financial statements with correspondingly reduced disclosure in the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” section (the “MD&A”) of this prospectus; | |

| ● | defer the auditor attestation requirement on the effectiveness of our system of internal control over financial reporting; | |

| ● | make reduced disclosures about our executive compensation arrangements; and | |

| ● | forego the adoption of new or revised financial accounting standards until they would be applicable to private companies. |

Certain of these reduced reporting requirements and exemptions were already available to us due to the fact that we also qualify as a “smaller reporting company” under SEC rules. For instance, smaller reporting companies are not required to obtain an auditor attestation and report regarding internal control over financial reporting, to provide a compensation discussion and analysis, or to provide a pay-for-performance graph or CEO pay ratio disclosure, and they may present two, rather than three, years of audited financial statements and related MD&A disclosure.

We may take advantage of these exemptions up until the last day of the fiscal year following the fifth anniversary of our initial public offering or until we are no longer an EGC, which would be the case if (i) our total annual gross revenues are $1.235 billion or more; (ii) we issue more than $1 billion in non-convertible debt during a consecutive three-year period; or (iii) we become a “large accelerated filer,” as defined in the Securities Exchange Act of 1934, as amended (the “Exchange Act”). We may choose to take advantage of some, but not all, of the available exemptions. We have taken advantage of certain reduced reporting obligations in this prospectus. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. For more information, see “Risk Factors—General Risk Factors—We are an “emerging growth company,” and the reduced disclosure requirements applicable to emerging growth companies may make our Common Stock less attractive to investors.”

Summary of Risk Factors

Like any emerging growth company, we face significant risk factors that may impede our plans for successful commercialization of our diagnostic and therapeutic products. These risks are discussed in detail under the “Risk Factors” discussion beginning on page 14 of this prospectus.

The following summarizes the principal factors that make an investment in our Company speculative or risky, all of which are more fully described in the section below titled “Risk Factors.” This summary should be read in conjunction with the section below titled “Risk Factors” and should not be relied upon as an exhaustive summary of the material risks facing our business. The following factors could result in harm to our business, reputation, revenue, financial results, and prospects, among other impacts:

| ● | We may not experience the anticipated strategic benefits of the Acquisition; | |

| ● | We may be unable to successfully integrate the clinical pathology laboratory business with ours; | |

| ● | The future revenue to be generated from PPLS is uncertain; | |

| ● | The market price of our common stock following the Acquisition may decline; | |

| ● | Our stockholders will experience substantial dilution from the issuance of the Acquisition consideration; |

| ● | our limited operating history and history of net losses since our inception; | |

| ● | our need to obtain substantial additional funding to complete the development and commercialization of our diagnostic tests and therapeutic product candidates; | |

| ● | potential dilution to our stockholders, including purchasers of Common Stock in this Offering, resulting from the conversion of our preferred stock, par value $0.001 per share (our “Preferred Stock”) and convertible debt outstanding, and potential restrictions, due to raising additional capital; | |

| ● | the impact of a material weakness identified in our internal control over financial reporting; | |

| ● | the early stage of our development efforts; | |

| ● | the unpredictability of future trial results; | |

| ● | the difficulty in predicting the results, timing, and cost of our development of our diagnostic tests and therapeutic product candidates and the likelihood of obtaining regulatory approval; | |

| ● | the risk of experiencing delays or difficulties in the enrollment and/or retention of patients in clinical trials; |

| 8 |

| ● | potential changes to interim, “top-line” or preliminary results from our clinical trials as more patient data becomes available and are subject to audit and verification procedures; | |

| ● | the risk that the FDA may not agree with our LDT regulatory strategy or that Congress may enact legislation giving the FDA new authorities to regulate LDTs; | |

| ● | the lengthy, time-consuming, and unpredictable nature of regulatory approval processes; | |

| ● | the risk that our preclinical studies and clinical trials fail to demonstrate the safety and efficacy of our diagnostic tests or therapeutic product candidates; | |

| ● | the risk that data from clinical trials conducted outside of the United States may not be accepted by regulatory authorities; | |

| ● | the impact of ongoing regulatory obligations and continued regulatory review, even if we receive regulatory approval for any of our diagnostic tests or therapeutic product candidates; | |

| ● | our lack of control over the supply, regulatory status, or regulatory approval of third-party drugs or biologics with which our diagnostic tests or therapeutic product candidates are used in combination; | |

| ● | our lack of control over the conduct of investigator-initiated clinical trials or other clinical trials sponsored by organizations or agencies other than us; | |

| ● | the risk that we fail to develop additional diagnostic tests or therapeutic product candidates; | |

| ● | the risk that we are unable to penetrate multiple markets; | |

| ● | the risk that our diagnostic tests and therapeutic product candidates may fail to achieve market acceptance, even if they receive marketing authorization; | |

| ● | if we are unable to obtain and maintain sufficient intellectual property protection for our platform and our diagnostic tests or therapeutic product candidates, or if the scope of the intellectual property protection is not sufficiently broad, our competitive position may be adversely affected; | |

| ● | the price of our stock may be volatile, and you could lose all or part of your investment. Unstable market and economic conditions may have serious adverse consequences on our business, financial condition and stock price; | |

| ● | our success is highly dependent on our ability to attract and retain highly skilled executive officers and employees; | |

| ● | we face significant competition from other biotechnology and pharmaceutical companies, and our operating results will suffer if we fail to compete effectively; and | |

| ● | our business is affected by the ongoing COVID-19 pandemic and may be significantly adversely affected as the pandemic continues or if other events out of our control disrupt our business or that of our third-party providers. |

| 9 |

THE OFFERING

| Issuer | bioAffinity Technologies, Inc. | |

| Securities Offered | 3,086,419 Units (based on an assumed public offering price of $1.62 per Unit, which is based on the closing price of the Common Stock on September 13, 2023), each Unit consisting of one share of our Common Stock and one Warrant. | |

| Description of the Warrants | Each Warrant is exercisable for one share of Common Stock for an assumed price of $[●] per share (120% of the Offering Price of one Unit). Each Warrant will be exercisable immediately upon issuance and will expire five (5) years after the initial issuance date. For more information regarding the Warrants, you should carefully read the section titled “Description of Securities—Warrants” on page 99 of this prospectus. | |

| Over-Allotment Option | We have granted the underwriters a 45-day Over-Allotment Option to purchase up to an additional 462,962 shares of Common Stock and /or 462,962 additional Warrants at a per share price equal to the Offering Price per Unit minus $0.01 and per Warrant price of $0.01, or any combination of additional shares of Common Stock and Warrants, in all cases less the underwriting discounts payable by us. | |

Shares of Common Stock Outstanding prior to the Offering(1) |

9,350,297 shares as of September 20, 2023 | |

| Shares of Common Stock Outstanding after the Offering(1)(2) | 12,436,716 shares | |

| Use of Proceeds | We estimate that the net proceeds to us from the sale of our Units in this Offering will be approximately $4.0 million, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us. If the underwriters exercise their Over-Allotment Option in shares of Common Stock in full, the net proceeds to us will be approximately $4.7 million.

We intend to use the net proceeds from this Offering for working capital and for general corporate purposes, which may include laboratory test and therapeutic product development, general and administrative matters, and capital expenditures. We may also use a portion of the net proceeds for the acquisition of, or investment in, technologies, solutions or businesses that complement our business, although we have no present definitive commitments or agreements to enter into any acquisitions or investments.

We cannot specify with certainty all of the uses of the net proceeds that we will receive from this Offering. Accordingly, we will have broad discretion in the application of these proceeds and our investors will be relying on the judgment of our management regarding the application of the net proceeds of this Offering. | |

| Representative’s Warrant | The registration statement of which this prospectus is a part also registers for sale the Representative’s Warrant, which gives the Representative the right to purchase up to 2.0% (subject to reduction) of the shares of Common Stock underlying the Units sold in this Offering, as a portion of the underwriting compensation in connection with this Offering. The Representative’s Warrant will be exercisable at any time, and from time to time, in whole or in part, commencing on a date that is 180 days after the commencement of sales of the Units in this Offering and expiring five years from the date of the registration statement in this Offering at an exercise price of $[●] (120% of the assumed offering price per Unit). We are registering the Representative’s Warrant and the shares of Common Stock underlying the Representative’s Warrant in the registration statement of which this prospectus is a part. See “Underwriting—Representative’s Warrant” on page 108 of this prospectus for a description of the Representative’s Warrant. |

| 10 |

| Lock-Up Agreements | We have agreed with the underwriters not to sell additional equity securities for a period of 180 days after the effective date of this Offering. Our directors and officers have agreed with the underwriters not to offer for sale, issue, sell, contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible into Common Stock, subject to certain exceptions, for a period of 180 days after the date of this prospectus, which restriction may be waived in the discretion of the Representative. See “Underwriting—Lock-Up Agreements” on page 108 of this prospectus. | |

| Risk Factors | You should read the “Risk Factors” section beginning on page 14 of this prospectus and the other information included herein for a discussion of factors to consider prior to deciding to invest in our Units. | |

| Nasdaq Capital Market Listing | Our Common Stock is listed on the Nasdaq Capital Market under the symbol “BIAF and our Warrants issued in our initial public offering are listed on the Nasdaq Capital Market under the symbol “BIAFW.” | |

| Transfer Agent and Warrant Agent | The transfer agent and registrar for our Common Stock and the Warrant Agent for our Warrants is VStock Transfer, LLC. |

| (1) | The number of shares of Common Stock outstanding immediately prior to and after this Offering is based on 9,350,297 shares of Common Stock outstanding as of September 20, 2023 and includes: (i) 133,414 unvested shares of restricted Common Stock, which are subject to forfeiture, but which are outstanding and have voting rights; and (ii) 564,972 shares of Common Stock issued to the Joyce Trust pursuant to the terms of the Asset Purchase Agreement on September 20, 2023. |

| (2) |

The number of shares of Common Stock outstanding immediately following this Offering is based on all of the shares listed in number (1) above and excludes: |

| ● | 3,086,419 shares of Common Stock issuable upon the exercise of the Warrants underlying the Units sold in this Offering; | |

| ● | 462,962 shares of Common Stock issuable upon the exercise of the Over-Allotment Option; | |

| ● | 462,962 shares of Common Stock issuable upon the exercise of 462,962 Warrants issuable upon the exercise of the Over-Allotment Option; | |

| ● | 61,728 shares of Common Stock issuable upon the exercise of the Representative’s Warrant; | |

| ● | 806,392 shares of Common Stock issuable upon the exercise of stock options issued under our 2014 Equity Incentive Plan to certain of our employees, directors, and consultants with a weighted average exercise price equal to $4.33; | |

| ● | an aggregate of 4,305,812 shares of Common Stock issuable upon the exercise of outstanding Tradeable Warrants and Non-Tradeable Warrants, (which share number reflects an adjustment in the number of shares to be issued upon exercise of the Tradeable Warrants and Non-Tradeable Warrants that will be effected upon consummation of this Offering in accordance with the price protection provisions contained in the Tradeable Warrants and Non-Tradeable Warrants) all of which, upon consummation of the Acquisition, will have an exercise price that will be reduced to $3.0625 per share; | |

| ● | 2,900,904 shares of Common Stock issuable upon the exercise of outstanding warrants issued prior to consummation of our initial public offering, with a weighted average exercise price equal to $5.31 per share; and | |

| ● | 658,294 shares of our Common Stock that are reserved for equity awards that may be granted under our 2014 Equity Incentive Plan. |

Except as otherwise indicated, all information in this prospectus assumes:

| ● | An assumed initial Offering Price of $1.62 per Unit, which is the closing price of our Common Stock on the Nasdaq on September 13, 2023 set forth on the cover page of this prospectus; | |

| ● | no exercise of the Warrants underlying the Units in this Offering; | |

| ● | no exercise of any options under our 2014 Equity Incentive Plan; | |

| ● | no exercise of any outstanding warrants; and | |