UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

bioAffinity Technologies, Inc.

(Exact Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

bioAffinity Technologies, Inc.

22211 West Interstate 10, Suite 1206

San Antonio, Texas 78257

April [●], 2024

Dear Stockholder:

I am pleased to invite you to attend the Annual Meeting of Stockholders of bioAffinity Technologies, Inc. on Tuesday, June 4, 2024, at 8:00 a.m. Central Time. The Annual Meeting will be held in person at the Company’s principal office at 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257.

bioAffinity Technologies is committed to developing noninvasive diagnostics for lung cancer and other diseases of the lung. Our team of scientists and business professionals is driven by its mission to increase detection of cancer at early stage when accurate diagnosis leads to longer lives, fewer unnecessary invasive procedures, reduced patient anxiety, and lower medical costs. As President and Chief Executive Officer of bioAffinity Technologies, I am greatly encouraged by the growing adoption and use by physicians of our first test, CyPath® Lung, a noninvasive test for lung cancer, and of the technological advancements that our team continues to make in its fight to address the urgent need for noninvasive, early-stage diagnosis.

Whether or not you plan to attend the Annual Meeting, your vote matters. We encourage you to promptly vote your shares by proxy over the internet, via telephone or by mail.

Your trust in our team and belief in our technology are invaluable. On behalf of our Board of Directors, our executive leadership team, and our dedicated team of scientists and businesspeople, we extend our sincerest gratitude for your continued support of and investment in bioAffinity Technologies.

| Sincerely, | |

| |

| Maria Zannes | |

| President and Chief Executive Officer |

| 2 |

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 4, 2024

Notice is hereby given that bioAffinity Technologies, Inc. (the “Company”) will host its Annual Meeting of Stockholders on Tuesday, June 4, 2024, at 8:00 a.m. Central Time (the “Annual Meeting”). The Annual Meeting will be held in person at the Company’s principal office at 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257. The Annual Meeting is being held for the following purposes:

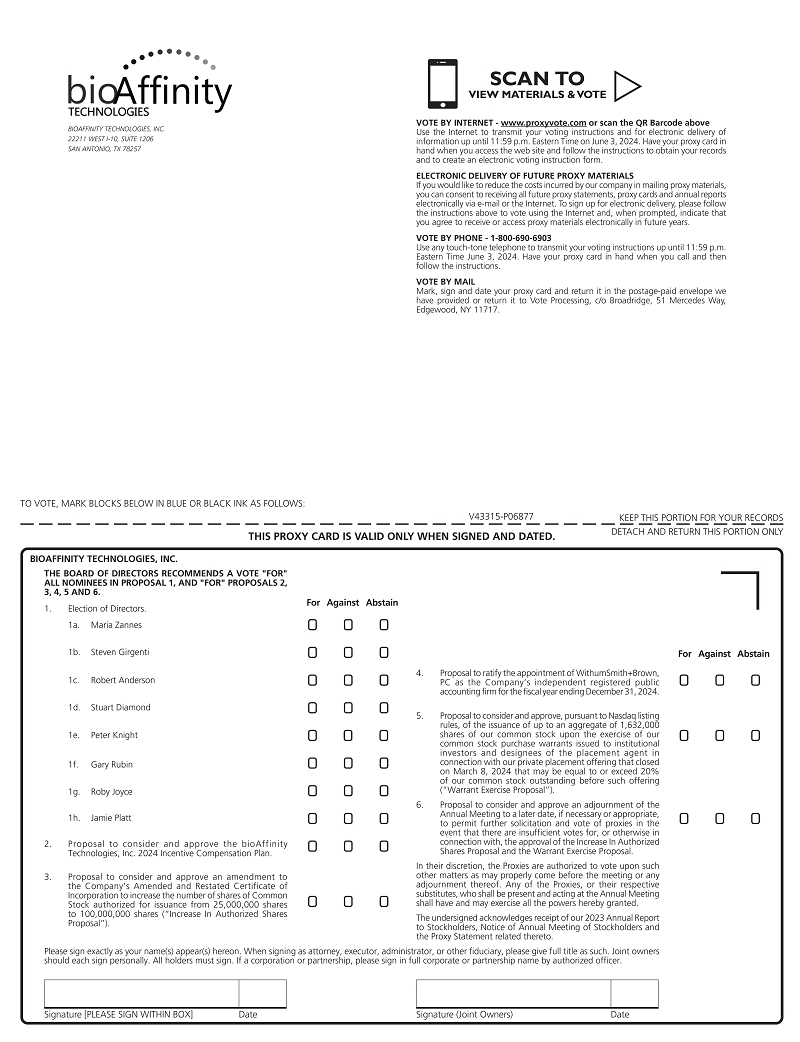

| (1) | To elect the eight director nominees listed in the accompanying Proxy Statement to serve until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified; | |

| (2) | To consider and approve the bioAffinity Technologies, Inc. 2024 Incentive Compensation Plan (the “2024 Plan”); | |

| (3) | To consider and approve an amendment to the Company’s Amended and Restated Certificate of Incorporation to increase the number of shares of common stock authorized for issuance from 25,000,000 shares to 100,000,000 shares (“Increase In Authorized Shares Proposal”); | |

| (4) | To ratify the appointment of WithumSmith+Brown, PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024; | |

| (5) | To approve, pursuant to Nasdaq listing rules, the issuance of up to an aggregate of 1,632,000 shares of our common stock upon the exercise of our common stock purchase warrants issued to institutional investors and designees of the placement agent in connection with our private placement offering that closed on March 8, 2024, that may be equal to or exceed 20% of our common stock outstanding before such offering (the “Warrant Exercise Proposal”); | |

| (6) | To approve a proposal to adjourn the Annual Meeting to a later date, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Increase In Authorized Shares Proposal and the Warrant Exercise Proposal (the “Adjournment Proposal”); and | |

| (7) | To transact such other business as may lawfully come before the meeting or any adjournment thereof. |

Stockholders of record at the close of business on April 8, 2024, are entitled to notice of and to vote at the Annual Meeting and any postponements or adjournments thereof. A list of stockholders of record at the close of business on April 8, 2024, will be available for inspection by any stockholder for a period of ten days prior to the Annual Meeting at our principal office at 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257.

The Notice of Internet Availability of Proxy Materials will be mailed to our stockholders on or about April [●], 2024. If you previously requested electronic or paper delivery of the proxy materials, you will be sent the proxy statement, the accompanying proxy card and our 2023 Annual Report to Stockholders on or about April [●], 2024. The Notice of Internet Availability of Proxy Materials contains instructions on how to access an electronic copy of our proxy materials.

| 3 |

Your vote is very important. Whether or not you plan to attend the Annual Meeting, we encourage you to read the accompanying Proxy Statement and to submit your proxy or voting instructions as soon as possible. In order to ensure the representation of a quorum at the Annual Meeting, stockholders who do not expect to attend the Annual Meeting are urged to vote as soon as possible. For information on how to vote your shares, please refer to the section of the Proxy Statement entitled “Questions and Answers About the Proxy Materials and the Annual Meeting” and to the instructions provided in your proxy card or Notice of Internet Availability of Proxy Materials or by your broker, bank, or other nominee.

| By Order of the Board of Directors: | |

| |

| Maria Zannes | |

| President and Chief Executive Officer | |

| Dated: April [●], 2024 |

Important Notice Regarding the Availability of Proxy Materials

for the Stockholder Meeting to Be Held on June 4, 2024

The proxy statement and the 2023 Annual Report to Stockholders are available at www.proxyvote.com.

| 4 |

bioAffinity Technologies, Inc.

22211 W Interstate 10, Suite 1206

San Antonio, Texas 78257

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 4, 2024

GENERAL INFORMATION

The Board of Directors (the “Board”) of bioAffinity Technologies, Inc., a Delaware corporation (the “Company”), is soliciting proxies to be used at the 2024 Annual Meeting of Stockholders to be held on Tuesday, June 4, 2024, at 8:00 a.m. Central Time (the “Annual Meeting”) at the Company’s principal office at 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257. This proxy statement (this “Proxy Statement”) and the 2023 Annual Report to Stockholders are posted on the internet at www.proxyvote.com, and the Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed to our stockholders on or about April [●], 2024. If you previously requested electronic or paper delivery of the proxy materials, you will be sent the proxy statement, the accompanying proxy card, and the 2023 Annual Report to Stockholders on or about April [●], 2024.

Voting Matters and the Board’s Recommendation

| Agenda Item | Board

Vote Recommendation |

Page Reference |

| Election of eight directors | FOR each Director Nominee | [●] |

| Approval of the bioAffinity Technologies, Inc. 2024 Incentive Compensation Plan | FOR | [●] |

| Approval of charter amendment to increase authorized shares from 25,000,000 shares to 100,000,000 shares | FOR | [●] |

| Ratification of WithumSmith+Brown, PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024 | FOR | [●] |

| Approval of the issuance of up to an aggregate of 1,632,000 shares of our common stock upon the exercise of our common stock purchase warrants issued or issuable in connection with our private placement offering that closed on March 8, 2024 | FOR | [●] |

| Approval of the Adjournment Proposal | FOR | [●] |

In addition to these matters, stockholders may be asked to vote on such other business as may properly come before the Annual Meeting.

Even if you plan to attend the Annual Meeting, please vote in advance so that your vote will be counted if you later decide not to attend the Annual Meeting.

| 5 |

QUESTIONS AND ANSWERS ABOUT

THE PROXY MATERIALS AND THE ANNUAL MEETING

Who is soliciting my vote?

The Board of Directors of bioAffinity Technologies, Inc. is soliciting your proxy to be used at the Annual Meeting.

Why did I receive a one-page Notice in the mail regarding the internet availability of proxy materials this year instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to mail to our stockholders a Notice of Internet Availability of Proxy Materials instead of a paper copy of the proxy materials. All stockholders receiving the Notice will have the ability to access the proxy materials over the internet and receive a paper copy of the proxy materials by mail on request. Instructions on how to access the proxy materials over the internet or to request a paper copy may be found in the Notice. In addition, the Notice contains instructions on how you may access proxy materials in printed form by mail or electronically on an ongoing basis. This process has allowed us to expedite our stockholders’ receipt of proxy materials, lower the costs of distribution, and reduce the environmental impact of our Annual Meeting.

When and where will the Annual Meeting be held?

The Annual Meeting will be held on Tuesday, June 4, 2024, at 8:00 a.m. Central Time, at the Company’s principal office at 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257.

| What do I need to do if I would like to attend the Annual Meeting? |

If you wish to attend the Annual Meeting in person, you must present a valid form of photo identification, such as a driver’s license. If you are a beneficial owner of common stock that is held of record by a bank, broker, or other nominee, you will also need proof of ownership to be admitted. In this regard, a recent brokerage statement or a letter from your bank or broker are examples of proof of ownership. The Company reserves the right to prohibit cameras, recording equipment, or electronic devices in the Annual Meeting.

What am I voting on at the Annual Meeting?

The purpose of the Annual Meeting is to vote on the following items described in this Proxy Statement:

| Proposal No. 1: To elect the eight director nominees listed in the accompanying Proxy Statement to serve until the next Annual Meeting of Stockholders and until their successors are duly elected and qualified. | ||

| Proposal No. 2: To consider and approve the bioAffinity Technologies, Inc. 2014 Incentive Compensation Plan (the “2024 Plan”) | ||

| Proposal No. 3: To consider and approve an amendment to the Company’s Amended and Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”) to increase the number of shares of common stock authorized for issuance from 25,000,000 shares to 100,000,000 shares (the “Increase In Authorized Shares Proposal”). | ||

Proposal No. 4: To ratify the appointment of WithumSmith+Brown, PC as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2024.

Proposal No. 5: To consider and approve the issuance of up to an aggregate of 1,632,000 shares of our common stock upon the exercise of our common stock purchase warrants issued or issuable to institutional investors and designees of the placement agent in connection with our private placement offering that closed on March 8, 2024, that may be equal to or exceed 20% of our common stock outstanding before such offering (the “Warrant Exercise Proposal”).

Proposal No. 6: To consider and approve the adjournment of the Annual Meeting to a later date, if necessary or appropriate, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the Increase In Authorized Shares Proposal and the Warrant Exercise Proposal (the “Adjournment Proposal”). |

| 6 |

Additionally, the proxies, at their discretion and if designated as such, are authorized to vote upon such other business as may properly come before the Annual Meeting or any continuation, postponement, or adjournment thereof.

Who is entitled to vote?

Stockholders as of the close of business on the record date of April 8, 2024 (the “Record Date”), are entitled to vote at the Annual Meeting or any postponement or adjournment thereof. As of the Record Date, there were [●] shares of the Company’s common stock, par value $0.007 per share (the “Common Stock”), outstanding.

How many votes per share of Common Stock held are stockholders entitled to?

Stockholders have one vote per share on all matters presented at the Annual Meeting.

What is the difference between holding shares of Common Stock as a “stockholder of record” and holding shares in “street name”?

Shares held as a “stockholder of record” (also called a “registered holder”) are shares held directly in your name. Shares held in “street name” are shares held for you in an account with a broker, bank, or other nominee.

How do I vote my shares?

If you are a registered holder, you may vote:

| ● | By internet. Via the Internet at www.proxyvote.com.; |

| ● | By telephone. If you are located within the United States and Canada, call 1-800-690-6903 (toll-free) from a touch-tone telephone; |

| ● | By mail. By returning a properly executed proxy card it in the postage-paid envelope provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717; or | |

| ● | In person. You may vote in person at the Annual Meeting. |

To vote online or via telephone, you will need your unique control number. You can find the control number on your proxy card or Notice. Be sure to have your proxy card or your Notice in hand and follow the instructions. Internet and telephone voting facilities will close at 11:59 p.m. Eastern Time on June 3, 2024, for the voting of shares held by stockholders of record as of the Record Date. Proxy cards with respect to shares held of record must be received no later than June 3, 2024.

If you hold your shares in street name, you may vote:

| ● | By internet*. Via the Internet at www.proxyvote.com. To vote online, you will need your unique control number; |

| ● | By telephone*. If you are located within the United States and Canada, call 1-800-454-8683 (toll-free) from a touch-tone telephone; |

| ● | By mail: By returning a properly executed voting instruction form by mail, depending upon the method(s) your broker, bank or other nominee makes available; or | |

| ● | In person: To do so, you must request a legal proxy from your broker, bank, or other nominee and present it at the Annual Meeting. |

*Not all street name holders may be able to vote at the web address and phone number provided above.

If your shares are held in street name, please check the voting instruction form or Notice provided to you by your broker, bank, or other nominee for internet or telephone voting availability. If internet and/or telephone voting are available to a street name holder, such facilities will close at 11:59 p.m. Eastern Time on June 3, 2024. To vote online or via telephone, you will need your unique control number. You can find the control number on your voting instruction form or Notice. Be sure to have your voting instruction form or your Notice in hand and follow the instructions.

| 7 |

What if I return a proxy card or otherwise submit a proxy but do not make specific choices?

All shares held by recordholders entitled to vote, represented by a properly executed and unrevoked proxy received in time for the Annual Meeting, will be voted in accordance with the instructions given. In the absence of such instructions, shares will be voted as recommended by the Board. The persons named as proxies will also be authorized to vote in their discretion upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. If any nominee for director is unable to serve, which is not now contemplated, the proxies will be voted for such substitute nominee(s) as the Board recommends.

What are “broker non-votes”?

Banks, brokers, and other agents acting as nominees are permitted to use discretionary voting authority to vote for proposals that are deemed “routine” by the New York Stock Exchange, which means that they can submit a proxy or cast a ballot on behalf of stockholders who do not provide a specific voting instruction. Brokers, banks, or other nominees are not permitted to use discretionary voting authority to vote for proposals that are deemed “non-routine” by the New York Stock Exchange. Under the rules and interpretations of the New York Stock Exchange, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation, and certain corporate governance proposals, even if management supported. We believe that Proposals 3, 4 and 6 will be treated by the New York Stock Exchange as routine matters and Proposals 1, 2 and 5 will be treated by the New York Stock Exchange as non-routine matters. The determination of which proposals are deemed “routine” versus “non-routine” may not be made by the New York Stock Exchange until after the date on which this proxy statement has been distributed. As such, it is important that you provide voting instructions to your broker, bank, or other nominee as to how to vote your shares, if you wish to ensure that your shares are present and voted at the Annual Meeting on all matters and if you wish to direct the voting of your shares on “routine” matters.

When there is at least one “routine” matter to be considered at a meeting, a “broker non-vote” occurs when a proposal is deemed “non-routine” and a nominee holding shares for a beneficial owner does not have discretionary voting authority with respect to the “non-routine” matter being considered and has not received instructions from the beneficial owner.

What constitutes a quorum?

A quorum for the transaction of business at the Annual Meeting requires representation, in person or by proxy, of the holders of a majority of the Company’s issued and outstanding shares of Common Stock. Abstentions and broker non-votes will be counted as shares that are present for purposes of determining the presence of a quorum for the transaction of business at the Annual Meeting.

| 8 |

What is the voting requirement to approve each of the proposals?

| Proposal | Vote Required | Voting Options | Impact of “Abstain” Vote |

Impact of Broker Non-Votes | ||||

Proposal No. 1: Election of Directors |

Each nominee must receive a majority of the votes cast at the Annual Meeting in favor of the nominee’s election in order for the nominee to be elected to the Board. With respect to each director nominee, a majority of the votes cast means that the number of shares voted “FOR” the nominee must exceed the number of shares voted “AGAINST” such nominee’s election. | “FOR” “AGAINST” “ABSTAIN” |

No effect | No effect | ||||

Proposal No. 2: Approval of the 2024 Incentive Compensation Plan |

The affirmative vote of a majority of the shares present in person or by proxy and entitled to vote on the matter is required. | “FOR” “AGAINST” “ABSTAIN” |

Counts as a vote “AGAINST” this proposal. | No effect | ||||

Proposal No. 3: Increase In Authorized Shares Proposal |

The votes cast in favor of such proposal must exceed the votes cast against such proposal. | “FOR” “AGAINST” “ABSTAIN” |

No effect | Not applicable | ||||

Proposal No. 4: Ratification of Appointment of Independent Registered Public Accounting Firm |

The affirmative vote of a majority of the shares present in person or by proxy and entitled to vote on the matter is required. | “FOR” “AGAINST” “ABSTAIN” |

Counts as a vote “AGAINST” this proposal. | Not applicable | ||||

Proposal No. 5: Warrant Exercise Proposal |

The affirmative vote of a majority of the shares present in person or by proxy and entitled to vote on the matter is required. | “FOR” “AGAINST” “ABSTAIN” |

Counts as a vote “AGAINST” this proposal. | No effect | ||||

Proposal No. 6: Adjournment Proposal

|

The affirmative vote of a majority of the shares present in person or by proxy and entitled to vote on the matter is required. | “FOR” “AGAINST” “ABSTAIN” |

Counts as a vote “AGAINST” this proposal. | Not applicable |

How does the Board recommend that I vote?

The Board recommends that you vote your shares:

| ● | “FOR” the eight director nominees for election to the Board (Proposal No. 1); | |

| ● | “FOR” the approval of the Company’s 2024 Incentive Compensation Plan (Proposal No. 2); | |

| ● | “FOR” the approval of the Increase in Authorized Shares Proposal (Proposal No. 3); | |

| ● | “FOR” the ratification of the approval of WithumSmith+Brown, PC as the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2024 (Proposal No. 4); | |

| ● | “FOR” the Warrant Exercise Proposal (Proposal No. 5); and | |

| ● | “FOR” the Adjournment Proposal (Proposal No. 6). |

| 9 |

Who will count the vote?

One or more inspectors of election at the Annual Meeting will tabulate and certify the votes.

What does it mean if I receive more than one set of Proxy Materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, please submit your proxy for each set of Proxy Materials via the internet, telephone or by signing, dating, and returning the enclosed proxy card in the enclosed envelope.

May I change my vote or revoke my proxy?

Yes. Whether you have voted by internet, telephone or mail, if you are a stockholder of record, you may change your vote and revoke your proxy by:

| ● | sending a written statement to that effect to the attention of the Company’s Secretary at the Company’s principal office at 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257, at any time prior to the voting of the proxy, provided such statement is received no later than 11:59 p.m. Eastern Time on June 3, 2024; | |

| ● | voting again by internet or telephone at a later time before the closing of those voting facilities at 11:59 p.m. Eastern Time on June 3, 2024; | |

| ● | submitting a properly signed proxy card to the attention of the Company’s Secretary at the Company’s principal office at 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257, with a later date that is received no later than 11:59 p.m. Eastern Time on June 3, 2024; or | |

| ● | attending and voting at the Annual Meeting on June 4, 2024. |

Your last vote is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you give written notice of revocation to the Company before your proxy is voted or you vote at the Annual Meeting.

If you hold shares in street name, please refer to information from your bank, broker, or other intermediary on how to revoke or submit new voting instructions.

Who will pay for the cost of this proxy solicitation?

The Company will pay for the cost of soliciting proxies. Some of the Company’s directors, officers, or employees may (for no additional compensation) solicit proxies in person or by telephone, email, or facsimile transmission. Brokers and other nominees will be requested to solicit proxies or authorizations from beneficial owners and will be reimbursed for their reasonable expenses.

| 10 |

THE BOARD OF DIRECTORS AND CERTAIN CORPORATE GOVERNANCE MATTERS

The Company is committed to implementing sound corporate governance practices, adhering to a robust corporate ethics policy, and equipping the Board and executive team with the tools and training necessary to manage the Company for the long-term benefit of the Company’s stockholders and the Company’s long-term sustainability. The Board has implemented a number of enhancements to the Company’s corporate governance practices, including adopting a majority vote standard for director elections.

Director Independence

The Company’s Common Stock is listed on the Nasdaq Capital Market (“Nasdaq”). The Nasdaq Stock Market LLC Rules (the “Nasdaq Rules”) require that a majority of the Board be “independent directors,” as defined in Nasdaq Rule 5605(a)(2). The Nasdaq listing standards subject members of the Company’s Audit Committee and Compensation Committee to additional independence requirements. The Board has affirmatively determined that each of the Company’s non-employee directors, which include Messrs. Robert Anderson, Stuart Diamond, Peter Knight, Gary Rubin, and Jamie Platt are independent directors under the Nasdaq Rules and listing standards, including with respect to each director’s committee service.

Leadership Structure

Maria Zannes has served as the Company’s President and Chief Executive Officer (“CEO”) since the Company’s inception in March 2014. Steven Girgenti has served as the Company’s Executive Chairman since November 2014. In addition to the roles of the President, CEO, and Executive Chairman, the Company’s By-laws require the Board to elect or appoint a Chief Financial Officer, a Treasurer, and a Secretary, who collectively serve as the officers of the Company. Any two or more offices may be held by the same person.

The Board does not have a policy regarding whether the roles of the Executive Chairman and CEO should be separate or combined. The Board believes that it should retain flexibility in deciding from time to time which leadership structure is in the best interests of the Company and its stockholders. At this time, the Board believes that separating the Executive Chairman and CEO roles best serves the needs of the Company’s business, enabling the Company to benefit from Mr. Girgenti’s extensive experience in healthcare marketing strategies, financing, and business diversification through merger and acquisition opportunities along with his skill in building emerging growth companies into multi-national corporations, while leveraging Ms. Zannes’ legal and regulatory background, experience in project management and team leadership, long-standing relationships with the team of award-winning scientists and business leaders that she has built to advance the Company’s objectives, and passion for defining and advancing the Company’s strategic goals.

Communications with the Board of Directors

Stockholders may communicate directly with the Board. All communications should be in writing and directed to the Company Secretary, Timothy P. Zannes, at bioAffinity Technologies, Inc., 22211 West Interstate 10, Suite 1206, San Antonio, Texas 78257, and should prominently indicate on the outside of the envelope that it is intended for the Board. The Company Secretary has the authority to disregard any inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications. If deemed appropriate, the Company Secretary will forward correspondence to the Chairman of the Board or any specific director or Committee to whom the correspondence is directed.

Board Committees

The Board directs and oversees the management of the Company’s business and affairs and has three standing committees, consisting of the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each committee operates under a Board-approved charter, a copy of which is available on the Investor Relations section of the Company’s website at ir.bioaffinitytech.com and can be accessed through the “Governance Documents” hyperlink under the “Governance” tab.

Audit Committee

The Audit Committee consists of Stuart Diamond (Chairman), Robert Anderson, and Gary Rubin, all of whom have been deemed independent by the Board in accordance with the requirements of Rule 10A-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and applicable Nasdaq Rules. The Board has also determined that Stuart Diamond and Gary Rubin are “Audit Committee financial experts” as defined in Item 407(d)(5)(ii) of Regulation S-K. All members of the Audit Committee are financially literate, as determined by the Board, and can read and understand fundamental financial statements, including the Company’s balance sheet, income statement, and cash flow statement.

The responsibilities and duties of the Audit Committee are set forth in its charter and include assisting the Board in overseeing the following:

| ● | selecting, retaining, compensating, overseeing, and determining the retention of an independent registered public accounting firm to audit the Company’s annual financial statements, books, records, accounts, and internal controls over financial reporting and any other registered public accounting firm engaged to prepare or issue an audit report or to perform other audit, review, or attest services for the Company; | |

| ● | reviewing and discussing the results of a report prepared by the Company’s independent auditors concerning the accounting firm’s internal quality-control procedures; any material issues raised by the most recent internal quality-control review, peer review, or review by the Public Company Accounting Oversight Board (the “PCAOB”), and all relationships between the firm and the Company or any of its subsidiaries; |

| 11 |

| ● | reviewing and discussing with the Company’s independent auditors the responsibilities of the auditors under generally accepted auditing standards; any significant risks identified during the auditors’ risk-assessment procedures; the scope, timing and results of the Company’s annual audit; and all critical accounting policies and practices to be used in the audit; | |

| ● | reviewing, approving, and overseeing any transaction between the Company and any related person (as defined in Item 404 of Regulation S-K) on an ongoing basis; informing the Company’s independent auditors of the Company’s significant relationships and related-party transactions; and reviewing and discussing with the Company’s independent auditors the auditors’ evaluation of the Company’s identification of, accounting for, and disclosure of its related-party relationships and transactions; | |

| ● | recommending to the Board that the audited financial statements be included in the Company’s annual report on Form 10-K and producing the Audit Committee Report required to be included in this Proxy Statement; | |

| ● | establishing the Company’s hiring policies for employees or former employees of the Company’s independent auditors that participated in any capacity in any Company audit; | |

| ● | monitoring the Company’s compliance with, investigating any alleged breach of, and enforcing the Company’s Code of Business Conduct and Ethics; | |

| ● | reviewing and discussing the Company’s policies regarding information technology security and protection from cyber risks; | |

| ● | reviewing with the Company’s general counsel and outside legal counsel any legal and regulatory matters that could impact the Company’s financial statements; and | |

| ● | reporting regularly to the Board on the Audit Committee’s discussion and actions, including any significant issues or concerns that arise at the Audit Committee meetings. |

For additional information on the Audit Committee’s role and its oversight of the independent auditor during 2023, see “Report of the Audit Committee.”

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee consists of Gary Rubin (Chairman), Peter Knight, and Robert Anderson, each of whom has been deemed independent by the Board in accordance with the applicable Nasdaq Rules. The Nominating and Corporate Governance Committee is primarily responsible for identifying qualified candidates for nomination to the Board and for developing and maintaining the Company’s corporate governance policies.

The responsibilities and duties of the Nominating and Corporate Governance Committee are set forth in its charter and include the following:

| ● | identifying and screening individuals qualified to become members of the Board, consistent with Board-approved criteria; | |

| ● | making recommendations to the Board concerning the selection and approval of director-nominees to be submitted to a stockholder vote at the Annual Meeting, subject to the Board’s approval; | |

| ● | developing and recommending for the Board’s approval standards for assessing whether a director has a relationship with the Company that would impair director independence; and | |

| ● | reporting regularly to the Board regarding the Nominating and Corporate Governance Committee’s actions and making recommendations to the Board as appropriate. |

For more information concerning the Nominating and Corporate Governance Committee’s process of making director nominations and the current director nominees, see Proposal No. 1.

| 12 |

Compensation Committee

The Compensation Committee consists of Peter Knight (Chairman), Stuart Diamond, and Jamie Platt. The Board has determined that each Compensation Committee member is independent according to the applicable Nasdaq Rules and the Company’s independence guidelines.

The responsibilities and duties of the Compensation Committee are set forth in its charter and include the following:

| ● | reviewing and approving annually the corporate goals and objectives applicable to the CEO’s compensation, evaluating the CEO’s performance in light of those goals and objectives, and determining and approving the CEO’s compensation level based on the Compensation Committee’s evaluation; | |

| ● | reviewing and approving the compensation of all of the Company’s other executive officers; | |

| ● | assessing, making recommendations to the Board regarding, and administering the Company’s incentive-compensation plans and equity-based plans, including designating the recipients, amounts, and terms and conditions applicable to the awards to be granted under each plan; | |

| ● | reviewing and discussing at least annually the relationship between compensation and risk-management policies and practices; | |

| ● | reviewing at least annually all director compensation and benefits for service on the Board and Board committees and recommending any changes to the Board as necessary; and | |

| ● | reporting regularly to the Board regarding the Compensation Committee’s actions and making recommendations to the Board as appropriate. |

Attendance at Board Meetings and Executive Sessions

During 2023, the Board held five meetings, the Audit Committee held four meetings, the Compensation Committee held two meetings, and the Nominating and Corporate Governance Committee held one meeting. All of the directors attended at least 75% of the total number of Board meetings and, to the extent applicable, of the total number of meetings held by all Board committees on which such director served. The Board also took action on a number of occasions as needed without a physical meeting in the form of unanimous written consents.

Annual Meeting Attendance

Although the Company does not have a formal policy regarding director attendance at annual stockholder meetings, directors are encouraged to attend annual stockholder meetings. Two directors attended the 2023 annual meeting of stockholders.

Code of Ethics and Business Conduct

The Company has adopted a Code of Ethics and Business Conduct applicable to all of the Company’s directors, officers, and employees. A copy of the Code of Ethics and Business Conduct is available on the Investor Relations section of the Company’s website at ir.bioaffinitytech.com and can be accessed through the “Governance Documents” hyperlink under the “Governance” tab.

Insider Trading Policy

The Company maintains a policy on insider trading that applies to any and all transactions in the Company’s securities held by any director, officer, or employee. The policy prohibits all directors, officers, and employees of the Company from trading in the Company’s securities while in possession of material nonpublic information (“MNPI”) about the Company and from giving MNPI to others who may trade on the basis of such information. Under the policy, Timothy Zannes, the Company’s Executive Vice President, Secretary, and General Counsel, is designated as the Company’s Insider Trading Compliance Officer (the “Compliance Officer”). Prior to engaging in transfers of Company securities intended to comply with the affirmative defense provided under Rule 10b5-1 promulgated under the Exchange Act, employees, officers, and directors must receive the Compliance Officer’s approval.

| 13 |

Prohibition against Short Sales and Hedging

Pursuant to our Insider Trading Policy, we prohibit our employees, officers and directors from trading in any interest or position relating to the future price of Company securities, such as a put, call or short sale (including a short sale “against the box”).

Role of the Board in Risk Oversight

One of the key functions of the Board is informed oversight of the Company’s risk management process. The Board does not have a standing risk management committee but rather administers its oversight function directly through the Board as a whole and through its standing committees that address risks inherent in their respective oversight areas. In particular, the Board is responsible for monitoring and assessing strategic risk exposure. The Audit Committee has the responsibility to consider and discuss (i) the Company’s major financial risk exposures and the steps management has taken to monitor and control these exposures, which includes establishing guidelines and policies to govern the process by which risk assessment and management is undertaken and (ii) policies regarding information technology security and protection from cyber risks The Audit Committee also monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of the Company’s external audit function.

The Nominating and Corporate Governance Committee monitors the effectiveness of the Company’s corporate governance guidelines. The Compensation Committee assesses and monitors whether any of the Company’s compensation policies and programs has the potential to encourage excessive risk-taking. While each committee is responsible for evaluating certain risks and overseeing the management of such risks, the full Board is regularly informed of such risks through committee reports and otherwise. While the Board oversees the Company’s overall risk management, the day-to-day management processes are executed by the Company’s management team. The Company believes that division of responsibilities enables the Company to address risks most effectively.

Role of the Board in Human Capital Oversight

The Company places significant emphasis on the recruitment, development, and retention of its employees who include award-winning scientists dedicated to advancing scientific discovery from bench to bedside. Of our nine employees engaged in research and development, all of whom are employed full-time, one holds an M.D. and six hold Ph.Ds in biology or medicinal chemistry. Of the 53 employees at PPLS, nearly half have worked at our clinical laboratory for more than five years.

Our Executive Vice President and Chief Medical and Science Officer, Vivienne Rebel, holds an M.D. and Ph.D. Business development is led by our Chief Operating Officer, Xavier Reveles, who has 25 years of experience as a clinical geneticist skilled in the creation and management of clinical laboratories certified under the Clinical Laboratory Improvement Amendments of 1988 (“CLIA”), coding, and Current Procedural Terminology (“CPT”) reimbursement valuations. Mr. Reveles is board certified by the American Society of Clinical Pathology as a clinical specialist in cytogenetics who has successfully launched multiple diagnostics and commercial laboratories. We have recently attracted experienced salespeople with a proven record in the pulmonary field. In November 2023, we hired Dallas Coleman as National Sales Director who has more than 15 years of experience in medical sales and marketing, most recently as Executive Account Manager for the respiratory portfolio of Olympus America’s therapeutic solutions division. In February 2024, Cole Koeppen joined us as Pulmonary Sales Executive for CyPath® Lung in North Texas. Previously, he was Territory Sales Associate for Pulmonx Corporation, a provider of treatments for patients with COPD. Our innovative and collaborative culture is in part responsible for our ability to attract and retain highly skilled professionals seeking professional advancement. Outside partnerships and collaborations that advance business and scientific research are encouraged, allowing us to multiply workforce efforts without expending significant capital.

The Board, led by the Compensation Committee, oversees employee compensation and incentivization programs. The Company’s compensation systems reflect the Company’s emphasis on retention and development. The Board also oversees the Company’s efforts to provide pay, benefits, and services that help meet the varying needs of its employees. Compensation and benefits include market-competitive pay, retirement programs, broad-based bonuses, stock options, health and welfare benefits, financial counseling, paid time off, and family leave.

| 14 |

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Board Composition and Election

The Company’s By-laws require the Board to consist of at least five but not more than eight directors. Currently, the Board consists of eight directors. Each of the Company’s current directors is being nominated for re-election to the Board.

Directors are elected annually and hold office until their respective successors are duly elected and qualified. Each director nominee currently serves as a director of the Company. Proxies solicited by the Board will, unless otherwise directed, be voted to elect the eight nominees named below to constitute the entire Board. All nominees have consented to be named and have indicated their intent to serve if elected. In the event any of the nominees shall be unable or unwilling to serve as a director, the persons named in the proxy intend to vote “FOR” the election of any person as may be nominated by the Board in substitution. The Company has no reason to believe that any of the nominees named below will be unable to serve as a director if elected.

Board Nominations

The Board has established a Nominating and Corporate Governance Committee that operates pursuant to a charter adopted by the Board.

The Nominating and Corporate Governance Committee Charter sets forth criteria that the Committee may consider, among other criteria deemed appropriate by the committee, in recommending candidates for election to the Board. The Board has no formal policy regarding diversity, but diversity is considered when evaluating nominees because the Board believes that gender and minority representation is a key component in attaining the diverse array of viewpoints sought by the Board among its members. The Company also does not have formal stock ownership guidelines for directors, but ownership of the Company’s Common Stock by directors is encouraged and, in part, facilitated by grants of stock options and restricted stock awards to directors as described below under “Director and Executive Compensation – Director Compensation.”

Directors are not restricted to term limits, but the Board considers each director’s tenure, level of involvement on the Board, and other attributes and qualities to determine whether to approve a director as a nominee for re-election.

The Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders if provided with the following: (i) the written consent of the candidate(s) for nomination as a director and verification as to the accuracy of the biographical and other information submitted in support of the candidate; (ii) a resume or other written statement of the qualifications of the candidate(s) for nomination as a director; and (iii) all information regarding the candidate(s) and the submitting stockholder that would be required to be disclosed in a proxy statement filed with the SEC if the candidate(s) were nominated for election to the Board. Any recommendations received from stockholders will be evaluated in the same manner that other potential nominees are evaluated. Any stockholder that wishes to present a director candidate for consideration should submit the information identified above pursuant to the procedures set forth above under “Communications with the Board of Directors.” With respect to the timing of stockholder nominations for the 2025 annual meeting of stockholders (the “2025 Annual Meeting”), please see the discussion set forth below under “Stockholder Proposals For 2025 Annual Meeting.” The Company received no nominations of board candidates from any stockholders for this year’s Annual Meeting.

Director Nominee Information

Certain information concerning each director nominee as of April 8, 2024, is set forth below.

| Director Nominee | Age | Director Since | Current Company Position(s) | |||

| Maria Zannes, JD | 68 | March 2014 | President, CEO, and Director | |||

| Steven Girgenti | 78 | March 2014 | Executive Chairman and Director | |||

| Robert Anderson | 83 | March 2014 | Director (1) (2) (3) | |||

| Stuart Diamond | 63 | January 2022 | Director (1*) (2) | |||

| Peter Knight | 73 | May 2018 | Director (2*) (3) | |||

| Gary Rubin | 68 | October 2017 | Director (1) (3*) | |||

| Roby Joyce, MD | 76 | September 2023 | Director | |||

| Jamie Platt, PhD | 57 | December 2023 | Director (2) |

| (1) | Member of the Audit Committee. |

| (2) | Member of the Compensation Committee. |

| (3) | Member of the Nominating and Corporate Governance Committee |

| * | Committee Chairman |

| 15 |

The business experience, qualifications, attributes, and skills that led the Nominating and Corporate Governance Committee to nominate each director nominee are provided below.

Director Qualifications and Experience

In determining which director nominees to nominate for election to the Board, the Board considered an array of factors related to each nominee’s primary experience, qualifications, attributes, and skills. Among such factors, the Board evaluated each nominee’s professional standing in the nominee’s chosen field, experience in financial services or related industries, experience reviewing financial statements and financial matters, civic and community involvement, qualification for director independence, leadership and team building skills, diversity by race, gender, or culture, degree of collegiality and insightfulness, and stock ownership in the Company.

Director Biographical Information

The biographical information of each director nominee is included in this Proxy Statement under “Directors and Executive Officers – Biographical Information.”

Vote Required

If a quorum exists, the nominees for director receiving a majority of the votes cast (i.e., the number of shares voted “for” a director nominee exceeds the number of votes cast “against” that nominee), will be elected as directors. Abstentions and broker non-votes are not votes cast and will have no effect on the outcome of this vote.

THE BOARD RECOMMENDS A VOTE “FOR” EACH OF THE NAMED DIRECTOR NOMINEES TO BE ELECTED TO THE BOARD OF DIRECTORS.

| 16 |

PROPOSAL NO. 2

APPROVAL OF THE BIOAFFINITY 2024 INCENTIVE COMPENSATION PLAN

Our 2014 Equity Incentive Plan terminated on the tenth anniversary of its date of adoption by the Board of Directors and our stockholders. Therefore, we no longer have an active plan pursuant to which we can issue equity awards to our employees or directors and are requesting approval of a new plan pursuant to which we can issue equity awards to officer, directors and certain consultants. The 2024 Incentive Compensation Plan (the “2024 Plan”) was approved and adopted on March 27, 2024 by our Board of Directors. The principal provisions of the 2024 Plan are summarized below.

Reasons for the Proposed 2024 Plan

The Board of Directors recommends that stockholders vote “FOR” the adoption of the 2024 Plan. In making such recommendation, the Board of Directors considered a number of factors, including the following:

| ● | Equity-based compensation awards are a critical element of our overall compensation program. We believe that our long-term incentive compensation program aligns the interests of management, employees, and stockholders to create long-term stockholder value. The 2024 Plan will allow us to continue to attract, motivate, and retain our officers, key employees, non-employee directors, and consultants. | |

| ● | Due to the expiration of the 2014 Equity Incentive Plan (the “2014 Plan”), we no longer have any shares remaining available for grant under the prior plan. |

Stockholders are asked to approve the 2024 Plan to satisfy Nasdaq requirements relating to stockholder approval of equity compensation and to qualify certain stock options authorized under the 2024 Plan for treatment as incentive stock options under Section 422 of the Internal Revenue Code.

Administration

The 2024 Plan vests broad powers in a committee to administer and interpret the 2024 Plan. Our Board has initially designated the Compensation Committee to administer the 2024 Plan. Except when limited by the terms of the 2024 Plan, the Compensation Committee has the authority to, among other things: select the persons to be granted awards; determine the type, size and term of awards; establish performance objectives and conditions for earning awards; determine whether such performance objectives and conditions have been met; and accelerate the vesting or exercisability of an award. In its discretion, the Compensation Committee may delegate all or part of its authority and duties with respect to granting awards to one or more of our officers, subject to certain limitations and provided applicable law so permits.

Our Board may amend, alter or discontinue the 2024 Plan and the Compensation Committee may amend any outstanding award at any time; provided, however, that no such amendment or termination may adversely affect awards then outstanding without the holder’s permission. In addition, any amendments seeking to increase the total number of shares reserved for issuance under the 2024 Plan or modifying the classes of participants eligible to receive awards under the 2024 Plan will require ratification by our stockholders in accordance with applicable law. Additionally, as described more fully below, neither the Compensation Committee nor the Board is permitted to reprice outstanding options or stock appreciation rights without stockholder consent.

Eligibility

Any of our employees, directors, consultants, and other service providers, or those of our affiliates, are eligible to participate in the 2024 Plan and may be selected by the Compensation Committee to receive an award.

Vesting

The Compensation Committee determines the vesting conditions for awards. These conditions may include the continued employment or service of the participant, the attainment of specific individual or corporate performance goals, or other factors as determined in the Compensation Committee’s discretion (collectively, “Vesting Conditions”).

| 17 |

Shares of Stock Available for Issuance

Subject to certain adjustments, the maximum number of shares of Common Stock that may be issued under the 2024 Plan in connection with awards is 2,000,000 shares. All available shares may be utilized toward the grant of any type of award under the 2024 Plan. The 2024 Plan imposes a $250,000 limitation on the total grant date fair value of awards granted to any non-employee director in his or her capacity as a non-employee director in any single calendar year.

In the event of any merger, consolidation, reorganization, recapitalization, stock split, reverse stock split, split up, spin-off, combination of shares, exchange of shares, stock dividend, dividend in kind, or other like change in capital structure (other than ordinary cash dividends), or other similar corporate event or transaction that affects our Common Stock, the Compensation Committee shall make adjustments to the number and kind of shares authorized by the 2024 Plan and covered under outstanding 2024 Plan awards as it determines appropriate and equitable. Shares subject to 2024 Plan awards that expire without being fully exercised or that are otherwise forfeited, cancelled, or terminated may again be made available for issuance under the 2024 Plan. However, shares withheld in settlement of a tax withholding obligation, or in satisfaction of the exercise price payable upon exercise of an option, will not again become available for issuance under the 2024 Plan.

Types of Awards

The following types of awards may be granted to participants under the 2024 Plan: (i) incentive stock options (“ISOs”); (ii) nonqualified stock options (“NQOs”) and together with ISOs, options, (iii) stock appreciation rights, (iv) restricted stock, or (v) restricted stock units.

Stock Options. An option entitles the holder to purchase from us a stated number of shares of Common Stock. An ISO may only be granted to an employee of ours or our eligible affiliates. The Compensation Committee will specify the number of shares of Common Stock subject to each option and the exercise price for such option, provided that the exercise price may not be less than the fair market value of a share of Common Stock on the date the option is granted. Notwithstanding the foregoing, if ISOs are granted to any 10% stockholder, the exercise price shall not be less than 110% of the fair market value of Common Stock on the date the option is granted.

Generally, options may be exercised in whole or in part through a cash payment. The Compensation Committee may, in its sole discretion, permit payment of the exercise price of an option in the form of previously acquired shares based on the fair market value of the shares on the date the option is exercised, through means of “net settlement,” which involves the cancellation of a portion of the option to cover the cost of exercising the balance of the option or by such other means as it deems acceptable.

All options shall be or become exercisable in accordance with the terms of the applicable award agreement. The maximum term of an option shall be determined by the Compensation Committee on the date of grant but shall not exceed 10 years (five years in the case of ISOs granted to any 10% stockholder). In the case of ISOs, the aggregate fair market value (determined as of the date of grant) of Common Stock with respect to which such ISOs become exercisable for the first time during any calendar year cannot exceed $100,000. ISOs granted in excess of this limitation will be treated as non-qualified stock options.

On March 28, 2024, the closing price of our Common Stock was $2.02 per share.

Stock Appreciation Rights. A stock appreciation right represents the right to receive, upon exercise, any appreciation in a share of Common Stock over a particular time period. The base price of a stock appreciation right shall not be less than the fair market value of a share of Common Stock on the date the stock appreciation right is granted. This award is intended to mirror the benefit the participant would have received if the Compensation Committee had granted the participant an option. The maximum term of a stock appreciation right shall be determined by the Compensation Committee on the date of grant but shall not exceed 10 years. Distributions with respect to stock appreciation rights may be made in cash, shares of Common Stock, or a combination of both, at the Compensation Committee’s discretion.

| 18 |

Unless otherwise provided in an award agreement or determined by the Compensation Committee, if a participant terminates employment with us (or our affiliates) due to death or disability, the participant’s unexercised options and stock appreciation rights may be exercised, to the extent they were exercisable on the termination date, for a period of 12 months from the termination date or until the expiration of the original award term, whichever period is shorter. If the participant terminates employment with us (or our affiliates) for cause, (i) all unexercised options and stock appreciation rights (whether vested or unvested) shall terminate and be forfeited on the termination date, and (ii) any shares in respect of exercised options or stock appreciation rights for which we have not yet delivered share certificates will be forfeited and we will refund to the participant the option exercise price paid for those shares, if any. If the participant’s employment terminates for any other reason, any vested but unexercised options and stock appreciation rights may be exercised by the participant, to the extent exercisable at the time of termination, for a period of 90 days from the termination date (or such time as specified by the Compensation Committee at or after grant) or until the expiration of the original option or stock appreciation right term, whichever period is shorter. Unless otherwise provided by the Compensation Committee, any options and stock appreciation rights that are not exercisable at the time of termination of employment shall terminate and be forfeited on the termination date.

Restricted Stock. A restricted stock award is a grant of shares of Common Stock, which are subject to forfeiture restrictions during a restriction period. The Compensation Committee will determine the price, if any, to be paid by the participant for each share of Common Stock subject to a restricted stock award. The restricted stock may be subject to Vesting Conditions. If the specified Vesting Conditions are not attained, the participant will forfeit the portion of the restricted stock award with respect to which those conditions are not attained, and the underlying Common Stock will be forfeited to us. At the end of the restriction period, if the Vesting Conditions have been satisfied, the restrictions imposed will lapse with respect to the applicable number of shares. Unless otherwise provided in an award agreement or determined by the Compensation Committee, upon termination a participant will forfeit all restricted stock that then remains subject to forfeiture restrictions.

Restricted Stock Units. Restricted stock units are granted in reference to a specified number of shares of Common Stock and entitle the holder to receive, on the achievement of applicable Vesting Conditions, shares of Common Stock. Unless otherwise provided in an award agreement or determined by the Compensation Committee, upon termination a participant will forfeit all restricted stock units that then remain subject to forfeiture.

Change in Control

In the event of a change in control, the Compensation Committee may, on a participant-by-participant basis: (i) cause any or all outstanding awards to become vested and immediately exercisable (as applicable), in whole or in part; (ii) cause any outstanding option or stock appreciation right to become fully vested and immediately exercisable for a reasonable period in advance of the change in control and, to the extent not exercised prior to that change in control, cancel that option or stock appreciation right upon closing of the change in control; (iii) cancel any unvested award or unvested portion thereof, with or without consideration; (iv) cancel any award in exchange for a substitute award; (v) redeem any restricted stock or restricted stock unit for cash and/or other substitute consideration with value equal to the fair market value of an unrestricted share on the date of the change in control; (vi) cancel any outstanding option or stock appreciation right with respect to all Common Stock for which the award remains unexercised in exchange for a cash payment equal to the excess (if any) of the fair market value of the Common Stock subject to the option or stock appreciation right over the exercise price of the option or stock appreciation right; (vii) impose vesting terms on cash or substitute consideration payable upon cancellation of an award that are substantially similar to those that applied to the cancelled award immediately prior to the change in control, and/or earn-out, escrow, holdback, or similar arrangements, to the extent such arrangements are applicable to any consideration paid to stockholders in connection with the change in control; (viii) take such other action as the Compensation Committee shall determine to be reasonable under the circumstances; and/or (ix) in the case of any award subject to Section 409A of the Code, the Compensation Committee shall only be permitted to use discretion to alter the settlement timing of the award to the extent that such discretion would be permitted under Section 409A of the Code.

Repricing

Neither our Board nor the Compensation Committee may, without obtaining prior approval of our stockholders: (i) implement any cancellation/re-grant program pursuant to which outstanding options or stock appreciation rights under the 2024 Plan are cancelled and new options or stock appreciation rights are granted in replacement with a lower exercise per share; (ii) cancel outstanding options or stock appreciation rights under the 2024 Plan with an exercise price per share in excess of the then current fair market value per share for consideration payable in our equity securities; or (iii) otherwise directly reduce the exercise price in effect for outstanding options or stock appreciation rights under the 2024 Plan.

| 19 |

Miscellaneous

Generally, awards granted under the 2024 Plan shall be nontransferable except by will or by the laws of descent and distribution. No participant shall have any rights as a stockholder with respect to shares covered by options or restricted stock units, unless and until such awards are settled in shares of Common Stock. The Company’s obligation to issue shares or to otherwise make payments in respect of 2024 Plan awards will be conditioned on the Company’s ability to do so in compliance with all applicable laws and exchange listing requirements. The awards will be subject to our recoupment and stock ownership policies, as may be in effect from time to time. The 2024 Plan will expire 10 years after it becomes effective.

U.S. Federal Income Tax Consequences

The following is a brief summary of the general U.S. federal income tax consequences relating to the 2024 Plan. This summary is based on U.S. federal tax laws and regulations in effect on the date of this Proxy Statement and does not purport to be a complete description of the U.S. federal income tax laws.

Incentive Stock Options. Incentive stock options are intended to qualify for special treatment available under Section 422 of the Internal Revenue Code. A participant who is granted an incentive stock option will not recognize ordinary income at the time of grant. A participant will not recognize ordinary income upon the exercise of an incentive stock option provided that the participant was, without a break in service, an employee of the Company or a subsidiary during the period beginning on the grant date of the option and ending on the date three months prior to the date of exercise (one year prior to the date of exercise if the participant’s employment is terminated due to permanent and total disability).

If the participant does not sell or otherwise dispose of the shares of Common Stock acquired upon the exercise of an incentive stock option within two years from the grant date of the incentive stock option or within one year after he or she receives the shares of Common Stock, then, upon disposition of such shares of Common Stock, any amount recognized in excess of the exercise price will be taxed to the participant as a capital gain. The participant will generally recognize a capital loss to the extent that the amount recognized is less than the exercise price.

If the foregoing holding period requirements are not met, the participant will generally recognize ordinary income at the time of the disposition of the shares of Common Stock in an amount equal to the lesser of (i) the excess of the fair market value of the shares of Common Stock on the date of exercise over the exercise price or (ii) the excess, if any, of the amount recognized upon disposition of the shares of Common Stock over the exercise price. Any amount recognized in excess of the value of the shares of Common Stock on the date of exercise will be capital gain. If the amount recognized is less than the exercise price, the participant generally will recognize a capital loss equal to the excess of the exercise price over the amount recognized upon the disposition of the shares of Common Stock.

The rules described above that generally apply to incentive stock options do not apply when calculating any alternative minimum tax liability. The rules affecting the application of the alternative minimum tax are complex, and their effect depends on individual circumstances, including whether a participant has items of adjustment other than those derived from incentive stock options.

Nonqualified Stock Options. A participant will not recognize ordinary income when a nonqualified stock option is granted. When a nonqualified stock option is exercised, a participant will recognize ordinary income in an amount equal to the excess, if any, of the fair market value of the shares of Common Stock that the participant purchased over the exercise price he or she paid.

Stock Appreciation Rights. A participant will not recognize ordinary income when a SAR is granted. When a SAR is exercised, the participant will recognize ordinary income equal to the cash and/or the fair market value of shares of Common Stock the participant receives.

Restricted Shares. A participant who has been granted restricted shares will not recognize ordinary income at the time of grant, assuming that the underlying shares of Common Stock are not transferable and that the restrictions create a “substantial risk of forfeiture” for federal income tax purposes and that the participant does not make an election under Section 83(b) of the Internal Revenue Code. Generally, upon the vesting of restricted shares, the participant will recognize ordinary income in an amount equal to the then fair market value of the shares of Common Stock, less any consideration paid for such shares of Common Stock. Any gains or losses recognized by the participant upon disposition of the shares of Common Stock will be treated as capital gains or losses. However, a participant may elect, pursuant to Section 83(b) of the Internal Revenue Code, to have income recognized at the date of grant of a restricted share award equal to the fair market value of the shares of Common Stock on the grant date (less any amount paid for the restricted shares) and to have the applicable capital gain holding period commence as of that date.

| 20 |

Restricted Share Units. A participant generally will not recognize ordinary income when restricted share units are granted. Instead, a participant will recognize ordinary income when the restricted share units are settled in an amount equal to the fair market value of the shares of Common Stock or the cash he or she receives, less any consideration paid.

Other Share-Based Awards. Generally, participants will recognize ordinary income equal to the fair market value of the shares of Common Stock subject to other share-based awards when they receive the shares of Common Stock.

Cash-Based Awards. Generally, a participant will recognize ordinary income when a cash-based award is settled in an amount equal to the cash he or she receives.

Sale of Shares. When a participant sells shares of Common Stock that he or she has received under an award, the participant will generally recognize long-term capital gain or loss if, at the time of the sale, the participant has held the shares of Common Stock for more than one year (or, in the case of a restricted share award, more than one year from the date the restricted shares vested unless the participant made an election pursuant to Section 83(b) of the Internal Revenue Code, described above). If the participant has held the shares of Common Stock for one year or less, the gain or loss will be a short-term capital gain or loss.

Section 409A of the Tax Code. In 2004, the Internal Revenue Code was amended to add Section 409A, which created new rules for amounts deferred under nonqualified deferred compensation plans. Section 409A includes a broad definition of nonqualified deferred compensation plans which may extend to various types of awards granted under the 2024 Plan. If an award is subject to, but fails to comply with, Section 409A, the participant would generally be subject to accelerated income taxation, plus a 20% penalty tax and an interest charge. The Company intends that awards granted under the 2024 Plan will either be exempt from, or will comply with, Section 409A.

Tax Deductibility of Compensation Provided Under the 2024 Plan. When a participant recognizes ordinary compensation income as a result of an award granted under the 2024 Plan, the Company may be permitted to claim a federal income tax deduction for such compensation, subject to various limitations that may apply under applicable law.

Further, to the extent that compensation provided under the 2024 Plan may be deemed to be contingent upon a change in control of the Company, a portion of such compensation may be non-deductible by the Company under Section 280G of the Internal Revenue Code and may be subject to a 20% excise tax imposed on the recipient of the compensation.

New Plan Benefits

Because it is within the discretion of the Compensation Committee to determine which non-employee directors, employees and consultants will receive awards and the amount and type of awards received, it is not presently possible to determine the number of individuals to whom awards will be made in the future under the 2024 Plan or the amount of the awards except that (i) due to the expiration of the 2014 Plan on March 25, 2024, none of the Company’s directors received an April 2024 restricted stock grant in accordance with the director compensation program then in effect, accordingly, upon approval of the 2024 Plan, each director will be granted a restricted stock award valued at $18,750 based on the fair market value of the Company’s Common Stock on the grant date (which shall be deemed to be the greater of (a) the average closing price of the Company’s Common Stock on the Nasdaq Stock Market over the 30 trading days prior to the grant date, or (b) the closing price of the Company’s Common Stock on the Nasdaq Stock Market on the trading date immediately prior to the grant date) that will vest after three months of continued service by the director, and (ii) we have adopted a director compensation policy that provides that each director will receive an annual equity grant of restricted stock on July 1 of each year with a grant date value (which shall be equal to the closing price of a share of the Company’s Common Stock as of the date of grant on the principal established stock exchange or national market system on which the Company’s Common Stock is then traded) of approximately $75,000 that will vest pro rata on a monthly basis for 12 months commencing on August 1 of each year.

| 21 |

The awards granted during 2023 under our 2014 Plan are set forth in the following table.

| Name and Position | Number of Stock Options | Number of Restricted Shares/Restricted Stock Units | ||||||

| Maria Zannes, Chief Executive Officer | — | 66,437 | ||||||

| Steve Girgenti, Executive Chairman | — | 58,347 | ||||||

| Michael Dougherty, Chief Financial Officer | — | 52,356 | ||||||

| Current Executive Officers as a Group | — | 177,140 | ||||||

| Current Non-Executive Director Group | — | 213,162 | ||||||

| Current Non-Executive Officer Employee Group | — | — | ||||||

Equity Compensation Plan Information

The following table sets forth information as of December 31, 2023, with respect to the Company’s 2014 Incentive Compensation Plan, which was approved by the Company’s stockholders:

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (2) | |||||||||

| Equity compensation plans approved by security holders (1) | 676,553 | $ | 3.98 | 683,175 | ||||||||

| Total | 676,553 | $ | 3.98 | 683,175 | ||||||||

| (1) | This table does not include shares proposed to be authorized under the 2024 Plan. | |

| (2) | This number consists of shares available for issuance under the 2014 Plan as of December 31, 2023. The 2014 Plan expired on March 25, 2024, and no further equity awards may be granted under the 2014 Plan. |

Interests of Directors and Executive Officers.

Our current directors and executive officers have substantial interests in the matters set forth in this proposal since equity awards may be granted to them under the 2024 Plan.

Registration with the Securities and Exchange Commission.

After approval of the Amendment to the 2024 Plan by our stockholders, we intend to file with the SEC a Registration Statement on Form S-8 relating to the shares reserved for issuance under the 2024 Plan.

Required Vote

The affirmative vote from the holders of a majority of the shares present in person or represented by proxy and entitled to vote on the proposal to approve the 2024 Plan at the Annual Meeting is required for approval of this proposal. Abstentions will have the same effect as a vote AGAINST this proposal. Broker non-votes will have no effect on this proposal.

The Board unanimously recommends that you vote “FOR” the approval of the 2024 Plan.

| 22 |

PROPOSAL NO. 3

APPROVAL OF AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO INCREASE THE AUTHORIZED NUMBER OF SHARES OF COMMON STOCK

FROM 25,000,000 TO 100,000,000

The Board has approved and is asking stockholders to approve an increase in the number of authorized shares of Common Stock from 25,000,000 shares to 100,000,000 shares (the “Authorized Share Increase”) and a corresponding amendment to the Amended and Restated Certificate of Incorporation to effect the Authorized Share Increase (the “Charter Amendment”).

Purpose of the Authorized Share Increase

The purpose of the Authorized Share Increase is so that the Company will have shares of Common Stock available to provide additional flexibility to promptly and appropriately use its Common Stock for business and financial purposes in the future, as well as to have sufficient shares available to provide appropriate equity incentives for our employees and other eligible service providers. Under its Amended and Restated Certificate of Incorporation, the Company is currently authorized to issue up to 25,000,000 shares of Common Stock and 5,000,000 shares of Preferred Stock. As of the close of business on the Record Date, there were 11,514,354 shares of Common Stock issued and outstanding and no shares of Preferred Stock issued and outstanding. There are also 11,450,422 shares of Common Stock reserved for issuance pursuant to: (i) outstanding stock options, (ii) outstanding warrants, and (iii) assuming Proposal 2 is approved, future awards which may be made under the Company’s 2024 Plan, leaving a balance of 2,035,224 shares of Common Stock available for issuance.